Variable cost refers to expenses that change directly with production volume, such as raw materials and labor. Understanding these costs helps you manage profitability and make informed pricing decisions. Explore the rest of the article to learn how variable costs impact your business strategy.

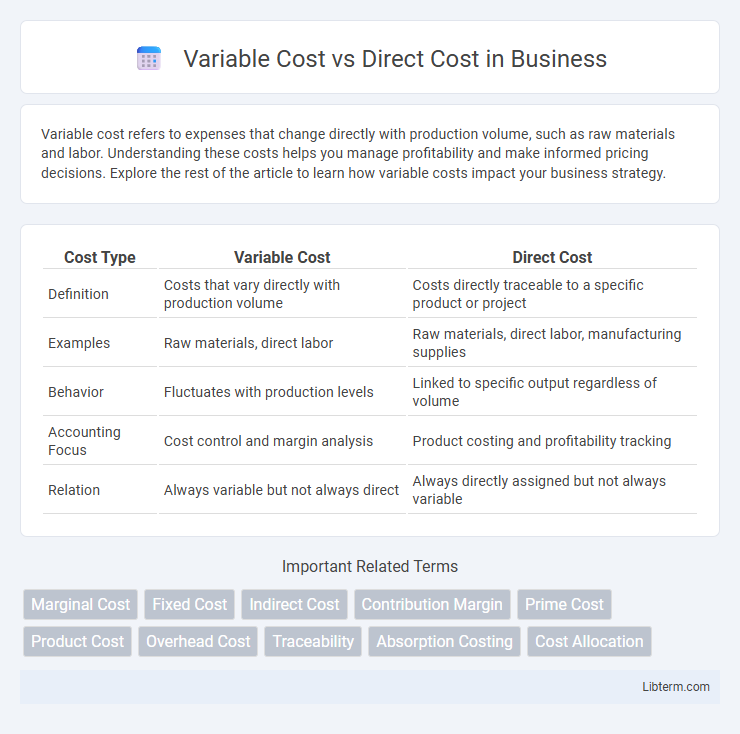

Table of Comparison

| Cost Type | Variable Cost | Direct Cost |

|---|---|---|

| Definition | Costs that vary directly with production volume | Costs directly traceable to a specific product or project |

| Examples | Raw materials, direct labor | Raw materials, direct labor, manufacturing supplies |

| Behavior | Fluctuates with production levels | Linked to specific output regardless of volume |

| Accounting Focus | Cost control and margin analysis | Product costing and profitability tracking |

| Relation | Always variable but not always direct | Always directly assigned but not always variable |

Introduction to Variable Cost and Direct Cost

Variable cost changes directly with production volume, such as raw materials and direct labor expenses, which increase as more units are produced. Direct cost refers specifically to expenses that can be directly traced to the production of goods or services, including both variable costs like materials and fixed costs like dedicated equipment depreciation. Understanding the distinction between variable and direct costs is crucial for accurate cost allocation and effective budgeting in manufacturing and service industries.

Definitions: What Are Variable Costs?

Variable costs are expenses that fluctuate directly with production volume, such as raw materials and direct labor. These costs increase as output rises and decrease when production slows, reflecting the operational scale. Unlike fixed costs, variable costs vary in total but remain constant per unit within a relevant range of activity.

Definitions: What Are Direct Costs?

Direct costs are expenses that can be directly attributed to the production of goods or services, including raw materials, labor, and manufacturing supplies. These costs vary proportionally with the level of production, making them variable in nature but distinct from indirect costs like overhead. Understanding direct costs is essential for accurate product costing, budgeting, and profitability analysis in managerial accounting.

Key Differences Between Variable Cost and Direct Cost

Variable cost fluctuates with production volume, representing expenses like raw materials and labor directly tied to the number of units produced. Direct cost specifically refers to expenses that can be directly traced to a cost object such as a product, including both fixed and variable expenses like direct labor, direct materials, and manufacturing supplies. The key difference lies in variable costs changing with production levels, while direct costs are identified by their traceability to a product regardless of cost behavior.

Similarities Between Variable Cost and Direct Cost

Variable costs and direct costs both fluctuate in direct proportion to the level of production or business activity, reflecting changes in output volume. These cost types can be traced specifically to the production process, making them essential for calculating product cost and profitability. Both variable and direct costs include expenses such as raw materials and direct labor, allowing businesses to attribute costs accurately to individual units or projects.

Examples of Variable Costs in Business

Variable costs in business fluctuate directly with production volume, including expenses such as raw materials, direct labor costs, and sales commissions. For example, a manufacturing company incurs variable costs through the purchase of components needed for each unit produced, while a retail business faces variability in packaging and shipping costs dependent on sales volume. Understanding these specific variable costs is crucial for accurate pricing strategies and cost management.

Examples of Direct Costs in Business

Direct costs in business include expenses that can be directly attributed to the production of goods or services, such as raw materials, direct labor wages, and manufacturing supplies. Variable costs often overlap with direct costs because they fluctuate with production volume; for instance, costs of components used in assembly line manufacturing increase as more units are produced. Other examples include commission paid to sales staff based on sales volume and costs of packaging materials specifically for completed products.

How Variable and Direct Costs Impact Profitability

Variable costs fluctuate directly with production volume, influencing profit margins by increasing total expenses as output rises, thereby reducing profitability if sales prices remain constant. Direct costs, such as raw materials and labor directly tied to production, are essential in calculating the gross profit since they are subtracted from revenue to determine the profit generated by core operations. Understanding the distinction and management of both costs allows businesses to optimize pricing strategies and production efficiency, ultimately enhancing overall profitability.

Variable Cost vs Direct Cost: Implications for Budgeting

Variable costs fluctuate directly with production volume, such as raw materials and direct labor, making them essential for accurate budgeting in dynamic manufacturing environments. Direct costs encompass all expenses directly traceable to a product, including both variable costs and fixed direct costs like equipment depreciation. Understanding the distinction between variable and direct costs enables more precise forecasting and resource allocation, improving budget flexibility and cost control.

Conclusion: Choosing the Right Cost Approach

Selecting between variable cost and direct cost methods depends on the specific business scenario and management objectives. Variable cost provides clearer insight into cost behavior relative to production levels, aiding in short-term decision-making and budgeting. Direct cost, by including only costs directly traceable to a product, supports precise product costing and pricing strategies in manufacturing and service industries.

Variable Cost Infographic

libterm.com

libterm.com