Growth drives progress, enabling businesses and individuals to expand their capabilities and reach new milestones. By focusing on continuous improvement and adapting to change, you can unlock potential and achieve lasting success. Explore the rest of this article to discover effective strategies for fostering sustainable growth.

Table of Comparison

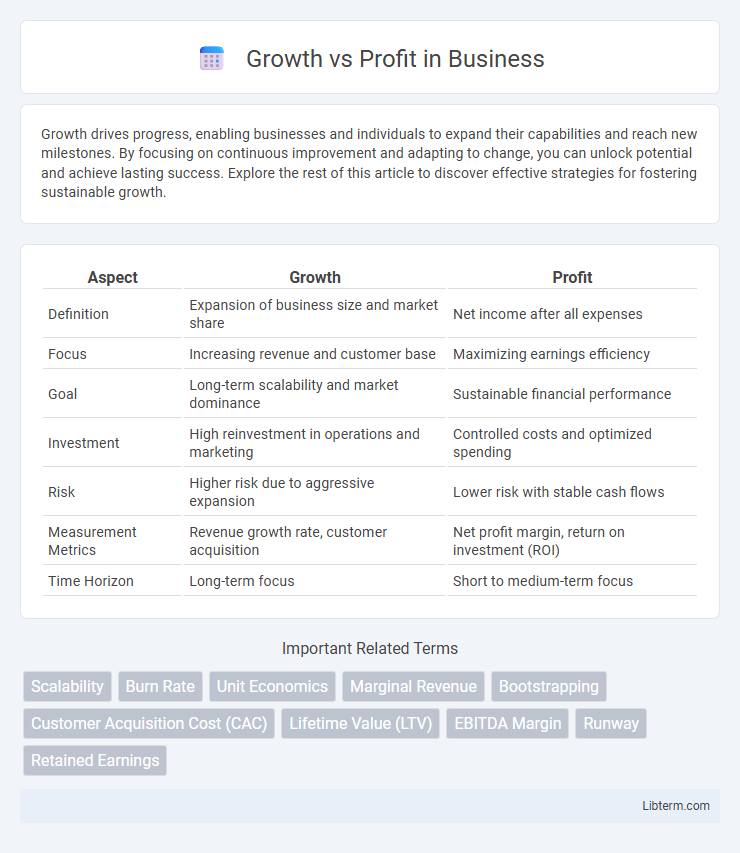

| Aspect | Growth | Profit |

|---|---|---|

| Definition | Expansion of business size and market share | Net income after all expenses |

| Focus | Increasing revenue and customer base | Maximizing earnings efficiency |

| Goal | Long-term scalability and market dominance | Sustainable financial performance |

| Investment | High reinvestment in operations and marketing | Controlled costs and optimized spending |

| Risk | Higher risk due to aggressive expansion | Lower risk with stable cash flows |

| Measurement Metrics | Revenue growth rate, customer acquisition | Net profit margin, return on investment (ROI) |

| Time Horizon | Long-term focus | Short to medium-term focus |

Understanding Growth and Profit

Growth represents the expansion of a company's market share, revenue, or customer base, emphasizing top-line increases. Profit measures the bottom-line financial gain after deducting expenses, reflecting operational efficiency and sustainability. Balancing Growth and Profit is essential for long-term business success, as rapid Growth without Profit can lead to cash flow problems, while prioritizing Profit may limit market opportunities.

Key Differences Between Growth and Profit

Growth emphasizes expanding a company's market share, revenue, or customer base, while profit centers on maximizing net income after expenses. Growth often requires reinvestment and can result in lower short-term profits, whereas profit prioritizes efficient cost management and immediate financial returns. Understanding the key differences helps businesses balance scaling operations with sustainable profitability.

Why Businesses Prioritize Growth

Businesses prioritize growth to capture larger market share, increase brand recognition, and attract investments, which are crucial for long-term sustainability and competitive advantage. Rapid expansion often leads to economies of scale, enhanced customer loyalty, and innovation opportunities that can drive future profitability. Growth-focused companies typically reinvest earnings to fuel product development and market penetration, positioning themselves for higher valuation and exit options.

The Importance of Profitability

Profitability serves as the foundation for sustainable business growth, enabling companies to reinvest earnings into innovation, market expansion, and operational improvements. Prioritizing profit ensures financial stability, supports long-term strategic initiatives, and attracts investors by demonstrating effective resource management. Without consistent profit, growth efforts risk becoming unsustainable, leading to cash flow challenges and potential business failure.

Growth Strategies for Businesses

Implementing targeted growth strategies such as market penetration, product diversification, and digital transformation enables businesses to expand their customer base and increase revenue streams. Leveraging data analytics and customer insights enhances decision-making, driving scalable growth while maintaining operational efficiency. Strategic partnerships and investment in innovation foster competitive advantage, accelerating business expansion in dynamic markets.

Measuring Profit: Metrics and Methods

Measuring profit involves key metrics such as gross profit margin, net profit margin, and operating profit, each providing insight into different aspects of financial performance. Methods like profit and loss analysis, return on investment (ROI), and EBITDA assessment offer actionable data to evaluate profitability effectively. Accurate profit measurement supports informed strategic decisions by highlighting areas for cost reduction and revenue enhancement.

Challenges of Pursuing Rapid Growth

Pursuing rapid growth often strains operational capacity, leading to resource allocation challenges and increased overhead costs. Scaling quickly can dilute product quality and customer experience, risking brand reputation and market position. Financial pressure intensifies as companies invest heavily in expansion while managing cash flow and maintaining profitability.

Balancing Growth and Profit Objectives

Balancing growth and profit objectives requires strategic resource allocation to ensure sustainable expansion without compromising financial health. Companies should monitor key performance indicators like gross margin and return on investment (ROI) to align growth initiatives with profitability targets. Implementing scalable business models enables capturing market share while maintaining positive cash flow and long-term viability.

Case Studies: Growth vs Profit in Action

Case studies from companies like Amazon and Tesla highlight the strategic tension between prioritizing growth and focusing on profit. Amazon's aggressive reinvestment of revenue into expansion allowed rapid market dominance but delayed consistent profitability; Tesla balanced growth with improving profit margins through scaling production and innovation in electric vehicles. These real-world examples demonstrate how tailored approaches to growth versus profit impact long-term business sustainability and market position.

Choosing the Right Focus for Your Business

Balancing growth and profit is essential for sustainable business success, as rapid expansion can strain cash flow while prioritizing profit may limit market share opportunities. Analyzing market conditions, customer demand, and operational capacity guides entrepreneurs in selecting a focus that maximizes long-term value. Strategic decisions should consider industry benchmarks and financial metrics to align growth initiatives with profitability goals effectively.

Growth Infographic

libterm.com

libterm.com