Par value represents the nominal or face value of a security, such as a bond or stock, assigned at issuance. It serves as a baseline for pricing but does not necessarily reflect the market value or trading price. Explore the rest of the article to understand how par value impacts your investment strategy.

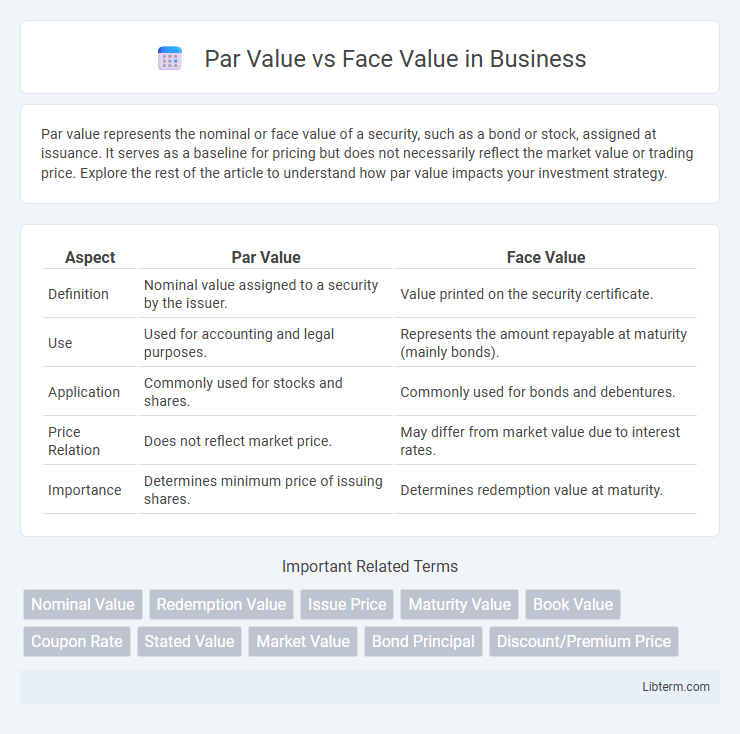

Table of Comparison

| Aspect | Par Value | Face Value |

|---|---|---|

| Definition | Nominal value assigned to a security by the issuer. | Value printed on the security certificate. |

| Use | Used for accounting and legal purposes. | Represents the amount repayable at maturity (mainly bonds). |

| Application | Commonly used for stocks and shares. | Commonly used for bonds and debentures. |

| Price Relation | Does not reflect market price. | May differ from market value due to interest rates. |

| Importance | Determines minimum price of issuing shares. | Determines redemption value at maturity. |

Introduction to Par Value and Face Value

Par value represents the nominal or stated value assigned to a bond or stock at issuance, serving as a baseline for accounting and dividend calculations. Face value refers specifically to the amount printed on a bond certificate, indicating the principal amount repayable at maturity. Both terms are critical in finance for determining securities' worth and investor obligations.

Definition of Par Value

Par value refers to the nominal or fixed value assigned to a security, such as a stock or bond, at the time of issuance, representing the minimum price at which shares can be sold. It is a legal accounting measure that does not necessarily reflect the market value or trading price of the security. Unlike face value, which commonly applies to bonds as the amount paid to bondholders at maturity, par value primarily relates to stocks and helps establish the stated capital of a company.

Definition of Face Value

Face value refers to the nominal worth printed on a financial instrument such as a bond, stock certificate, or currency note, representing its original cost or redemption value at maturity. This value is crucial for investors as it determines the amount payable to the holder upon maturity in bonds or the original price of a share issued by a company. Understanding face value helps in assessing the basic value of securities apart from market price fluctuations.

Key Differences Between Par Value and Face Value

Par value refers to the nominal value assigned to a bond or stock by the issuer, often representing the minimum price for issuance and used for accounting purposes. Face value, commonly associated with bonds, is the amount paid to the holder at maturity, reflecting the bond's principal value regardless of market fluctuations. The key difference lies in par value being a fixed accounting measure for stocks and shares, while face value specifically denotes the redemption value of debt instruments like bonds.

Importance of Par Value in Financial Markets

Par value represents the nominal or stated value of a security as assigned by the issuer and is crucial in determining the minimum price at issuance, affecting how stocks and bonds are initially valued. It serves as a legal benchmark for equity capital and influences dividend calculations, shareholder equity, and the accounting treatment of issued shares. In bond markets, par value dictates the redemption amount at maturity, plays a role in yield calculations, and helps investors assess price premiums or discounts relative to face value.

Significance of Face Value for Investors

Face value represents the nominal worth of a security as stated on the certificate, crucial for investors to determine the repayment amount upon maturity for bonds or the base price for stocks. This value serves as the foundation for calculating interest payments on bonds, directly impacting the investor's expected income. Understanding face value helps investors assess the initial investment risk and the potential return, guiding more informed decisions in portfolio management.

Par Value vs Face Value in Bonds

Par value in bonds refers to the amount the issuer agrees to repay the bondholder at maturity, typically set at $1,000 per bond. Face value is often used interchangeably with par value but specifically denotes the bond's stated value printed on the certificate, serving as the basis for interest payments. Differences arise when bonds trade at premiums or discounts, causing market price to diverge from both par and face values despite their nominal equivalence.

Par Value vs Face Value in Stocks

Par value in stocks refers to the nominal or minimum price assigned to a share at issuance, primarily serving legal or accounting purposes without reflecting market value. Face value, often used interchangeably with par value, specifically denotes the value printed on a stock certificate but does not impact market price or dividends. Investors focus on market price rather than par or face value when assessing stock worth, as these values have limited practical significance in modern trading and valuation.

Common Misconceptions

Par value and face value are often mistakenly considered interchangeable terms, but they serve different purposes in finance and securities. Par value refers to the nominal value assigned to a stock or bond at issuance, typically a minimal amount that has little bearing on market price, while face value denotes the amount the bondholder will receive at maturity. A common misconception is that par value reflects the market value of a stock, whereas market price fluctuates based on supply and demand, independent of the par or face values.

Conclusion: Choosing the Right Metric

Choosing between par value and face value depends on the specific financial context and investment goals. Par value primarily serves as a legal accounting baseline for stock issuance, while face value directly impacts bond pricing and maturity payouts. Investors and companies must evaluate which metric offers better clarity and relevance for valuation, risk assessment, and regulatory compliance in their particular scenario.

Par Value Infographic

libterm.com

libterm.com