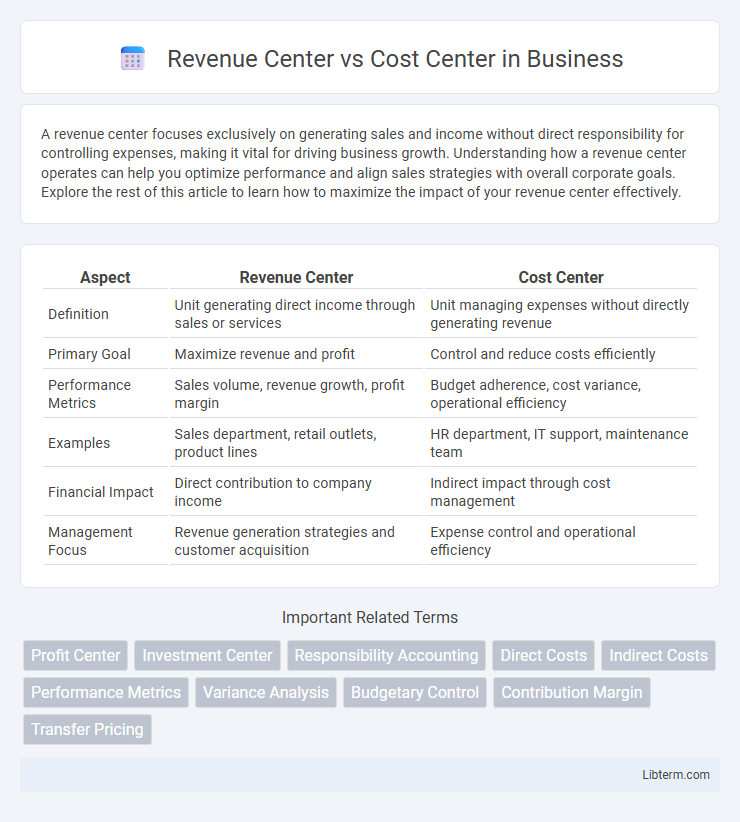

A revenue center focuses exclusively on generating sales and income without direct responsibility for controlling expenses, making it vital for driving business growth. Understanding how a revenue center operates can help you optimize performance and align sales strategies with overall corporate goals. Explore the rest of this article to learn how to maximize the impact of your revenue center effectively.

Table of Comparison

| Aspect | Revenue Center | Cost Center |

|---|---|---|

| Definition | Unit generating direct income through sales or services | Unit managing expenses without directly generating revenue |

| Primary Goal | Maximize revenue and profit | Control and reduce costs efficiently |

| Performance Metrics | Sales volume, revenue growth, profit margin | Budget adherence, cost variance, operational efficiency |

| Examples | Sales department, retail outlets, product lines | HR department, IT support, maintenance team |

| Financial Impact | Direct contribution to company income | Indirect impact through cost management |

| Management Focus | Revenue generation strategies and customer acquisition | Expense control and operational efficiency |

Introduction to Revenue Centers and Cost Centers

Revenue centers generate income directly through sales or services, playing a crucial role in driving overall business profitability by focusing on revenue-producing activities. Cost centers, in contrast, do not generate revenue but are essential for supporting operations, managing expenses related to departments like administration, maintenance, or IT. Understanding the distinction between revenue centers and cost centers helps optimize financial performance by allocating resources effectively and evaluating departmental efficiency.

Defining Revenue Centers

A Revenue Center is a business unit or department responsible for generating sales and income, directly impacting an organization's top line. It focuses on activities that drive revenue growth, such as marketing, sales, or product development, and is measured by its ability to increase profits. Unlike Cost Centers, Revenue Centers have accountability for both generating income and controlling associated costs to maximize overall business performance.

Defining Cost Centers

Cost centers are organizational units or departments within a company that incur expenses but do not directly generate revenue, such as human resources, IT, or maintenance. Their primary function is to manage and control costs while supporting revenue-generating activities indirectly. Effective cost center management involves budgeting, expense tracking, and performance analysis to optimize operational efficiency and reduce unnecessary expenditures.

Key Differences Between Revenue Centers and Cost Centers

Revenue centers generate income by focusing on sales, services, and product delivery, directly contributing to a company's profitability. Cost centers primarily manage expenses and operational costs without directly producing revenue, emphasizing efficiency and budget control. The key difference lies in revenue centers being profit-driven units, while cost centers function to minimize costs and support overall business operations.

Roles and Responsibilities in Each Center

Revenue centers primarily focus on generating sales and increasing company income through direct customer interactions and market expansion, with roles centered on business development, sales strategies, and customer relationship management. Cost centers emphasize controlling and minimizing expenses by managing operational efficiency and resource utilization, with responsibilities often including budgeting, cost tracking, and process optimization. Both centers require clear accountability, but revenue centers drive profitability through income generation while cost centers maintain financial discipline by regulating spending.

Performance Measurement for Revenue and Cost Centers

Revenue centers are evaluated primarily on their ability to generate sales and increase income, using performance metrics such as revenue growth, sales volume, and profit margins. Cost centers are assessed based on their efficiency in managing expenses, with key performance indicators including cost variances, budget adherence, and operational efficiency. Effective performance measurement aligns revenue centers with profit maximization goals while cost centers focus on cost control and resource optimization.

Impact on Organizational Decision-Making

Revenue centers directly influence organizational decision-making by driving sales targets, budget allocations, and growth strategies, emphasizing profit generation and market expansion. Cost centers focus on controlling expenses and optimizing operational efficiency, impacting decisions related to cost management, resource allocation, and process improvements. Understanding the distinct roles of revenue and cost centers enables leaders to balance profitability and cost-efficiency for informed strategic planning.

Examples of Revenue Centers in Business

Revenue centers in business primarily generate income through direct sales or services, examples include retail stores, sales departments, and online e-commerce platforms. These centers are tasked with increasing revenue streams by attracting customers and driving transactions, such as sales teams in technology firms or customer service units handling subscriptions. Unlike cost centers, which focus on controlling expenses, revenue centers emphasize profit generation through measurable sales performance metrics.

Examples of Cost Centers in Business

Examples of cost centers in business include human resources departments, IT support teams, and maintenance units, all of which incur expenses without directly generating revenue. Manufacturing plants and customer service departments also function as cost centers by focusing on operational efficiency and support rather than sales performance. These units play crucial roles in controlling costs and supporting revenue-generating divisions within an organization.

Choosing the Right Center Structure for Your Business

Choosing the right center structure for your business involves evaluating whether your department directly generates revenue or primarily supports other functions, classifying it as a revenue center or a cost center. Revenue centers focus on sales and income generation, essential for businesses aiming to drive growth and profitability, while cost centers manage expenses and optimize operational efficiency without directly producing income. Strategic alignment of these centers with business goals improves financial management and resource allocation, enhancing overall organizational performance.

Revenue Center Infographic

libterm.com

libterm.com