Private equity acquisition involves investment firms purchasing companies to improve their value and achieve profitable exits. These transactions often include strategic restructuring, operational enhancements, and financial engineering to maximize returns. Discover how private equity acquisitions can impact your business and the key factors to consider by reading the full article.

Table of Comparison

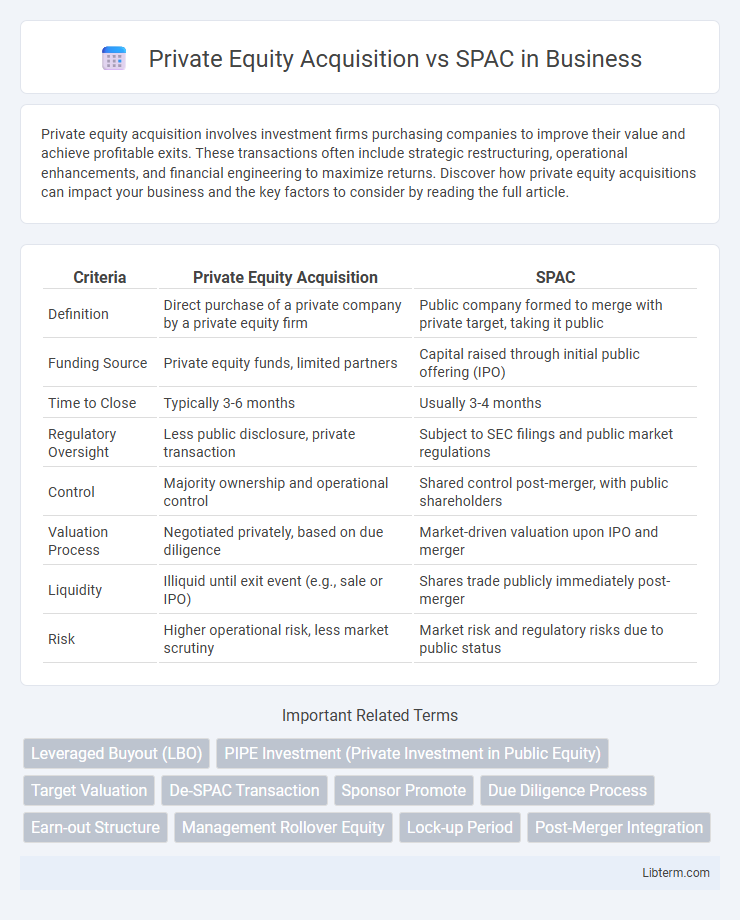

| Criteria | Private Equity Acquisition | SPAC |

|---|---|---|

| Definition | Direct purchase of a private company by a private equity firm | Public company formed to merge with private target, taking it public |

| Funding Source | Private equity funds, limited partners | Capital raised through initial public offering (IPO) |

| Time to Close | Typically 3-6 months | Usually 3-4 months |

| Regulatory Oversight | Less public disclosure, private transaction | Subject to SEC filings and public market regulations |

| Control | Majority ownership and operational control | Shared control post-merger, with public shareholders |

| Valuation Process | Negotiated privately, based on due diligence | Market-driven valuation upon IPO and merger |

| Liquidity | Illiquid until exit event (e.g., sale or IPO) | Shares trade publicly immediately post-merger |

| Risk | Higher operational risk, less market scrutiny | Market risk and regulatory risks due to public status |

Introduction to Private Equity Acquisition and SPAC

Private Equity Acquisition involves investment firms acquiring companies to improve operational efficiency and increase value over time, typically through direct ownership and active management. SPAC (Special Purpose Acquisition Company) is a publicly traded shell corporation created to merge with a private company, enabling the private company to go public without a traditional IPO process. Both methods offer alternative pathways for companies to access capital and liquidity, but differ in structure, timeline, and investor involvement.

What is a Private Equity Acquisition?

A Private Equity Acquisition involves a private equity firm purchasing a controlling interest in a company, aiming to improve its operations and increase value before eventually exiting through a sale or public offering. This method leverages deep industry expertise, operational improvements, and strategic restructuring to drive growth. Unlike SPAC transactions, private equity acquisitions emphasize long-term value creation through active management and hands-on involvement in the portfolio company.

Understanding Special Purpose Acquisition Companies (SPACs)

Special Purpose Acquisition Companies (SPACs) are shell corporations listed on a stock exchange with the primary purpose of acquiring a private company, enabling it to go public without a traditional initial public offering (IPO). Unlike private equity acquisitions that involve direct purchase and operational control of private firms, SPACs raise capital through an IPO before identifying a target company for a business combination, often completing transactions within 18-24 months. SPACs provide faster access to public markets, increased capital transparency, and potential for higher valuation multiples compared to conventional private equity acquisitions.

Key Differences Between Private Equity Acquisitions and SPACs

Private equity acquisitions involve direct investment in private companies or buyouts using pooled funds from limited partners, emphasizing operational control and long-term value creation. SPACs (Special Purpose Acquisition Companies) raise capital through public markets via an initial public offering (IPO) to acquire private firms, offering faster access to public equity but with less direct operational involvement. Key differences include the timeline, with private equity acquisitions typically taking 6 to 12 months, versus SPACs completing deals within 3 to 6 months, and the involvement level, where private equity firms actively manage portfolio companies compared to SPAC sponsors who focus on deal-making and rely on post-merger management teams.

Pros and Cons of Private Equity Acquisitions

Private equity acquisitions offer deep operational expertise and long-term value creation by allowing buyers to implement strategic changes and improve company performance over time. However, these acquisitions often involve lengthy due diligence processes and require significant capital commitments, which can delay returns and increase financial risk. Unlike SPACs that provide quicker public market access, private equity acquisitions typically result in less liquidity for investors until an eventual exit event.

Pros and Cons of SPAC Transactions

SPAC transactions offer faster market access and reduced regulatory hurdles compared to traditional private equity acquisitions, making them appealing for companies seeking quicker capital infusion. However, SPAC deals often face criticism over potential dilution, higher costs, and alignment issues between sponsors and public investors, which can impact long-term shareholder value. Despite these challenges, SPACs provide a transparent pricing mechanism and broader investor reach, distinguishing them from private equity's typically more negotiated and confidential processes.

Impact on Target Companies: PE Acquisition vs SPAC

Private equity acquisitions typically lead to extensive operational restructuring and strategic realignment within target companies, aiming for long-term value creation through active management involvement and efficiency improvements. SPAC mergers often result in faster access to public capital markets but may impose shorter-term performance pressures, affecting the target's growth trajectory and governance structures. The fundamental difference lies in PE's hands-on approach to enhancing intrinsic business value versus SPAC's emphasis on capitalization and market entry speed.

Regulatory Considerations and Compliance

Regulatory considerations for Private Equity (PE) acquisitions involve rigorous due diligence, adherence to securities laws, and compliance with antitrust regulations enforced by entities like the SEC and FTC. SPAC transactions require strict compliance with SEC disclosure rules, including detailed reporting on PIPE investments and the de-SPAC merger process to avoid fraud allegations. Both PE acquisitions and SPACs demand comprehensive adherence to regulatory frameworks to ensure transparency, investor protection, and successful deal closure.

Market Trends: Private Equity vs SPAC Activity

Private equity acquisitions have demonstrated steady growth with increased capital deployment targeting established companies, reflecting investor confidence in long-term value creation. In contrast, SPAC activity surged dramatically in recent years but has seen a marked decline due to regulatory scrutiny and market volatility, leading to a more cautious approach. Market trends indicate private equity's dominance in deal volume and deal value, while SPACs remain a volatile alternative for rapid public listings.

Choosing the Right Path: Factors to Consider

Private equity acquisitions offer control, operational involvement, and long-term value creation through direct ownership, suited for investors seeking strategic influence and extended investment horizons. SPACs provide a faster route to public markets with less regulatory scrutiny, appealing to companies aiming for liquidity and growth capital without prolonged deal processes. Key factors include desired control level, timeline flexibility, regulatory exposure, target company maturity, and investor risk tolerance, which collectively influence the optimal choice between private equity and SPAC transactions.

Private Equity Acquisition Infographic

libterm.com

libterm.com