Bill management directly impacts your financial health by ensuring timely payments and avoiding unnecessary fees. Understanding different types of bills and how to prioritize them can enhance your budgeting skills and reduce stress. Explore the rest of the article to learn practical strategies for optimizing your bill payments and improving your financial stability.

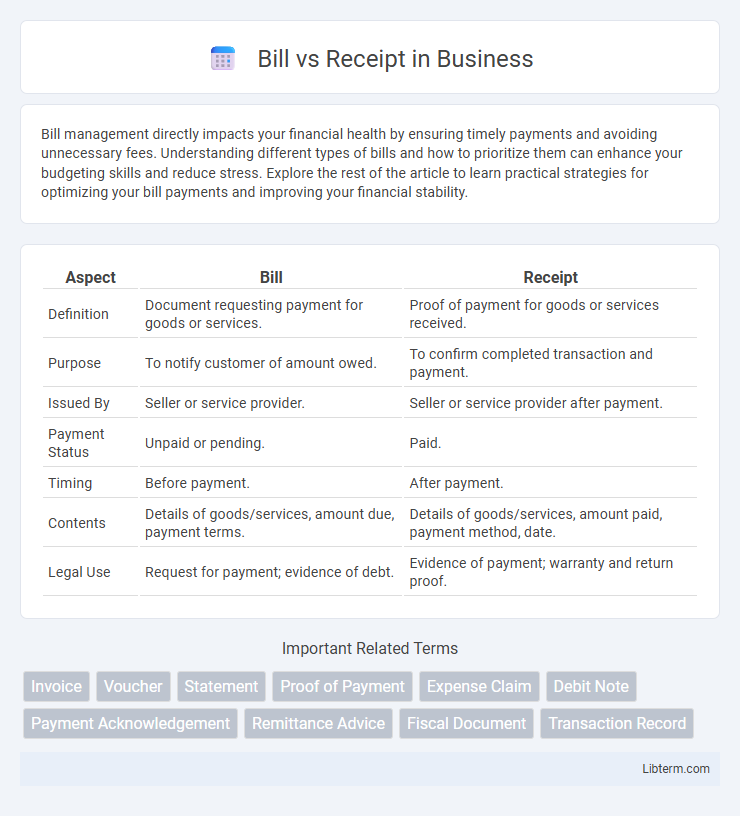

Table of Comparison

| Aspect | Bill | Receipt |

|---|---|---|

| Definition | Document requesting payment for goods or services. | Proof of payment for goods or services received. |

| Purpose | To notify customer of amount owed. | To confirm completed transaction and payment. |

| Issued By | Seller or service provider. | Seller or service provider after payment. |

| Payment Status | Unpaid or pending. | Paid. |

| Timing | Before payment. | After payment. |

| Contents | Details of goods/services, amount due, payment terms. | Details of goods/services, amount paid, payment method, date. |

| Legal Use | Request for payment; evidence of debt. | Evidence of payment; warranty and return proof. |

Understanding the Difference: Bill vs Receipt

A bill is a statement requesting payment for goods or services provided, detailing the amount owed before the transaction is completed. A receipt, on the other hand, serves as proof of payment and confirms that the bill has been settled. Understanding the difference between a bill and a receipt is crucial for accurate financial record-keeping and transaction verification.

Definitions: What Is a Bill? What Is a Receipt?

A bill is a detailed statement issued by a seller to a buyer listing goods or services provided along with the amount due for payment. A receipt is a proof of payment document issued after the buyer has settled the bill, confirming the transaction's completion. Bills serve as a request for payment, while receipts act as evidence that payment has been made.

Purpose of Bills and Receipts

Bills serve as formal requests for payment issued by sellers to buyers, detailing the amount owed for goods or services provided. Receipts function as proof of payment, confirming that a transaction has been completed and funds have been received. Both documents play critical roles in financial record-keeping and accounting accuracy.

Key Elements Included in a Bill

A bill typically includes key elements such as the date of issue, detailed list of goods or services provided, quantities, unit prices, total amount payable, payment terms, and the vendor's contact information. It may also feature tax identification numbers, invoice or bill number for tracking, and applicable taxes or discounts. These elements ensure clarity in the payment process and create a formal record for both parties involved.

Key Elements Included in a Receipt

A receipt typically includes key elements such as the date of the transaction, the seller's and buyer's contact information, a detailed list of purchased items or services with individual prices, the total amount paid, payment method, and any applicable taxes or discounts. It serves as proof of purchase and is essential for returns, warranties, and expense tracking. Unlike a bill, a receipt confirms that the payment has been completed.

The Billing Process Explained

The billing process involves generating a bill, which is a detailed statement of charges for goods or services provided, serving as a request for payment. A receipt, on the other hand, is issued after the payment is made, confirming the transaction and showing the amount paid. Understanding the distinction between a bill and a receipt is essential for effective financial record-keeping and accurate accounting.

When and How Receipts Are Issued

Receipts are issued immediately after a transaction is completed to provide proof of payment and detail the purchased items, quantities, and prices. They serve as official documentation for the buyer and seller, often required for returns, exchanges, or accounting purposes. Unlike bills, which request payment before or at the time of purchase, receipts confirm that payment has already been made.

Legal and Accounting Implications

A bill serves as a formal request for payment and is considered an offer to pay under legal frameworks, while a receipt acts as evidence of payment and ownership transfer, solidifying the transaction in accounting records. From an accounting perspective, bills are recorded as accounts payable or receivable, affecting liabilities or assets, whereas receipts validate these transactions and are essential for auditing and tax compliance. Legal implications dictate that improper handling of bills or receipts can lead to disputes, fines, or violations of financial reporting standards mandated by regulatory authorities like the IRS or SEC.

Common Mistakes: Mixing Up Bills and Receipts

Mixing up bills and receipts often leads to confusion in financial records, as bills represent amounts owed while receipts confirm payments made. Common mistakes include treating a receipt as a bill, which can result in missed payments or inaccurate expense tracking. Clear differentiation between these documents is crucial for accurate budgeting and accounting.

Best Practices for Managing Bills and Receipts

Organizing bills and receipts systematically improves financial tracking and simplifies expense reconciliation. Utilize digital tools with OCR (Optical Character Recognition) capabilities to scan and categorize documents, enabling quick retrieval and reducing paper clutter. Establish a consistent filing system, separate personal and business expenses, and regularly review for accuracy to ensure efficient management and compliance.

Bill Infographic

libterm.com

libterm.com