A retainer fee is an upfront payment made to secure professional services, ensuring priority access and commitment from a service provider. This arrangement often applies to legal, consulting, or creative fields where ongoing support and availability are crucial. Discover how a retainer fee can benefit your projects and what to consider before agreeing by reading the rest of this article.

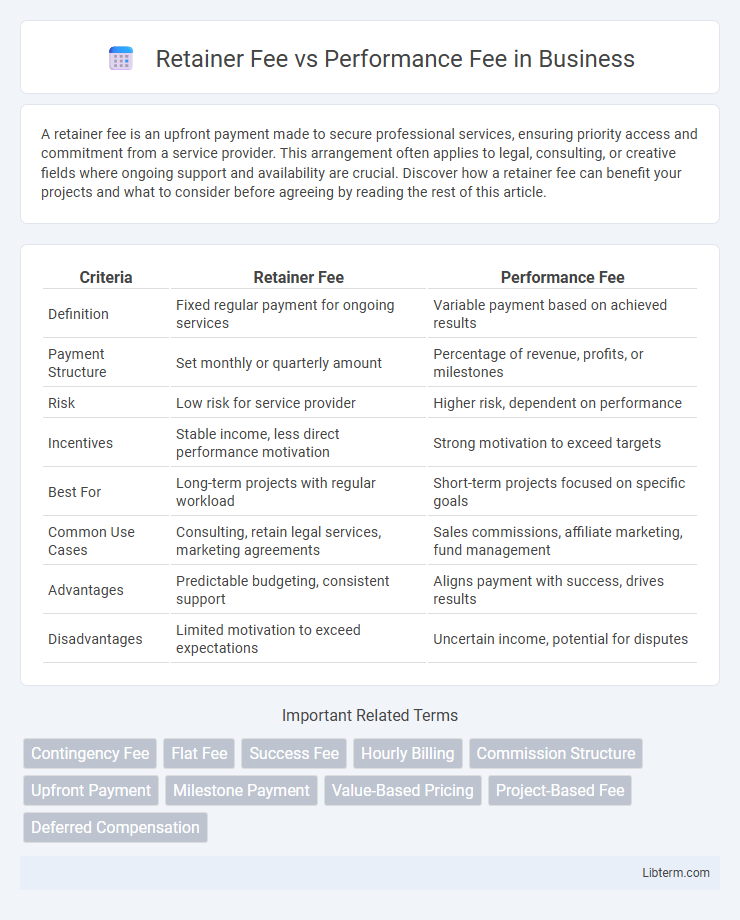

Table of Comparison

| Criteria | Retainer Fee | Performance Fee |

|---|---|---|

| Definition | Fixed regular payment for ongoing services | Variable payment based on achieved results |

| Payment Structure | Set monthly or quarterly amount | Percentage of revenue, profits, or milestones |

| Risk | Low risk for service provider | Higher risk, dependent on performance |

| Incentives | Stable income, less direct performance motivation | Strong motivation to exceed targets |

| Best For | Long-term projects with regular workload | Short-term projects focused on specific goals |

| Common Use Cases | Consulting, retain legal services, marketing agreements | Sales commissions, affiliate marketing, fund management |

| Advantages | Predictable budgeting, consistent support | Aligns payment with success, drives results |

| Disadvantages | Limited motivation to exceed expectations | Uncertain income, potential for disputes |

Introduction to Retainer Fee and Performance Fee

Retainer fees are fixed payments made upfront to secure ongoing services or expertise, commonly used in legal, consulting, and creative industries to ensure availability and prioritized attention. Performance fees, on the other hand, are contingent payments based on achieving specific results or benchmarks, frequently employed in investment management and sales sectors to align incentives with performance outcomes. Understanding the distinction between retainer fees and performance fees is essential for structuring compensation agreements that balance risk and reward for both parties.

Definition of Retainer Fee

A retainer fee is a fixed upfront payment made to secure services from a professional, ensuring their availability over a specified period. Unlike performance fees, which depend on achieving specific results or milestones, retainer fees provide predictable income and establish a commitment between client and service provider. This fee structure is commonly used in legal, marketing, and consulting industries to guarantee priority access and ongoing advisory support.

Definition of Performance Fee

A performance fee is a compensation structure where an investment manager or advisor earns a percentage of the profits generated above a predetermined benchmark or hurdle rate. Unlike a retainer fee, which is a fixed, upfront payment for services rendered regardless of outcomes, a performance fee directly aligns the manager's earnings with the success of the investment. This fee model incentivizes managers to maximize returns, often seen in hedge funds, private equity, and asset management industries.

Key Differences Between Retainer and Performance Fees

Retainer fees are fixed, upfront payments ensuring ongoing access to services regardless of outcomes, while performance fees are variable and contingent upon achieving specific results or milestones. Retainer fees provide predictable cash flow and secure resource allocation, whereas performance fees align incentives by rewarding actual success or performance improvements. The choice depends on client risk tolerance, project scope, and desired alignment of interests between service provider and client.

Pros and Cons of Retainer Fees

Retainer fees provide stable, predictable income for service providers, ensuring consistent cash flow irrespective of performance outcomes, which benefits long-term planning and resource allocation. However, retainer fees can be less motivating for service providers since compensation is guaranteed regardless of results, potentially reducing the incentive for exceptional performance. Clients may also face higher upfront costs without direct correlation to performance, risking overpayment if deliverables or outcomes fail to meet expectations.

Pros and Cons of Performance Fees

Performance fees align investment manager incentives with client outcomes, motivating higher returns through a share of profits, often set at 20% of gains. However, performance fees may encourage excessive risk-taking as managers seek to maximize short-term profits, potentially leading to volatility and conflicts of interest. Investors might face unpredictability in costs and diminished value during market downturns since fees are only triggered by positive performance.

Industry Applications for Each Fee Structure

Retainer fees are commonly used in consulting, legal, and marketing industries where ongoing services and continuous support are required, providing predictable cash flow and client commitment. Performance fees dominate hedge funds, asset management, and sales-driven sectors, aligning compensation directly with achieved results to incentivize superior outcomes. Companies often choose retainer fees for stability in long-term projects and performance fees when goal-oriented achievements are measurable and critical to success.

How to Choose the Right Fee Model

Selecting the right fee model depends on your project's scope and risk tolerance. Retainer fees offer predictable costs suited for ongoing services, while performance fees align payments with results, incentivizing outcomes-driven efforts. Evaluate budget stability, desired accountability, and the nature of deliverables to determine the optimal balance between fixed costs and performance-based incentives.

Common Misconceptions About Fee Structures

Many clients mistakenly believe retainer fees guarantee specific outcomes, while these fees primarily cover ongoing services irrespective of results. Performance fees are often misunderstood as unfairly high-risk, but they align agency incentives with client success by tying compensation directly to measurable achievements. Clarifying these distinctions helps businesses choose transparent, effective fee structures that balance predictability and motivation.

Conclusion: Which Fee Structure is Best for You?

Choosing between a retainer fee and a performance fee depends on your business goals and risk tolerance. A retainer fee provides predictable costs and consistent service levels, ideal for projects requiring ongoing support or consultation. Performance fees align expenses with results, making them suitable for outcome-driven contracts where incentive and accountability are paramount.

Retainer Fee Infographic

libterm.com

libterm.com