Liquidity risk refers to the potential inability of an individual or institution to quickly convert assets into cash without significant loss in value. This risk can severely impact your financial stability, especially during unexpected market downturns or economic crises. Explore the full article to understand how to manage liquidity risk effectively and protect your investments.

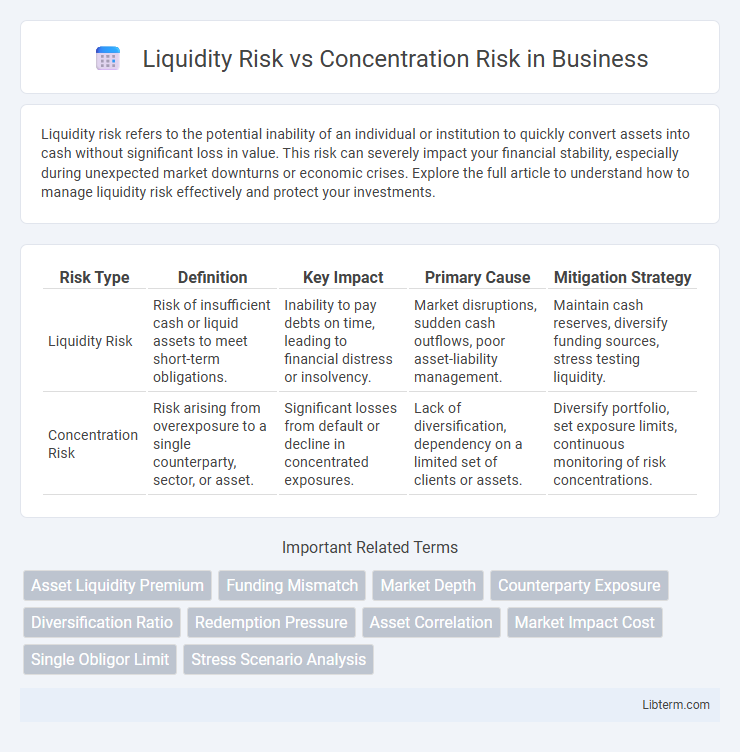

Table of Comparison

| Risk Type | Definition | Key Impact | Primary Cause | Mitigation Strategy |

|---|---|---|---|---|

| Liquidity Risk | Risk of insufficient cash or liquid assets to meet short-term obligations. | Inability to pay debts on time, leading to financial distress or insolvency. | Market disruptions, sudden cash outflows, poor asset-liability management. | Maintain cash reserves, diversify funding sources, stress testing liquidity. |

| Concentration Risk | Risk arising from overexposure to a single counterparty, sector, or asset. | Significant losses from default or decline in concentrated exposures. | Lack of diversification, dependency on a limited set of clients or assets. | Diversify portfolio, set exposure limits, continuous monitoring of risk concentrations. |

Understanding Liquidity Risk

Liquidity risk refers to the potential inability of an institution to meet its short-term financial obligations due to insufficient cash or liquid assets, causing operational disruptions or forced asset sales at unfavorable prices. It arises from market conditions, funding mismatches, or unexpected cash flow demands, impacting banks, investment funds, and corporations. Effective liquidity risk management involves maintaining adequate liquid reserves, stress testing scenarios, and diversifying funding sources to ensure resilience in volatile markets.

Defining Concentration Risk

Concentration risk refers to the potential for significant losses arising from an excessive exposure to a single counterparty, industry, geographic region, or asset type within a portfolio. It increases vulnerability to adverse events affecting the concentrated segment, potentially amplifying financial instability. Unlike liquidity risk, which involves the difficulty of quickly converting assets to cash without significant loss, concentration risk is specifically tied to lack of diversification and the resulting heightened susceptibility to correlated losses.

Key Differences Between Liquidity and Concentration Risk

Liquidity risk refers to the danger that an entity cannot meet its short-term financial obligations due to insufficient liquid assets, impacting cash flow and operational stability. Concentration risk arises from a lack of diversification, where excessive exposure to a single counterparty, sector, or asset class increases the potential for significant losses. The key difference lies in liquidity risk focusing on the availability and timing of cash, whereas concentration risk centers on portfolio or exposure concentration that exacerbates potential financial vulnerability.

Causes of Liquidity Risk

Liquidity risk arises primarily from inadequate cash flow management, unexpected large withdrawals, and market disruptions that hinder the ability to quickly convert assets into cash without significant loss. It is often caused by sudden changes in funding conditions, asset-liability mismatches, and reliance on short-term borrowing. Financial institutions face liquidity risk when concentrated exposures lead to stress on cash reserves and reduce access to funding sources.

Factors Contributing to Concentration Risk

Concentration risk arises when a portfolio or institution holds excessive exposure to a single counterparty, industry, or geographic region, increasing vulnerability to adverse events affecting that specific area. Key factors contributing to concentration risk include lack of diversification, correlated asset classes, and significant reliance on a few large clients or sectors. High concentration amplifies potential losses and reduces the ability to absorb shocks, making robust risk management and monitoring essential.

Measuring Liquidity Risk in Financial Portfolios

Measuring liquidity risk in financial portfolios involves assessing the ease with which assets can be converted into cash without significantly affecting their market price, often using metrics like bid-ask spreads, trading volumes, and time-to-liquidate estimates. Stress testing scenarios simulate market disruptions to evaluate potential liquidity shortfalls, while liquidity coverage ratios (LCR) ensure sufficient high-quality liquid assets to meet short-term obligations. Concentration risk, by contrast, focuses on exposure to single assets or sectors, and combining both risks provides a comprehensive view of potential vulnerabilities in portfolio management.

Assessing Concentration Risk Exposure

Assessing concentration risk exposure involves analyzing the degree to which a portfolio or institution is dependent on a limited number of counterparties, sectors, or asset types, which can magnify potential losses during market stress. Key metrics such as the Herfindahl-Hirschman Index (HHI) and exposure limits help quantify and control concentration risk, ensuring diversification across credit, geographic, and industry dimensions. Effective concentration risk assessment supports liquidity risk management by preventing overreliance on a narrow funding base or asset class that could impair cash flow during adverse conditions.

Impact of Liquidity vs Concentration Risks on Asset Management

Liquidity risk directly affects asset management by limiting the ability to quickly buy or sell assets without significant price changes, potentially leading to forced asset sales and reduced portfolio flexibility. Concentration risk impacts asset management by increasing vulnerability to specific sectors or issuers, which can result in substantial losses if those concentrated holdings underperform. Both risks demand careful portfolio diversification and liquidity management strategies to minimize adverse effects on overall investment performance.

Mitigation Strategies for Liquidity and Concentration Risks

Mitigation strategies for liquidity risk include maintaining adequate cash reserves, diversifying funding sources, and implementing robust cash flow forecasting models to anticipate and manage shortfalls. Concentration risk can be minimized by spreading investments across various counterparties, industries, and geographic regions to avoid excessive exposure to any single entity or sector. Employing stress testing and scenario analysis enhances preparedness by revealing vulnerabilities in liquidity and concentration profiles under adverse conditions.

Best Practices for Risk Management and Diversification

Effective liquidity risk management involves maintaining adequate cash reserves and access to diverse funding sources to meet short-term obligations without distress. Best practices for concentration risk include diversifying asset portfolios across sectors, geographies, and counterparties to reduce exposure to any single risk factor. Implementing robust stress testing and scenario analysis enhances the identification and mitigation of vulnerabilities related to both liquidity and concentration risks.

Liquidity Risk Infographic

libterm.com

libterm.com