Social enterprises prioritize societal impact alongside profit, using business strategies to address social, environmental, or community challenges. These organizations reinvest their earnings into their mission to create sustainable change and improve lives globally. Discover how your support can empower social enterprises and drive meaningful progress by exploring the rest of the article.

Table of Comparison

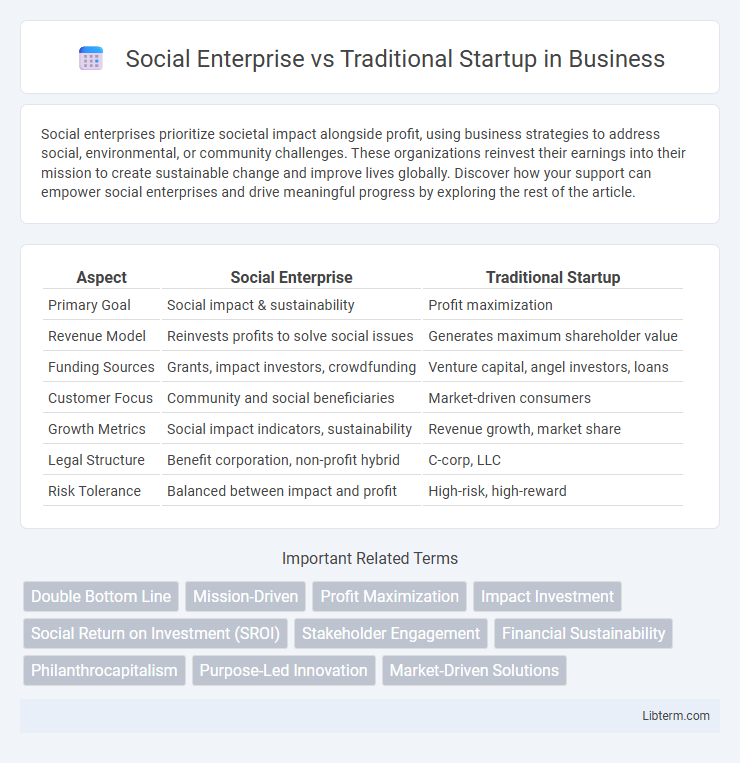

| Aspect | Social Enterprise | Traditional Startup |

|---|---|---|

| Primary Goal | Social impact & sustainability | Profit maximization |

| Revenue Model | Reinvests profits to solve social issues | Generates maximum shareholder value |

| Funding Sources | Grants, impact investors, crowdfunding | Venture capital, angel investors, loans |

| Customer Focus | Community and social beneficiaries | Market-driven consumers |

| Growth Metrics | Social impact indicators, sustainability | Revenue growth, market share |

| Legal Structure | Benefit corporation, non-profit hybrid | C-corp, LLC |

| Risk Tolerance | Balanced between impact and profit | High-risk, high-reward |

Understanding Social Enterprises and Traditional Startups

Social enterprises prioritize social impact alongside financial sustainability, integrating mission-driven goals with business strategies to address societal challenges. Traditional startups focus primarily on rapid growth and profitability, aiming to disrupt markets through innovative products or services. Understanding these differences highlights how social enterprises measure success by social value creation, whereas traditional startups emphasize shareholder returns and market share expansion.

Core Mission: Profit vs. Purpose

Social enterprises prioritize a core mission centered on creating positive social or environmental impact, integrating purpose into their business models. Traditional startups primarily focus on maximizing financial profit and market growth to satisfy investors and stakeholders. This fundamental difference shapes strategic decisions, resource allocation, and long-term sustainability approaches in each type of venture.

Business Models and Revenue Streams

Social enterprises adopt mission-driven business models prioritizing social or environmental impact alongside financial sustainability, often blending earned income with grants, donations, and impact investments as revenue streams. Traditional startups focus primarily on scalable profit-driven models, relying heavily on venture capital, equity funding, and product or service sales to generate revenue. The distinct difference lies in the social enterprise's integration of purpose with profit, which shapes diversified revenue channels aimed at long-term impact rather than rapid market expansion.

Funding and Investment Approaches

Social enterprises primarily rely on impact investors, grants, and crowdfunding platforms targeting social outcomes, distinguishing their funding approach from traditional startups that depend heavily on venture capital and angel investors seeking high financial returns. Social enterprises often blend earned revenue with philanthropic funding to sustain operations, whereas traditional startups focus on rapid scalability to attract equity investment. This fundamental difference in funding strategies reflects the social mission-driven model versus profit-driven growth priorities.

Measuring Success: Impact vs. Financial Performance

Social enterprises measure success primarily through social and environmental impact metrics, such as the number of beneficiaries served, community improvement indices, and sustainability outcomes, alongside financial viability. Traditional startups prioritize financial performance indicators like revenue growth, profit margins, market share, and investor return on investment (ROI). While both models require financial sustainability, social enterprises balance dual objectives by quantifying impact using tools like the Social Return on Investment (SROI) alongside traditional financial metrics.

Stakeholder Engagement and Community Involvement

Social enterprises prioritize stakeholder engagement by integrating community needs and feedback into their business models, fostering long-term value for both investors and local populations. Traditional startups typically focus on shareholder returns, often engaging stakeholders primarily to enhance business growth and profitability. The deep community involvement in social enterprises drives social impact alongside financial sustainability, distinguishing them from profit-centric startups.

Legal Structures and Regulatory Considerations

Social enterprises often adopt legal structures such as Benefit Corporations (B Corps), Community Interest Companies (CICs), or Nonprofit Corporations to prioritize social impact alongside profit, whereas traditional startups typically incorporate as C Corporations or Limited Liability Companies (LLCs) focused primarily on financial returns. Regulatory considerations for social enterprises include compliance with impact reporting, transparency requirements, and specific state or country laws that mandate social or environmental goals, contrasting with traditional startups that mostly adhere to general business regulations and tax requirements. The choice of legal structure for social enterprises affects funding options, tax treatment, and stakeholder accountability, distinguishing them from the conventional startup legal frameworks.

Challenges and Opportunities for Growth

Social enterprises face challenges balancing profit with social missions, often struggling to secure funding that prioritizes impact alongside returns, unlike traditional startups focused primarily on financial growth. Opportunities for growth in social enterprises include accessing impact investing and government grants aimed at sustainable development, while traditional startups thrive on venture capital and rapid scalability. Navigating regulatory complexities and measuring social impact present unique hurdles for social enterprises, contrasting with the straightforward growth metrics used by traditional startups.

Case Studies: Examples of Social Enterprises and Startups

Social enterprises like TOMS Shoes integrate social impact by donating a pair of shoes for every pair sold, exemplifying mission-driven business models that address social issues. In contrast, traditional startups such as Airbnb focus primarily on scalability and profitability, disrupting markets through innovative technology and user experience. Case studies reveal that while social enterprises prioritize sustainable societal benefits, startups prioritize rapid financial growth and market expansion.

Choosing the Right Path: Key Considerations

Choosing between a social enterprise and a traditional startup involves evaluating mission alignment, funding sources, and impact goals. Social enterprises prioritize social or environmental missions alongside profitability, often seeking impact investors and grants, while traditional startups focus primarily on scalable financial returns with venture capital funding. Key considerations include market demand, stakeholder expectations, and long-term sustainability strategies tailored to either social value creation or pure profit maximization.

Social Enterprise Infographic

libterm.com

libterm.com