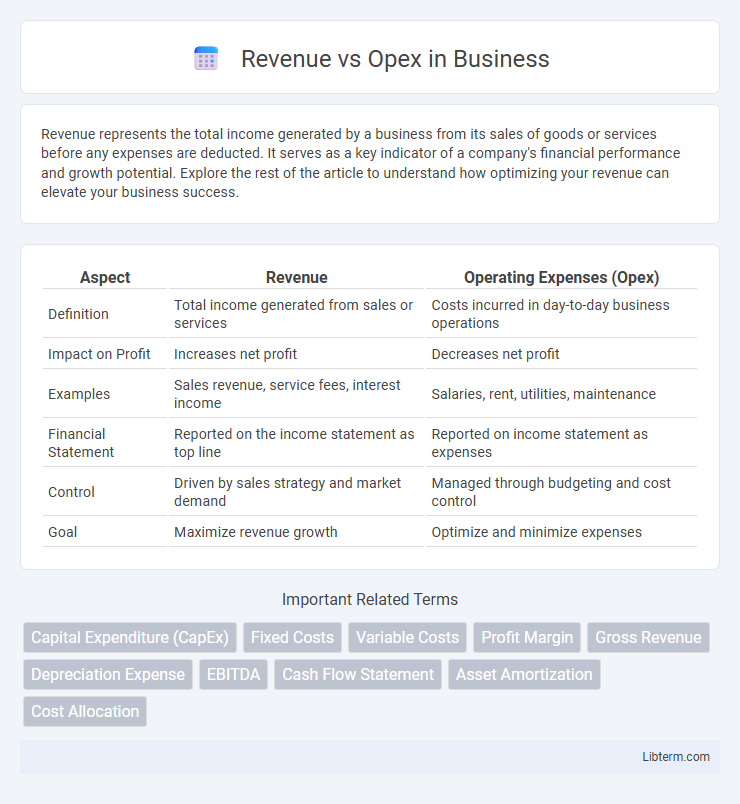

Revenue represents the total income generated by a business from its sales of goods or services before any expenses are deducted. It serves as a key indicator of a company's financial performance and growth potential. Explore the rest of the article to understand how optimizing your revenue can elevate your business success.

Table of Comparison

| Aspect | Revenue | Operating Expenses (Opex) |

|---|---|---|

| Definition | Total income generated from sales or services | Costs incurred in day-to-day business operations |

| Impact on Profit | Increases net profit | Decreases net profit |

| Examples | Sales revenue, service fees, interest income | Salaries, rent, utilities, maintenance |

| Financial Statement | Reported on the income statement as top line | Reported on income statement as expenses |

| Control | Driven by sales strategy and market demand | Managed through budgeting and cost control |

| Goal | Maximize revenue growth | Optimize and minimize expenses |

Understanding Revenue: Definition and Importance

Revenue represents the total income generated by a company from its core business activities, such as sales of goods or services, before deducting any expenses. Understanding revenue is crucial as it indicates a company's ability to generate cash inflow, sustain operations, and fund growth initiatives. Accurate measurement and analysis of revenue help stakeholders assess financial health, forecast future performance, and make informed strategic decisions.

What Is Opex? Operational Expenses Explained

Operational expenses (Opex) refer to the ongoing costs a business incurs to run its day-to-day activities, including rent, utilities, payroll, and maintenance. Unlike capital expenditures (Capex), which involve large, one-time investments in assets, Opex covers expenses necessary for maintaining business operations and generating revenue. Efficient management of Opex is crucial for optimizing cash flow and profitability in competitive markets.

Key Differences Between Revenue and Opex

Revenue represents the total income generated from normal business operations, reflecting the inflow of assets such as cash from sales of goods and services. Operating Expenses (Opex) are the costs incurred during the day-to-day activities required to run the business, including salaries, rent, and utilities. The key difference lies in revenue being the inflow measuring business performance, while Opex captures the outflow necessary to maintain operations, directly impacting profitability and cash flow management.

Revenue Streams: Types and Examples

Revenue streams include diverse sources such as product sales, subscription fees, licensing, advertising income, and service charges, each varying by industry and business model. E-commerce companies often rely on direct product sales and affiliate marketing commissions, while SaaS businesses generate steady income through subscription-based fees. Advertising-driven platforms monetize user engagement via pay-per-click ads and sponsored content, creating multifaceted revenue flows essential for operational sustainability.

Common Opex Categories in Business

Common operational expenditure (Opex) categories in business include salaries and wages, rent and utilities, office supplies, marketing expenses, and maintenance costs. These recurring costs are essential for day-to-day operations and differ from revenue-generating activities which drive income. Effective management of Opex ensures optimized cash flow and overall financial health of the organization.

Impact of Revenue on Business Growth

Revenue directly influences business growth by providing the necessary capital for reinvestment in operations, marketing, and product development, which drives expansion and competitiveness. Higher revenue enables scaling of activities, increase in market share, and the ability to attract investment or favorable financing terms. Sustainable revenue growth supports long-term strategic planning and innovation, cementing a company's position in the industry.

How Opex Affects Profitability

Operational expenses (Opex) directly impact profitability by reducing net income since these recurring costs are essential for day-to-day business functions. Higher Opex can erode profit margins, making efficient cost management crucial for maintaining financial health. Companies that strategically control Opex often experience improved cash flow and increased ability to invest in growth opportunities.

Revenue Recognition: Best Practices

Revenue recognition best practices emphasize aligning revenue reporting with the actual delivery of goods or services, ensuring compliance with accounting standards like ASC 606 or IFRS 15. Accurate documentation of contracts, clear identification of performance obligations, and systematic tracking of transaction milestones optimize revenue accuracy and transparency. Implementing automated revenue recognition software enhances consistency, reduces errors, and supports timely financial reporting while maintaining audit readiness.

Managing and Reducing Opex Efficiently

Effective management and reduction of operational expenses (Opex) drive higher profitability by optimizing resource allocation and identifying cost-saving opportunities. Implementing automated processes, leveraging cloud solutions, and negotiating better vendor contracts contribute significantly to lowering Opex without affecting business performance. Continuous monitoring and data-driven analysis enable companies to forecast expenses accurately and adjust strategies to maintain a sustainable expense-to-revenue ratio.

Reviewing Revenue vs Opex: Strategic Insights

Reviewing revenue versus operating expenses (Opex) provides critical strategic insights into a company's financial health and efficiency. Analyzing the correlation between increasing revenue streams and controlling Opex reveals opportunities for sustainable profit growth and resource optimization. Strategic decisions grounded in this review help balance cost management with revenue generation to maximize organizational performance.

Revenue Infographic

libterm.com

libterm.com