Corporate bonds offer investors a fixed income stream by lending money to companies in exchange for periodic interest payments and the return of principal at maturity. These bonds vary in risk and return depending on the issuing company's creditworthiness and market conditions, providing opportunities for portfolio diversification and income generation. Explore the article to understand how corporate bonds can fit into your investment strategy and the factors to consider before buying.

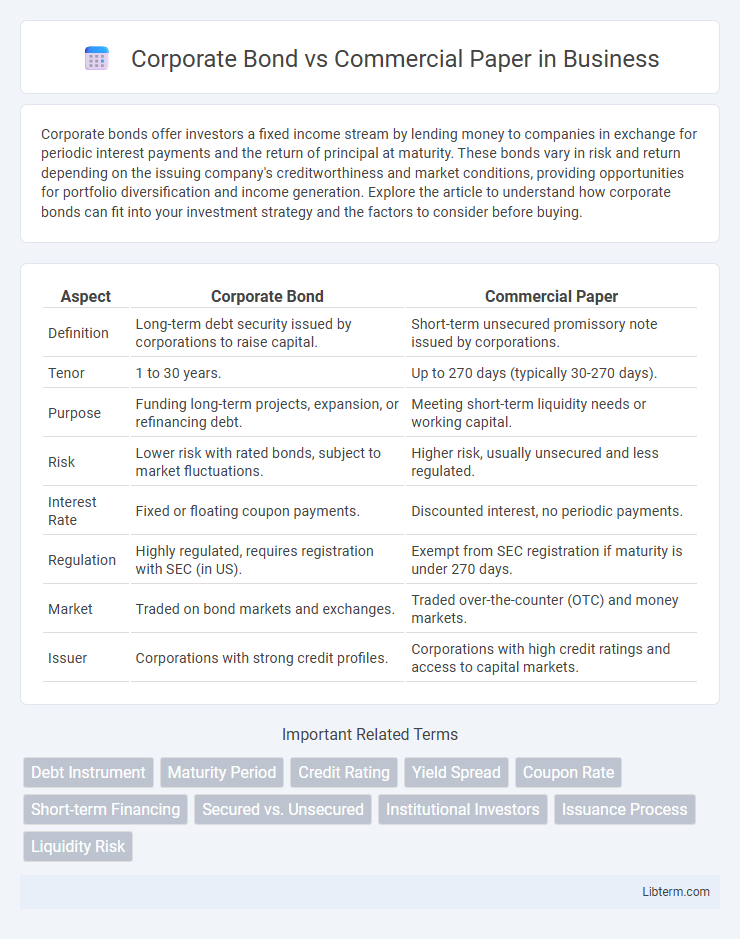

Table of Comparison

| Aspect | Corporate Bond | Commercial Paper |

|---|---|---|

| Definition | Long-term debt security issued by corporations to raise capital. | Short-term unsecured promissory note issued by corporations. |

| Tenor | 1 to 30 years. | Up to 270 days (typically 30-270 days). |

| Purpose | Funding long-term projects, expansion, or refinancing debt. | Meeting short-term liquidity needs or working capital. |

| Risk | Lower risk with rated bonds, subject to market fluctuations. | Higher risk, usually unsecured and less regulated. |

| Interest Rate | Fixed or floating coupon payments. | Discounted interest, no periodic payments. |

| Regulation | Highly regulated, requires registration with SEC (in US). | Exempt from SEC registration if maturity is under 270 days. |

| Market | Traded on bond markets and exchanges. | Traded over-the-counter (OTC) and money markets. |

| Issuer | Corporations with strong credit profiles. | Corporations with high credit ratings and access to capital markets. |

Introduction to Corporate Bonds and Commercial Paper

Corporate bonds are long-term debt securities issued by corporations to raise capital, typically with maturities exceeding one year and offering periodic interest payments to investors. Commercial paper is a short-term, unsecured promissory note issued by corporations to finance immediate operational needs, generally maturing within 270 days. Both instruments provide liquidity solutions for businesses but differ significantly in duration, risk profile, and investor base.

Key Definitions: Corporate Bonds vs Commercial Paper

Corporate bonds are long-term debt securities issued by corporations to raise funds, typically with maturities exceeding one year and fixed interest payments. Commercial paper is a short-term, unsecured promissory note issued by corporations to meet immediate financing needs, generally maturing within 270 days without collateral. Both instruments serve as critical tools for corporate financing but differ significantly in duration, risk, and liquidity.

Purpose and Use Cases

Corporate bonds are long-term debt instruments used by companies to raise substantial capital for major projects, acquisitions, or refinancing existing debt, providing investors with fixed interest payments over a specified period. Commercial paper is a short-term, unsecured promissory note issued primarily to finance immediate working capital needs, such as payroll, inventory, and accounts payable. Corporations prefer commercial paper for quick liquidity solutions, while corporate bonds serve strategic financing for growth and long-term investments.

Maturity Period Comparison

Corporate bonds typically have a longer maturity period ranging from 1 year to 30 years, making them suitable for long-term financing needs. Commercial paper, on the other hand, is a short-term debt instrument with maturities generally limited to 270 days or less, primarily used for immediate funding requirements. The significant difference in maturity periods influences their risk profiles, investor base, and regulatory requirements.

Credit Risk and Ratings

Corporate bonds typically carry lower credit risk compared to commercial paper due to their longer maturities and more extensive issuer disclosure requirements. Credit rating agencies assign higher credit ratings to corporate bonds as they undergo a rigorous evaluation of the issuer's financial strength and repayment capacity over an extended period. Commercial paper, often unsecured and short-term, usually carries higher credit risk and receives lower or no ratings, reflecting the issuer's immediate liquidity and creditworthiness concerns.

Interest Rates and Yields

Corporate bonds typically offer higher interest rates than commercial paper due to longer maturities and greater credit risk exposure. Commercial paper yields are generally lower, reflecting short-term borrowing horizons and higher liquidity. Investors favor commercial paper for quick returns with minimal risk, while corporate bonds attract those seeking stable income over extended periods.

Issuance and Regulation

Corporate bonds are typically issued through public offerings regulated by the Securities and Exchange Commission (SEC) and require extensive disclosure, making them suitable for long-term financing. Commercial paper is issued as unsecured, short-term promissory notes primarily by large corporations and is exempt from SEC registration if maturity is less than 270 days, subject to state blue sky laws for investor protection. The structured issuance processes and regulatory frameworks distinctly influence their accessibility, investor base, and compliance costs.

Investor Profiles

Corporate bonds attract long-term investors such as pension funds, insurance companies, and conservative individual investors seeking steady income through fixed interest payments. Commercial paper appeals to institutional investors and money market funds looking for short-term, low-risk investments with higher liquidity and slightly lower returns. Risk tolerance and investment horizon determine whether investors prefer the fixed maturity and credit risk of corporate bonds or the short-term, highly liquid nature of commercial paper.

Advantages and Disadvantages

Corporate bonds offer long-term financing with fixed interest rates, providing stable income for investors but often involve higher issuance costs and longer maturity periods compared to commercial paper. Commercial paper allows corporations to raise short-term funds quickly and at lower interest rates, enhancing liquidity; however, it carries higher refinancing risks and is limited to highly-rated companies. The choice depends on the company's capital structure needs, with corporate bonds better for long-term projects and commercial paper suitable for immediate working capital requirements.

Choosing Between Corporate Bonds and Commercial Paper

Choosing between corporate bonds and commercial paper depends on the company's financing needs and risk tolerance. Corporate bonds offer long-term funding with fixed interest rates, suitable for large capital projects, whereas commercial paper provides short-term, unsecured debt typically used for working capital. Investors prioritize corporate bonds for steady income and lower risk, while commercial paper appeals to those seeking higher liquidity and short maturity periods.

Corporate Bond Infographic

libterm.com

libterm.com