The duty of loyalty requires individuals, especially corporate directors and officers, to act in the best interests of the organization without personal conflicts or self-dealing. Breaching this duty can lead to legal consequences, emphasizing the importance of unwavering commitment when managing company affairs. Discover how understanding this principle can protect your interests and strengthen governance by reading the full article.

Table of Comparison

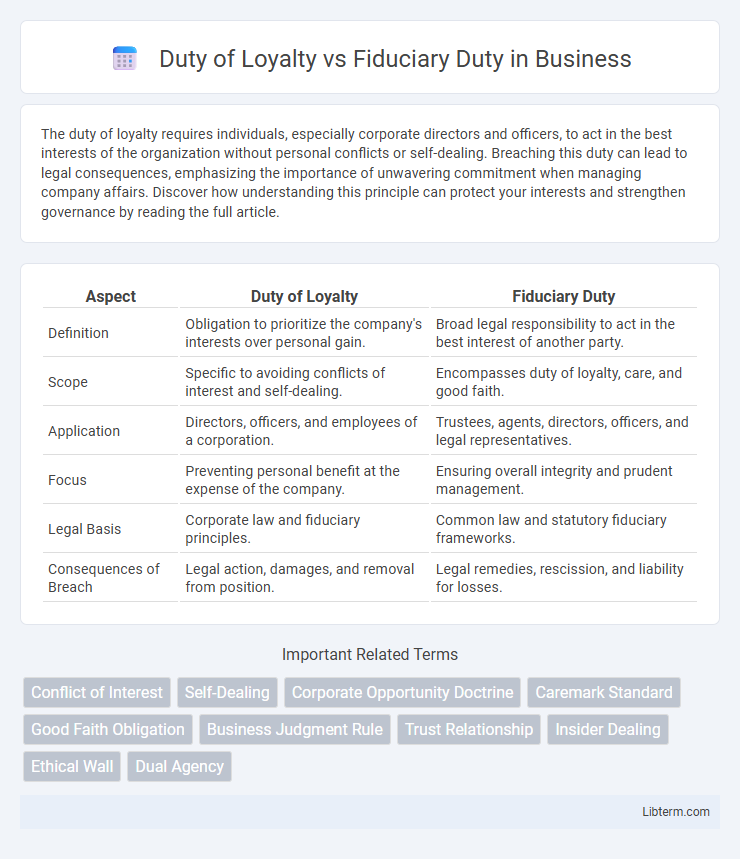

| Aspect | Duty of Loyalty | Fiduciary Duty |

|---|---|---|

| Definition | Obligation to prioritize the company's interests over personal gain. | Broad legal responsibility to act in the best interest of another party. |

| Scope | Specific to avoiding conflicts of interest and self-dealing. | Encompasses duty of loyalty, care, and good faith. |

| Application | Directors, officers, and employees of a corporation. | Trustees, agents, directors, officers, and legal representatives. |

| Focus | Preventing personal benefit at the expense of the company. | Ensuring overall integrity and prudent management. |

| Legal Basis | Corporate law and fiduciary principles. | Common law and statutory fiduciary frameworks. |

| Consequences of Breach | Legal action, damages, and removal from position. | Legal remedies, rescission, and liability for losses. |

Understanding Duty of Loyalty: Definition and Scope

Duty of loyalty requires individuals, especially fiduciaries, to act in the best interests of the principal or beneficiary, avoiding conflicts of interest and self-dealing. This duty mandates unwavering commitment, ensuring decisions promote the welfare of the organization or client above personal gains. It encompasses confidentiality, good faith, and full disclosure, forming a critical component of fiduciary duty in legal and corporate governance contexts.

What Is Fiduciary Duty? Key Principles Explained

Fiduciary duty refers to the legal and ethical obligation of one party, known as the fiduciary, to act in the best interests of another party, typically the beneficiary or principal. Key principles of fiduciary duty include loyalty, care, and good faith, requiring the fiduciary to avoid conflicts of interest and act with honesty and prudence. Unlike the narrower duty of loyalty, fiduciary duty encompasses a broader scope of responsibilities ensuring trust, transparency, and accountability in managing another's affairs or assets.

Core Differences: Duty of Loyalty vs Fiduciary Duty

The Duty of Loyalty requires fiduciaries to act in the best interest of the principal by avoiding conflicts of interest and self-dealing, ensuring undivided loyalty. In contrast, Fiduciary Duty encompasses a broader obligation, including duties of care, loyalty, and good faith, mandating fiduciaries to act prudently and ethically in managing another party's assets or interests. Core differences lie in the Duty of Loyalty's narrow focus on loyalty and conflict avoidance, while Fiduciary Duty covers comprehensive responsibilities beyond loyalty alone.

Legal Foundations: Origins and Evolution

The duty of loyalty originates from common law principles requiring fiduciaries to prioritize the interests of their principals above their own, ensuring no conflict of interest compromises their responsibilities. Fiduciary duty, encompassing the duty of loyalty along with duties of care and good faith, evolved through equitable doctrines developed by courts to govern relationships of trust such as those between trustees and beneficiaries or corporate directors and shareholders. Legal foundations of these duties have been shaped by landmark cases such as Meinhard v. Salmon and Guth v. Loft, which cemented the broad scope and stringent standards fiduciaries must adhere to in both common law and statutory frameworks.

Real-World Examples: Duty of Loyalty in Action

The Duty of Loyalty requires corporate directors to prioritize the company's interests over personal gains, as seen in cases where executives refrain from insider trading to avoid conflicts of interest. Fiduciary Duty broadly encompasses this obligation alongside duties of care and good faith, ensuring leaders act prudently for shareholders' benefit. Real-world examples include board members disclosing potential conflicts and abstaining from votes where personal interests might compromise corporate welfare.

Fiduciary Duty in Practice: Case Studies

Fiduciary duty in practice is exemplified by landmark cases such as the 2016 Delaware Chancery Court decision in *In re Walt Disney Co. Derivative Litigation*, where directors' duties to act in shareholders' best interests were scrutinized for alleged breaches of the duty of loyalty. In *Smith v. Van Gorkom* (1985), the court emphasized the necessity of informed decision-making, highlighting fiduciaries' obligation to act prudently and with due care. These cases demonstrate fiduciary duty's critical role in corporate governance, enforcing accountability beyond simple loyalty to prevent conflicts of interest and self-dealing.

Role in Corporate Governance

The duty of loyalty requires corporate directors and officers to prioritize the corporation's interests above their own, preventing conflicts of interest and self-dealing. Fiduciary duty encompasses the broader obligation of directors and officers to act in good faith, with due care, and in the best interest of the corporation and its shareholders. Both duties are fundamental in corporate governance, ensuring accountability and trust within the management structure.

Breaching Duties: Legal Consequences and Remedies

Breaching the duty of loyalty or fiduciary duty can lead to severe legal consequences including monetary damages, injunctions, and disqualification from corporate positions. Courts often impose remedies such as disgorgement of profits, constructive trusts, and recovery of losses caused by the breach. Shareholders and principals may bring derivative lawsuits or claims for specific performance to enforce these duties and obtain equitable relief.

Strengthening Compliance: Best Practices

Strengthening compliance with Duty of Loyalty and Fiduciary Duty requires implementing robust monitoring systems that detect conflicts of interest and ensure transparent decision-making processes. Best practices include regular training programs on ethical standards, clear policies outlining fiduciary responsibilities, and rigorous audit mechanisms to enforce accountability. Leveraging technology such as compliance software enhances real-time oversight and supports timely identification of potential breaches.

Final Thoughts: Choosing the Right Oversight Mechanism

Selecting the appropriate oversight mechanism hinges on understanding the distinct scopes of duty of loyalty and fiduciary duty. Duty of loyalty primarily mandates that agents prioritize the principal's interests over personal gain, whereas fiduciary duty encompasses a broader set of responsibilities, including care, confidentiality, and good faith. Aligning corporate governance with the specific requirements of these duties optimizes legal compliance and strengthens stakeholder trust.

Duty of Loyalty Infographic

libterm.com

libterm.com