Stock options provide you with the opportunity to buy company shares at a predetermined price, enabling potential profit if the stock value rises. Understanding key terms like vesting schedules, strike prices, and expiration dates is crucial for maximizing benefits. Explore the rest of the article to learn how stock options can enhance your financial strategy.

Table of Comparison

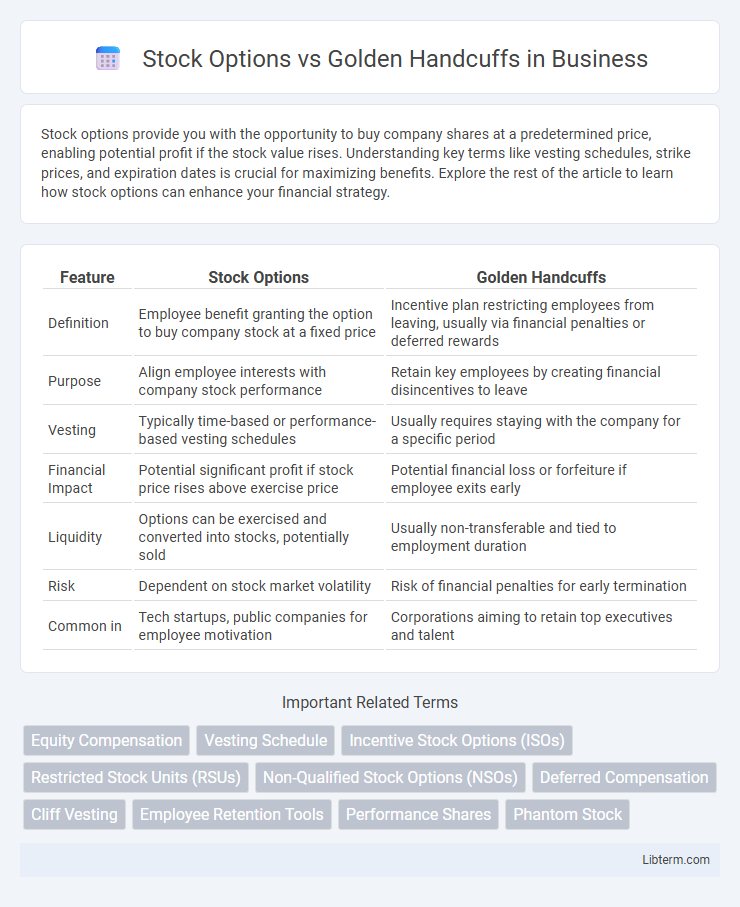

| Feature | Stock Options | Golden Handcuffs |

|---|---|---|

| Definition | Employee benefit granting the option to buy company stock at a fixed price | Incentive plan restricting employees from leaving, usually via financial penalties or deferred rewards |

| Purpose | Align employee interests with company stock performance | Retain key employees by creating financial disincentives to leave |

| Vesting | Typically time-based or performance-based vesting schedules | Usually requires staying with the company for a specific period |

| Financial Impact | Potential significant profit if stock price rises above exercise price | Potential financial loss or forfeiture if employee exits early |

| Liquidity | Options can be exercised and converted into stocks, potentially sold | Usually non-transferable and tied to employment duration |

| Risk | Dependent on stock market volatility | Risk of financial penalties for early termination |

| Common in | Tech startups, public companies for employee motivation | Corporations aiming to retain top executives and talent |

Understanding Stock Options: A Brief Overview

Stock options grant employees the right to purchase company shares at a predetermined price, incentivizing long-term investment in the company's success. They vest over time, aligning employee interests with shareholder value by encouraging retention and performance. Understanding stock options is crucial for assessing their potential financial benefits and tax implications compared to other employee compensation methods like golden handcuffs.

What Are Golden Handcuffs?

Golden handcuffs are financial incentives offered by employers to retain key employees, typically comprising stock options, bonuses, or restricted stock units that vest over time. These incentives create a strong economic motivation for employees to remain with the company, aligning their interests with long-term corporate performance. Unlike standard stock options, golden handcuffs often include forfeiture provisions if the employee leaves before the vesting period.

Key Differences Between Stock Options and Golden Handcuffs

Stock options grant employees the right to purchase company shares at a predetermined price, incentivizing long-term commitment through potential equity gains. Golden handcuffs involve financial incentives, such as bonuses or restricted stock units, that vest over time to encourage retention without requiring upfront purchase. Key differences include the acquisition mechanism, with stock options involving buying shares versus golden handcuffs relying on earned benefits, and the strategic focus on ownership versus retention incentives.

How Stock Options Motivate Employees

Stock options motivate employees by aligning their financial interests with company performance, encouraging long-term commitment and productivity. These options provide potential equity ownership, giving employees a direct stake in the company's growth and success. This incentive often enhances retention and drives employees to contribute to increasing shareholder value.

The Role of Golden Handcuffs in Employee Retention

Golden handcuffs serve as a strategic employee retention tool by offering financial incentives, such as restricted stock units or cash bonuses, contingent upon employees remaining with the company for a specified period. Unlike stock options, which provide the right to purchase shares at a set price, golden handcuffs create a binding commitment that discourages employees from leaving prematurely. This approach effectively aligns employee interests with long-term corporate goals, reducing turnover and fostering organizational stability.

Pros and Cons of Stock Options

Stock options provide employees with the potential for significant financial gain if the company's stock price increases, aligning employee and shareholder interests while incentivizing long-term commitment. However, stock options carry the risk of becoming worthless if the stock price falls below the exercise price, and employees may face tax liabilities upon exercising the options, which can reduce net gains. Unlike golden handcuffs that lock employees through retention bonuses or penalties, stock options offer flexibility but require market performance to realize value.

Pros and Cons of Golden Handcuffs

Golden handcuffs provide employees with strong financial incentives to remain with a company through bonuses, restricted stock units, or deferred compensation, enhancing long-term retention and aligning worker interests with company performance. However, they may also limit employee mobility and create dissatisfaction if the tied compensation outweighs the individual's career growth or market opportunities. Unlike stock options, which offer potential upside based on stock price appreciation, golden handcuffs often guarantee value but reduce flexibility.

Tax Implications: Stock Options vs Golden Handcuffs

Stock options often trigger taxable events upon exercise, with ordinary income tax applied to the difference between the exercise price and the fair market value, while capital gains tax may apply upon sale. Golden handcuffs, typically structured as restricted stock units (RSUs) or deferred compensation, are taxed as ordinary income when vesting conditions are met, with potential payroll tax liabilities. Understanding the timing and nature of these tax events is crucial for maximizing after-tax income and compliance.

Which Incentive Is Right for Your Company?

Choosing between stock options and golden handcuffs depends on your company's long-term retention goals and employee motivation strategies. Stock options offer employees the potential for equity growth, aligning their interests with company performance, while golden handcuffs provide guaranteed financial rewards tied to staying with the company over a set period. Evaluate your company's financial flexibility, culture, and talent retention needs to determine which incentive best supports sustainable growth and employee loyalty.

Future Trends in Employee Compensation and Incentives

Stock options continue evolving as key incentives in employee compensation, with future trends highlighting enhanced flexibility and tax efficiency to boost long-term retention. Golden handcuffs are increasingly structured through diversified benefits packages, integrating retirement savings and performance bonuses to create stronger employee commitment. Emerging approaches focus on combining stock options with golden handcuff elements to align employee interests with company growth and reduce turnover.

Stock Options Infographic

libterm.com

libterm.com