Insurtech and Healthtech are revolutionizing the insurance and healthcare industries by leveraging technology to enhance efficiency, personalization, and customer experience. Innovations such as AI-driven underwriting, telemedicine, and wearable health devices are transforming how services are delivered and risks are managed. Discover how these advancements can impact your future in the rapidly evolving world of digital health and insurance by reading the full article.

Table of Comparison

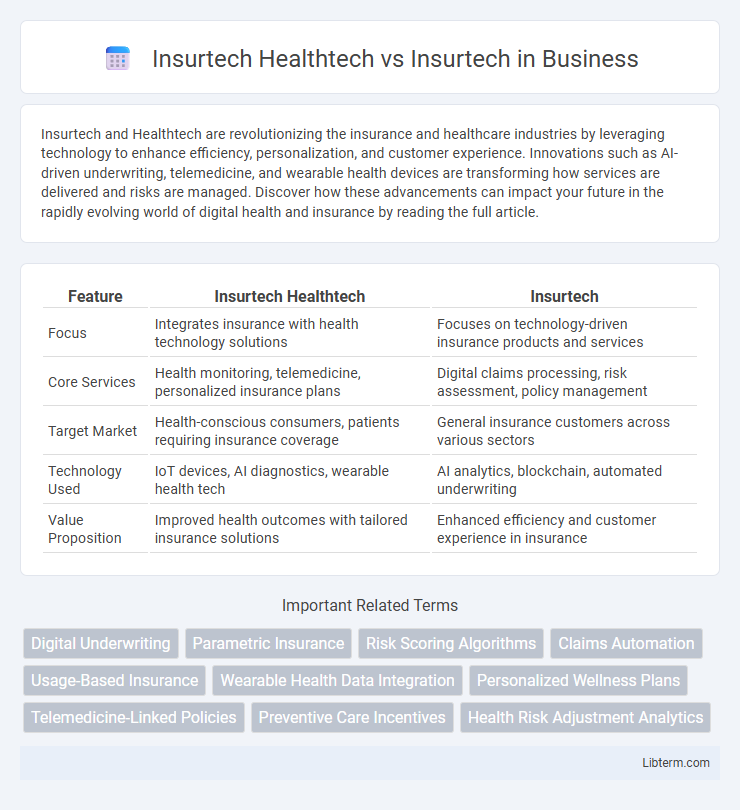

| Feature | Insurtech Healthtech | Insurtech |

|---|---|---|

| Focus | Integrates insurance with health technology solutions | Focuses on technology-driven insurance products and services |

| Core Services | Health monitoring, telemedicine, personalized insurance plans | Digital claims processing, risk assessment, policy management |

| Target Market | Health-conscious consumers, patients requiring insurance coverage | General insurance customers across various sectors |

| Technology Used | IoT devices, AI diagnostics, wearable health tech | AI analytics, blockchain, automated underwriting |

| Value Proposition | Improved health outcomes with tailored insurance solutions | Enhanced efficiency and customer experience in insurance |

Introduction to Insurtech and Healthtech

Insurtech leverages advanced technologies such as AI, big data analytics, and blockchain to disrupt traditional insurance models, enhancing efficiency and customer experiences. Healthtech focuses on digital innovations like telemedicine, wearable devices, and electronic health records to improve healthcare delivery and patient outcomes. The convergence of insurtech and healthtech creates opportunities for personalized insurance products that integrate real-time health data and predictive analytics for risk assessment.

Defining Insurtech in the Insurance Sector

Insurtech in the insurance sector refers to technology-driven innovations designed to enhance efficiency, customer experience, and risk management through data analytics, artificial intelligence, and automation. Unlike Healthtech, which specifically targets healthcare services and patient outcomes, Insurtech encompasses a broader range of insurance lines including property, casualty, and life insurance. Key developments in Insurtech include digital claims processing, personalized underwriting, and real-time risk assessment powered by IoT devices and big data.

What Sets Healthtech Apart in Healthcare?

Healthtech distinguishes itself within the insurtech landscape by integrating advanced healthcare technologies such as telemedicine, electronic health records (EHR), and AI-driven diagnostics to enhance patient outcomes and streamline medical processes. Unlike traditional insurtech, which primarily focuses on insurance policy management, claims processing, and risk assessment, Healthtech uniquely addresses clinical needs and personalized care delivery. This convergence of healthcare expertise with insurance innovation facilitates more precise risk modeling and promotes preventive healthcare strategies, setting Healthtech apart in the healthcare ecosystem.

Overlapping Areas: Where Insurtech Meets Healthtech

Insurtech and healthtech converge primarily in digital health insurance solutions, where advanced analytics and telemedicine integration optimize underwriting and claims management. Both sectors leverage AI-driven risk assessment and personalized policy offerings tailored to individual health data, enhancing customer experience and operational efficiency. This overlap fosters innovation in preventive care incentives and real-time health monitoring, reshaping traditional insurance models with technology-enabled health insights.

Key Technologies Fueling Insurtech

Key technologies fueling Insurtech include artificial intelligence (AI), machine learning, blockchain, and Internet of Things (IoT), which enhance risk assessment, fraud detection, and claims processing. Healthtech within Insurtech leverages wearable devices, telemedicine, and big data analytics to personalize insurance plans and improve preventive care. These technologies collectively drive greater efficiency, customer engagement, and innovation in the insurance industry.

Healthtech Innovations for Health Insurance

Healthtech innovations for health insurance focus on leveraging AI-powered diagnostics, telemedicine platforms, and wearable health devices to enhance personalized risk assessment and streamline claims processing. These technologies enable insurers to offer tailored policies based on real-time health data, improving prevention and early intervention strategies. Integration of electronic health records (EHR) and predictive analytics further reduces costs and enhances customer experience in health insurance offerings.

Comparison: Business Models of Insurtech vs Healthtech

Insurtech primarily revolutionizes traditional insurance business models by leveraging AI, big data, and blockchain to improve underwriting, claims processing, and customer experience, focusing on risk assessment and financial protection products. Healthtech business models emphasize digital health solutions like telemedicine, wearable diagnostics, and electronic health records, aiming to enhance patient care, health monitoring, and medical data management. While Insurtech monetizes through premiums and customized insurance products, Healthtech generates revenue via subscription services, medical device sales, and health platform integrations.

Regulatory Landscape: Insurtech vs Healthtech

The regulatory landscape for Insurtech is primarily governed by insurance laws, focusing on compliance with underwriting, claims processing, and consumer protection regulations, while Healthtech faces stringent healthcare regulations including HIPAA, FDA approvals, and patient data privacy standards. Insurtech companies must navigate state and federal insurance statutes, whereas Healthtech firms contend with healthcare-specific legislation that emphasizes patient safety and medical device compliance. Both sectors require robust regulatory strategies but differ significantly in regulatory scope and compliance complexity due to the nature of insurance versus healthcare services.

Impact on Customer Experience and Personalization

Insurtech Healthtech integrates cutting-edge digital health solutions with insurance services, significantly elevating customer experience through real-time health monitoring, personalized wellness programs, and proactive risk management. This fusion enables insurers to offer highly tailored policies and proactive care, enhancing personalization beyond traditional Insurtech's focus on digitizing claims and underwriting processes. The customer benefits from seamless, data-driven interactions that prioritize individual health outcomes and satisfaction, setting Insurtech Healthtech apart in delivering personalized insurance experiences.

Future Trends: The Convergence of Insurtech and Healthtech

The convergence of Insurtech and Healthtech is driving innovation through integrated digital platforms that combine insurance services with personalized health management tools, enhancing risk assessment and customer experience. Future trends indicate increased use of AI-driven predictive analytics to streamline claims processing and preventative care, reducing costs and improving policyholder outcomes. This synergy fosters the development of holistic insurance products that adapt dynamically to an individual's health data, promoting proactive wellness and financial resilience.

Insurtech Healthtech Infographic

libterm.com

libterm.com