A question mark is a punctuation symbol used at the end of interrogative sentences to indicate a direct question, helping to clarify meaning and tone in written language. Proper use of question marks enhances communication by signaling inquiry, prompting responses, and engaging the reader effectively. Explore the rest of the article to understand the rules and nuances of using question marks correctly in various contexts.

Table of Comparison

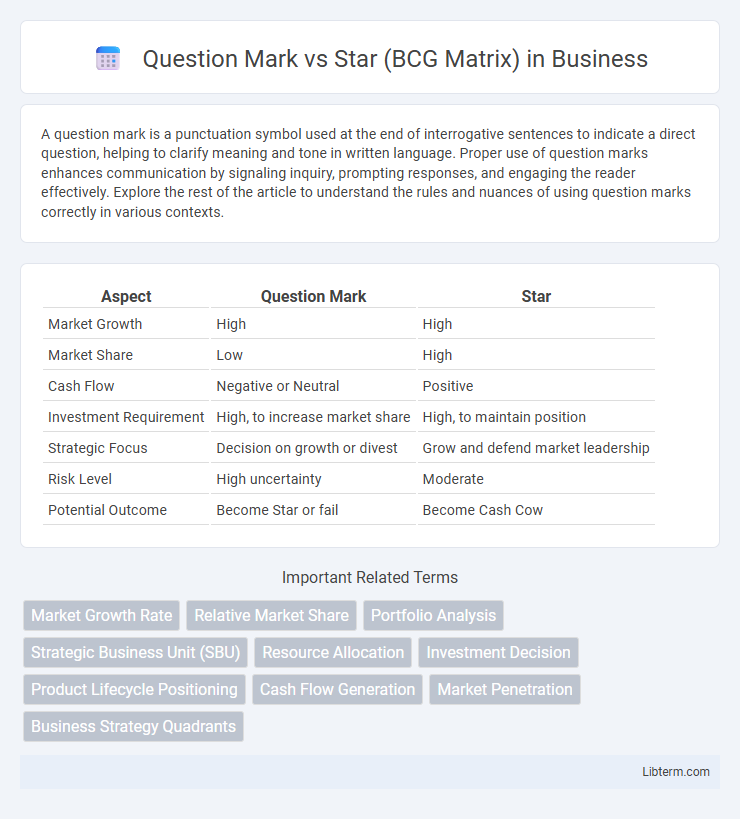

| Aspect | Question Mark | Star |

|---|---|---|

| Market Growth | High | High |

| Market Share | Low | High |

| Cash Flow | Negative or Neutral | Positive |

| Investment Requirement | High, to increase market share | High, to maintain position |

| Strategic Focus | Decision on growth or divest | Grow and defend market leadership |

| Risk Level | High uncertainty | Moderate |

| Potential Outcome | Become Star or fail | Become Cash Cow |

Understanding the BCG Matrix: An Overview

The BCG Matrix categorizes business units into four groups based on market growth and market share: Question Marks, Stars, Cash Cows, and Dogs. Question Marks represent products with low market share in high-growth markets, requiring significant investment to increase market share, while Stars have high market share in high-growth markets and generate substantial revenue. Understanding these distinctions helps companies allocate resources efficiently to maximize growth and profitability.

What Defines a Question Mark in the BCG Matrix?

A Question Mark in the BCG Matrix represents a business unit or product with high market growth but low market share, indicating uncertainty in its potential to become a Star or fail. It requires significant investment to increase market share and move towards becoming a Star. The key defining factor is its position in a rapidly growing market with currently weak competitive strength.

Star Category Explained: High Growth, High Market Share

Stars in the BCG Matrix represent business units or products with high market share in rapidly growing industries, indicating strong competitive positioning and significant potential for revenue generation. These units require substantial investment to maintain their growth trajectory and can eventually become cash cows as market growth stabilizes. Companies prioritize Stars for strategic development to maximize long-term profitability and market dominance.

Key Differences: Question Mark vs Star

Question Mark products in the BCG Matrix have low market share but operate in high-growth markets, requiring significant investment to increase their share, while Star products enjoy high market share in high-growth markets, generating substantial revenues and often leading to market leadership. Question Marks carry higher risk and uncertain potential for growth, needing strategic decisions to either invest heavily or divest, whereas Stars typically have established competitive advantages and are expected to become Cash Cows as market growth slows. The primary difference lies in their current market share and corresponding investment needs, with Stars representing successful growth outcomes and Question Marks representing potential growth opportunities with uncertain returns.

Investment Strategies for Question Marks

Question Marks in the BCG Matrix are businesses with low market share in high-growth industries, requiring significant investment to increase market share and become Stars. Investment strategies for Question Marks include allocating resources to product development, aggressive marketing, and capacity expansion to capitalize on growth potential. Careful analysis of competitive dynamics and market trends is essential to determine which Question Marks warrant continued investment or should be divested to optimize portfolio performance.

Growth Opportunities and Challenges for Stars

Stars in the BCG Matrix represent high-market-share products within rapidly growing industries, presenting significant growth opportunities through market expansion and increased revenue generation. These units demand substantial investment to maintain and accelerate growth, posing challenges such as escalating costs and competitive pressure. Effectively managing cash flow and innovation is crucial for stars to transition into cash cows as market growth stabilizes.

Resource Allocation: Where to Focus?

Question Marks in the BCG Matrix represent products with high market growth but low market share, requiring significant resource investment to increase competitive position. Stars generate substantial revenue due to high market share and growth, justifying sustained or increased resource allocation to maintain leadership. Companies should prioritize investing in Stars to capitalize on growth while carefully evaluating Question Marks to determine which have the potential to become Stars or should be divested.

Risks and Rewards: Navigating Uncertainty

Question Marks in the BCG Matrix represent high-growth, low-market-share businesses that offer significant reward potential but come with substantial risks due to uncertain market acceptance and heavy investment requirements. Stars indicate high-growth, high-market-share entities expected to generate substantial revenues and eventually transition into Cash Cows, yet maintaining their position requires continuous innovation and capital infusion. Navigating uncertainty involves balancing the risk of resource allocation in Question Marks against the reward of solidifying market leadership in Stars.

Real-World Examples of Question Marks and Stars

In the BCG Matrix, Question Marks typically represent products like electric vehicles in traditional automakers, which require substantial investment to increase market share despite uncertain growth potential. Stars include examples such as Apple's iPhone, leading in a high-growth market with a dominant market share and strong profitability. Companies strategically invest in Stars to maintain growth momentum, while Question Marks may be divested or aggressively developed depending on future market projections.

Strategic Implications for Business Decision-Making

Question Marks in the BCG Matrix represent business units with high market growth but low market share, requiring significant investment to increase market share or risk becoming Dogs. Stars hold high market share in high-growth markets, generating substantial cash flow and indicating a priority for resource allocation to sustain growth and maintain competitive advantage. Strategic decision-making involves evaluating whether to invest heavily in Question Marks to convert them into Stars or divest if potential is low, while continuing to support Stars to drive long-term business growth.

Question Mark Infographic

libterm.com

libterm.com