Family-owned businesses often emphasize personalized service, trust, and deep community connections, distinguishing them from larger corporations. These enterprises typically prioritize long-term relationships and uphold strong values passed down through generations. Discover how a family-owned approach can benefit you and your decisions by reading the rest of the article.

Table of Comparison

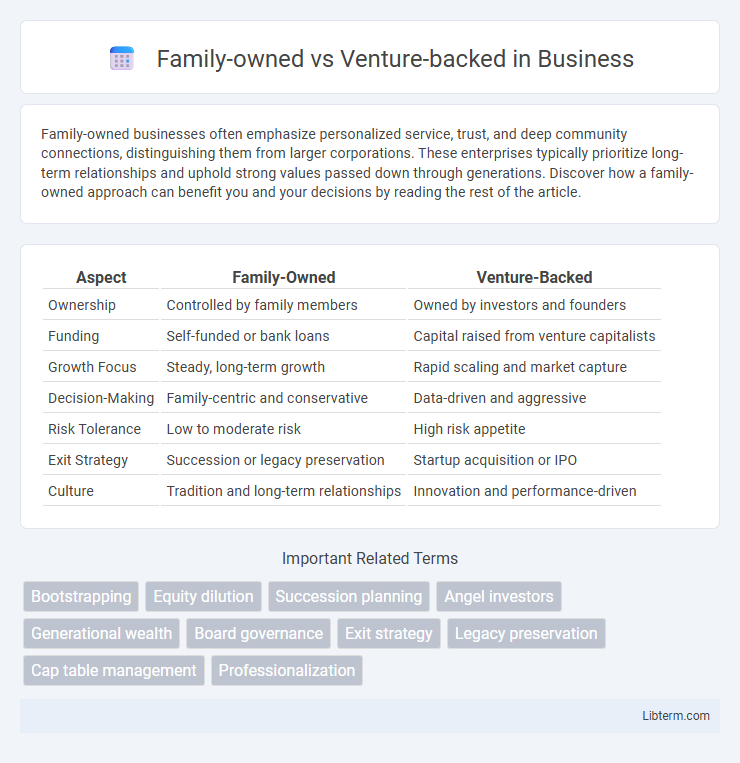

| Aspect | Family-Owned | Venture-Backed |

|---|---|---|

| Ownership | Controlled by family members | Owned by investors and founders |

| Funding | Self-funded or bank loans | Capital raised from venture capitalists |

| Growth Focus | Steady, long-term growth | Rapid scaling and market capture |

| Decision-Making | Family-centric and conservative | Data-driven and aggressive |

| Risk Tolerance | Low to moderate risk | High risk appetite |

| Exit Strategy | Succession or legacy preservation | Startup acquisition or IPO |

| Culture | Tradition and long-term relationships | Innovation and performance-driven |

Introduction to Business Ownership Structures

Family-owned businesses often prioritize long-term stability, personal legacy, and close-knit management, leveraging deep-rooted relationships and local market knowledge. Venture-backed companies focus on rapid growth, scalability, and innovation, fueled by external investments and aggressive market expansion strategies. Understanding these contrasting ownership structures helps entrepreneurs align their business goals with appropriate funding, governance, and operational models.

Defining Family-Owned Businesses

Family-owned businesses are entities primarily controlled and operated by one or more family members, often spanning multiple generations with ownership and leadership concentrated within the family circle. These businesses emphasize long-term stability, legacy preservation, and deep-rooted community ties, contrasting with venture-backed companies that prioritize rapid growth and external investor involvement. Ownership in family businesses typically reflects a commitment to maintaining family values and sustaining wealth across generations, influencing strategic decisions and corporate culture.

Understanding Venture-Backed Companies

Venture-backed companies secure funding from external investors aiming for rapid growth and scalable business models, often in technology or innovative sectors. These startups prioritize market disruption, aggressive expansion, and high return on investment, contrasting with family-owned firms that emphasize long-term stability and legacy. Understanding venture-backed dynamics involves analyzing investor expectations, funding rounds, and exit strategies such as IPOs or acquisitions.

Capital and Funding Strategies

Family-owned businesses typically rely on internal capital accumulation and reinvested earnings for funding, prioritizing steady growth and financial independence. Venture-backed companies access significant external funding through equity financing, enabling rapid expansion and scaling by leveraging venture capital firms and angel investors. These contrasting capital strategies directly influence risk tolerance, control dynamics, and long-term business objectives.

Leadership and Decision-Making Dynamics

Family-owned businesses often emphasize long-term stability and centralized leadership, with decisions strongly influenced by familial values and legacy preservation. Venture-backed companies typically adopt more dynamic leadership structures driven by investor expectations, prioritizing rapid growth and innovation. This contrast shapes distinct decision-making dynamics, where family firms may favor cautious, consensus-driven choices and venture-backed firms lean toward agile, data-driven strategies.

Growth Trajectories and Expansion

Family-owned businesses often pursue steady, organic growth driven by long-term goals and strong community ties, emphasizing sustainability and legacy preservation. Venture-backed companies typically experience rapid growth trajectories fueled by significant capital injections, aggressive market expansion, and scalability objectives. The contrasting expansion strategies reflect family firms' risk aversion and venture-backed startups' focus on capturing market share and accelerating valuation.

Risk Management Approaches

Family-owned businesses emphasize conservative risk management strategies, prioritizing long-term stability and preservation of legacy through careful financial stewardship and incremental growth. Venture-backed companies adopt aggressive risk-taking to accelerate innovation and market expansion, leveraging external capital to scale rapidly despite higher uncertainty. The contrast highlights family firms' emphasis on resilience and control versus venture-backed firms' focus on disruptive potential and flexible risk tolerance.

Company Culture and Core Values

Family-owned businesses prioritize long-term relationships, emphasizing trust, loyalty, and a strong sense of community within their company culture. Venture-backed startups often foster a high-performance culture driven by innovation, rapid growth, and adaptability, aligning core values with scalability and market disruption. The emphasis in family-owned firms is stability and heritage, while venture-backed companies focus on agility and investor-driven milestones.

Succession Planning and Long-Term Vision

Family-owned businesses prioritize succession planning through generational leadership transfer, ensuring legacy preservation and stable long-term vision aligned with family values. Venture-backed companies often focus on rapid growth and exit strategies, with succession planning centered on professional management transitions rather than familial continuity. Long-term vision in family firms emphasizes sustainability and legacy, while venture-backed firms prioritize scalability and market disruption.

Exit Strategies and Future Outlook

Family-owned businesses often prioritize long-term stability and legacy preservation, typically favoring succession planning or gradual ownership transfer as exit strategies. Venture-backed companies focus on rapid growth and high returns, frequently aiming for exits through initial public offerings (IPOs) or acquisitions by larger firms. The future outlook for family-owned firms emphasizes sustainable growth and resilience, while venture-backed startups anticipate dynamic market opportunities and scalable expansion.

Family-owned Infographic

libterm.com

libterm.com