Systematic risk refers to the inherent uncertainty that affects the entire market or a broad segment of it, driven by macroeconomic factors such as inflation, interest rates, and political instability. This type of risk cannot be eliminated through diversification, making it crucial for investors to understand how market-wide events impact their portfolios. Explore the rest of the article to learn how to manage and mitigate the effects of systematic risk on your investments.

Table of Comparison

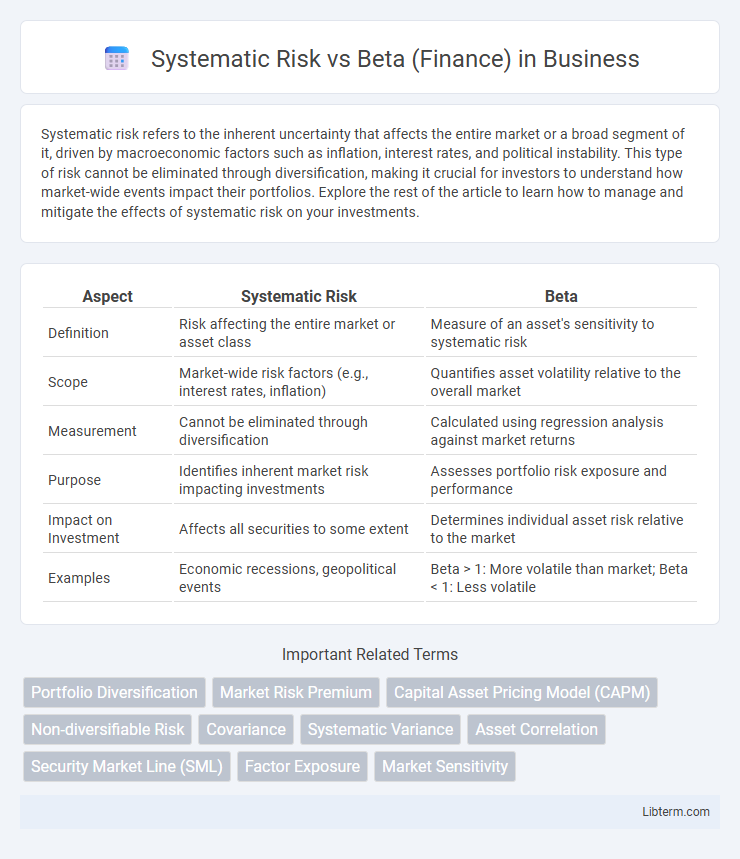

| Aspect | Systematic Risk | Beta |

|---|---|---|

| Definition | Risk affecting the entire market or asset class | Measure of an asset's sensitivity to systematic risk |

| Scope | Market-wide risk factors (e.g., interest rates, inflation) | Quantifies asset volatility relative to the overall market |

| Measurement | Cannot be eliminated through diversification | Calculated using regression analysis against market returns |

| Purpose | Identifies inherent market risk impacting investments | Assesses portfolio risk exposure and performance |

| Impact on Investment | Affects all securities to some extent | Determines individual asset risk relative to the market |

| Examples | Economic recessions, geopolitical events | Beta > 1: More volatile than market; Beta < 1: Less volatile |

Introduction to Systematic Risk and Beta

Systematic risk refers to the inherent market risk that affects all securities and cannot be diversified away, stemming from factors like economic recessions, interest rate changes, and geopolitical events. Beta is a quantitative measure indicating a security's sensitivity to systematic risk, with a beta greater than 1 signaling higher volatility relative to the market and a beta less than 1 indicating lower volatility. Investors use beta to assess a stock's exposure to market risk and to optimize portfolio risk management strategies.

Defining Systematic Risk in Finance

Systematic risk in finance refers to the inherent risk that affects the entire market or a broad segment of the market, arising from macroeconomic factors like interest rates, inflation, and geopolitical events. It cannot be eliminated through diversification, making it a fundamental component of market volatility. Beta measures the sensitivity of an individual asset's returns to movements in the overall market, quantifying its exposure to systematic risk.

Understanding Beta: A Measure of Market Sensitivity

Beta quantifies an asset's sensitivity to systematic risk by measuring its volatility relative to the overall market. A beta greater than 1 indicates higher market sensitivity, meaning the asset price tends to amplify market movements, while a beta less than 1 suggests lower sensitivity and reduced market-related fluctuations. Investors use beta to assess the risk of a security in comparison to market risk, aiding portfolio diversification and risk management strategies.

The Relationship between Systematic Risk and Beta

Systematic risk measures the overall market exposure affecting all securities, while Beta quantifies an individual asset's sensitivity to these market movements. A Beta greater than 1 indicates the asset experiences higher systematic risk compared to the market, whereas a Beta less than 1 implies lower sensitivity. This relationship allows investors to assess portfolio volatility relative to market fluctuations and make informed diversification decisions.

Calculating Beta: Methods and Interpretation

Calculating beta involves statistical methods such as regression analysis, where an asset's returns are regressed against market returns to measure systematic risk relative to the overall market. Beta values above 1 indicate higher volatility compared to the market, while values below 1 suggest lower sensitivity to market movements. Interpreting beta helps investors assess an asset's contribution to portfolio risk and make informed decisions on expected returns and risk management.

Systematic Risk vs. Unsystematic Risk: Key Differences

Systematic risk refers to the overall market risk that cannot be diversified away, affecting all securities due to economic, political, or social factors. Unsystematic risk, also known as specific or idiosyncratic risk, is unique to a particular company or industry and can be minimized through diversification. Beta measures a stock's sensitivity to systematic risk, indicating how much the stock price moves relative to the market, but it does not capture unsystematic risk.

The Role of Beta in Portfolio Management

Beta measures a security's sensitivity to systematic risk, indicating how much its returns move relative to the overall market. In portfolio management, beta is pivotal for assessing an asset's contribution to portfolio volatility and for constructing diversified portfolios that align with targeted risk levels. Accurate beta estimation helps managers optimize asset allocation, balancing risk and expected return in accordance with market fluctuations.

Implications of High and Low Beta Values

High beta values indicate that a stock or portfolio exhibits greater volatility compared to the overall market, implying higher systematic risk and potential for amplified returns or losses. Investors with high risk tolerance may seek high-beta assets for growth, while conservative investors prefer low-beta stocks for stability and reduced exposure to market fluctuations. Understanding beta's implications helps optimize portfolio diversification and risk management strategies aligned with investment objectives.

Systematic Risk and Beta in Asset Pricing Models

Systematic risk represents the inherent market risk that cannot be diversified away, affecting all securities in the financial market. Beta measures an asset's sensitivity to systematic risk, quantifying how much the asset's returns respond to fluctuations in the overall market. In asset pricing models such as the Capital Asset Pricing Model (CAPM), beta is a key variable used to estimate the expected return based on the asset's systematic risk exposure.

Managing Systematic Risk Using Beta Strategies

Managing systematic risk effectively involves using beta as a quantitative measure of a security's sensitivity to market movements, enabling portfolio managers to adjust exposure based on risk tolerance and market conditions. Low-beta stocks usually offer greater protection during market downturns, while high-beta assets provide opportunities for excess returns during bullish trends, allowing strategic allocation to balance risk and reward. Employing beta strategies such as beta hedging or beta targeting helps optimize portfolios by controlling volatility linked to systematic risk, thereby enhancing long-term risk-adjusted performance.

Systematic Risk Infographic

libterm.com

libterm.com