Top-line growth represents the increase in a company's revenue or gross sales, serving as a key metric for business expansion and market demand. Focusing on strategies such as product innovation, market penetration, and customer acquisition can significantly enhance your top-line performance. Explore the rest of this article to uncover effective techniques to drive sustainable top-line growth for your business.

Table of Comparison

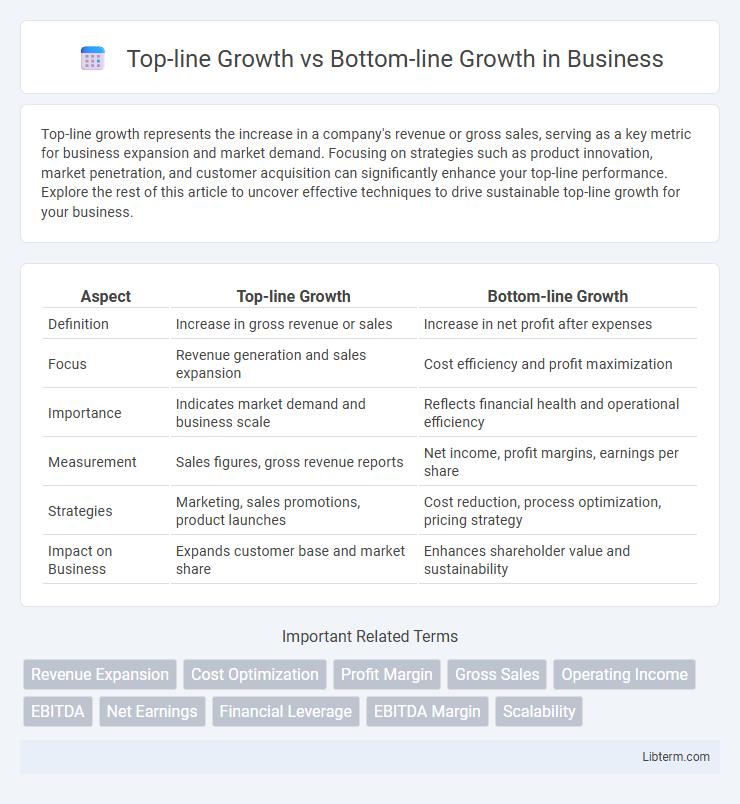

| Aspect | Top-line Growth | Bottom-line Growth |

|---|---|---|

| Definition | Increase in gross revenue or sales | Increase in net profit after expenses |

| Focus | Revenue generation and sales expansion | Cost efficiency and profit maximization |

| Importance | Indicates market demand and business scale | Reflects financial health and operational efficiency |

| Measurement | Sales figures, gross revenue reports | Net income, profit margins, earnings per share |

| Strategies | Marketing, sales promotions, product launches | Cost reduction, process optimization, pricing strategy |

| Impact on Business | Expands customer base and market share | Enhances shareholder value and sustainability |

Understanding Top-line Growth

Top-line growth refers to an increase in a company's gross revenue or sales over a specific period, serving as a critical indicator of business expansion and market demand. It emphasizes the total income generated before deducting expenses, highlighting the company's ability to attract more customers or increase sales volume. Monitoring top-line growth provides insights into the effectiveness of marketing strategies and product development initiatives aimed at boosting overall revenue streams.

What is Bottom-line Growth?

Bottom-line growth refers to the increase in a company's net income or profit after all expenses, taxes, and costs have been deducted from total revenue. It reflects the actual profitability and financial health of a business, highlighting efficiency in managing operational costs and expenses. Companies prioritize bottom-line growth to ensure sustainable profitability and enhanced shareholder value over time.

Key Differences Between Top-line and Bottom-line Growth

Top-line growth refers to the increase in a company's revenue or gross sales, indicating its ability to generate more income from core operations. Bottom-line growth focuses on net profit or net income, reflecting the company's efficiency in managing expenses and operational costs to maximize profitability. Key differences include that top-line growth emphasizes sales expansion, while bottom-line growth highlights cost control and profit margin improvement.

Why Top-line Growth Matters

Top-line growth, representing increases in a company's revenue, is crucial because it reflects the demand for products or services and signals market expansion potential. It drives investor confidence and provides the necessary resources for reinvestment, innovation, and scaling operations. Sustained top-line growth creates opportunities to improve profitability and enhances long-term competitive advantage.

Importance of Bottom-line Growth

Bottom-line growth, representing net profit increase, directly reflects a company's financial health and operational efficiency, making it a crucial indicator for investors and stakeholders. Unlike top-line growth, which measures revenue expansion, bottom-line growth emphasizes cost management, profit margins, and sustainable business practices essential for long-term success. Companies prioritizing bottom-line growth can enhance shareholder value by improving profitability through strategic expense control and optimized resource allocation.

Strategies to Drive Top-line Growth

Strategies to drive top-line growth center on increasing a company's revenue through market expansion, product innovation, and enhanced sales efforts. Leveraging digital marketing, entering new geographic markets, and diversifying the product portfolio can effectively boost sales volume and customer acquisition. Implementing dynamic pricing models and strengthening brand loyalty programs also contribute significantly to sustainable top-line growth.

Maximizing Bottom-line Growth: Best Practices

Maximizing bottom-line growth requires a strong focus on cost management and operational efficiency, leveraging data-driven decision-making to identify and eliminate wasteful expenses while enhancing productivity. Implementing lean processes and investing in technology can streamline workflows, reduce overhead, and improve profit margins without compromising product quality or customer satisfaction. Prioritizing strategic initiatives such as pricing optimization, supply chain improvements, and employee training drives sustainable profit increases and long-term financial health.

Top-line vs Bottom-line: Impact on Business Valuation

Top-line growth reflects an increase in a company's revenue, signaling market demand and potential for expansion, which often drives higher business valuation multiples due to anticipated future earnings. Bottom-line growth measures net profit improvement after expenses, directly enhancing cash flow and profitability, making the company more attractive to investors focused on operational efficiency. While top-line growth showcases market reach and scalability, bottom-line growth demonstrates financial health and sustainability, both critical factors influencing business valuation in financial analysis and investment decisions.

Common Challenges in Achieving Both Growth Types

Top-line growth focuses on increasing revenue through sales expansion or market penetration, while bottom-line growth emphasizes improving net profit by reducing costs and boosting efficiency. Common challenges in achieving both growth types include balancing investment in customer acquisition with cost management and aligning short-term revenue goals with long-term profitability. Companies often struggle with resource allocation, operational scalability, and maintaining sustainable margins during periods of aggressive growth.

Balancing Top-line and Bottom-line for Sustainable Success

Balancing top-line growth, which reflects increased revenues, with bottom-line growth, indicating improved net profits, is crucial for sustainable business success. Prioritizing revenue expansion without managing expenses can erode profit margins, while focusing solely on cost-cutting may stunt market share and long-term growth potential. Strategic initiatives that integrate efficient operational management with targeted sales growth ensure a robust financial foundation and lasting competitive advantage.

Top-line Growth Infographic

libterm.com

libterm.com