An underwriting fee is a charge applied by financial institutions to cover the cost of evaluating and processing a loan or insurance application. This fee ensures that the risk assessment and administrative tasks are adequately compensated. Discover how understanding underwriting fees can help you make more informed financial decisions by reading the rest of the article.

Table of Comparison

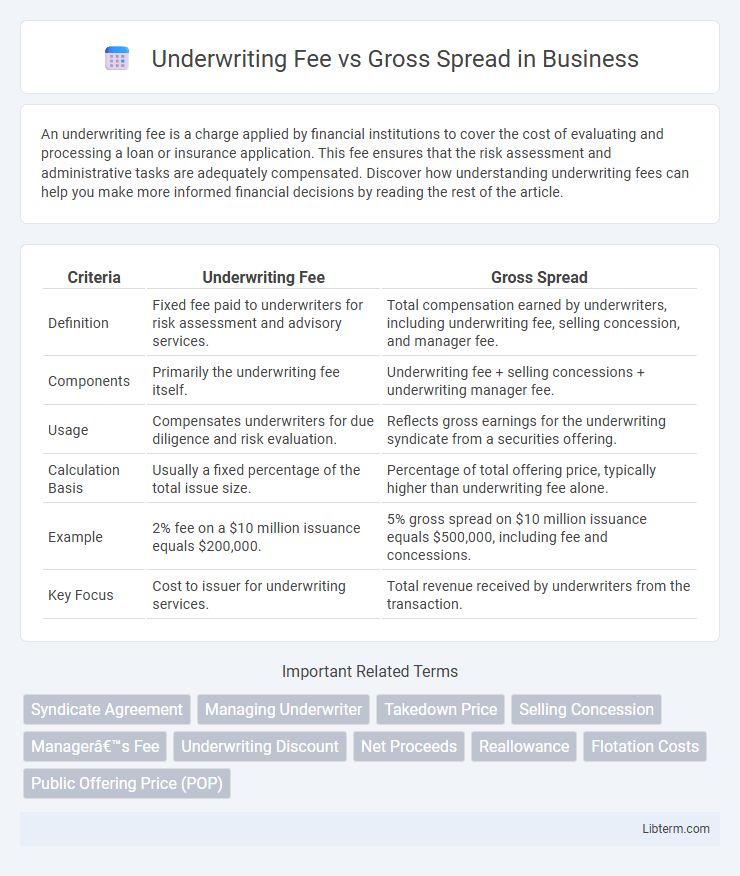

| Criteria | Underwriting Fee | Gross Spread |

|---|---|---|

| Definition | Fixed fee paid to underwriters for risk assessment and advisory services. | Total compensation earned by underwriters, including underwriting fee, selling concession, and manager fee. |

| Components | Primarily the underwriting fee itself. | Underwriting fee + selling concessions + underwriting manager fee. |

| Usage | Compensates underwriters for due diligence and risk evaluation. | Reflects gross earnings for the underwriting syndicate from a securities offering. |

| Calculation Basis | Usually a fixed percentage of the total issue size. | Percentage of total offering price, typically higher than underwriting fee alone. |

| Example | 2% fee on a $10 million issuance equals $200,000. | 5% gross spread on $10 million issuance equals $500,000, including fee and concessions. |

| Key Focus | Cost to issuer for underwriting services. | Total revenue received by underwriters from the transaction. |

Introduction to Underwriting Fee and Gross Spread

Underwriting fees represent the compensation paid to underwriters for managing the issuance and risk distribution of securities, typically calculated as a fixed percentage of the total offering. Gross spread refers to the difference between the price at which underwriters purchase securities from issuers and the price at which they sell them to the public, encompassing the underwriting fee along with other expenses like selling concessions and expenses. Understanding the distinction between underwriting fees and gross spread is crucial for analyzing the costs associated with public offerings in capital markets.

Definition of Underwriting Fee

The underwriting fee refers to the compensation paid to investment banks or underwriters for managing and assuming the risk of a securities offering. It is a specific portion of the gross spread, which represents the total difference between the price paid by underwriters to the issuing company and the price at which securities are sold to the public. Understanding the underwriting fee is essential for accurately assessing the cost structure involved in raising capital through public offerings.

What is Gross Spread?

Gross spread represents the total compensation earned by investment banks and underwriting syndicates from issuing new securities, typically expressed as a percentage of the offering price. It encompasses underwriting fees, management fees, and selling concessions, covering all costs associated with the distribution process. Understanding gross spread is essential for evaluating the overall cost structure and profitability of a securities offering.

Key Differences Between Underwriting Fee and Gross Spread

Underwriting fee is the specific compensation paid to investment banks for managing and assuming risk in a securities offering, typically expressed as a percentage of the total offering amount. Gross spread represents the total difference between the price at which underwriters purchase securities from the issuer and the price at which they sell those securities to the public, encompassing the underwriting fee plus additional costs such as selling concessions and expenses. Key differences include that underwriting fee is a component of the gross spread, whereas gross spread reflects the overall underwriting compensation and expense structure in an equity or debt issuance.

Components of Underwriting Fees

Underwriting fees consist primarily of management fees, underwriting fees, and selling concession, each representing distinct compensation for the services provided during the securities issuance process. The gross spread, the total discount between the price paid by underwriters and the price at which securities are sold to the public, encompasses these underwriting fee components and reflects the underwriters' compensation. Understanding these components is essential for accurately assessing the cost structure within initial public offerings (IPOs) and bond issuances.

Elements Included in Gross Spread

The gross spread encompasses the total underwriting compensation, including the underwriting fee, management fee, and selling concession, which collectively cover the underwriters' costs and profit margins. Elements included in the gross spread reflect the fees paid to investment banks for underwriting services, distribution efforts, and risk assumption during securities offerings. Understanding these components is essential for accurately assessing the cost structure in initial public offerings (IPOs) and bond issuances.

Importance of Understanding Both Terms in Investment Banking

Understanding the underwriting fee and gross spread is crucial in investment banking as they directly impact the cost and profitability of securities offerings. The underwriting fee is the amount paid to underwriters for their services, while the gross spread represents the difference between the price paid by the underwriters to the issuer and the price at which the securities are sold to the public. Accurate knowledge of both terms ensures transparent pricing strategies and effective financial management during capital raising processes.

Impact on Issuers and Investors

Underwriting fees directly reduce the net proceeds received by issuers, affecting the overall capital raised during securities offerings, while the gross spread represents the total compensation to underwriters, including underwriting fees, management fees, and selling concessions. For issuers, a higher underwriting fee can increase the cost of capital, potentially lowering investment in growth initiatives. Investors may face pricing impacts due to the gross spread, as underwriters factor these costs into the offer price, influencing demand and liquidity in the secondary market.

Industry Norms and Typical Percentages

Underwriting fees typically range from 1% to 3% of the total funds raised in equity or debt issuances, reflecting compensation for the underwriter's risk and advisory services. Gross spread, often between 5% and 7% for initial public offerings (IPOs), includes the underwriting fee plus selling concessions and manager's fees, representing the total compensation earned by the underwriting syndicate. Industry norms vary by transaction size, with larger deals usually commanding lower percentage spreads, while smaller or riskier issuances may see higher fees to account for increased risk and marketing efforts.

Conclusion: Choosing the Right Metric for Your IPO

When evaluating an IPO, selecting the appropriate metric between underwriting fee and gross spread depends on the level of detail needed in cost analysis. Underwriting fees provide a clear, specific cost charged by underwriters, while gross spread encompasses the total underwriters' compensation, reflecting the full scale of underwriting expenses. Understanding both metrics enables issuers to accurately assess underwriting costs and optimize pricing strategies for their public offering.

Underwriting Fee Infographic

libterm.com

libterm.com