Angel investing provides early-stage startups with critical capital, expertise, and mentorship to accelerate growth and innovation. By strategically supporting promising ventures, angel investors can achieve significant financial returns while fostering entrepreneurial ecosystems. Discover how angel investing can transform your portfolio and empower groundbreaking businesses in the rest of this article.

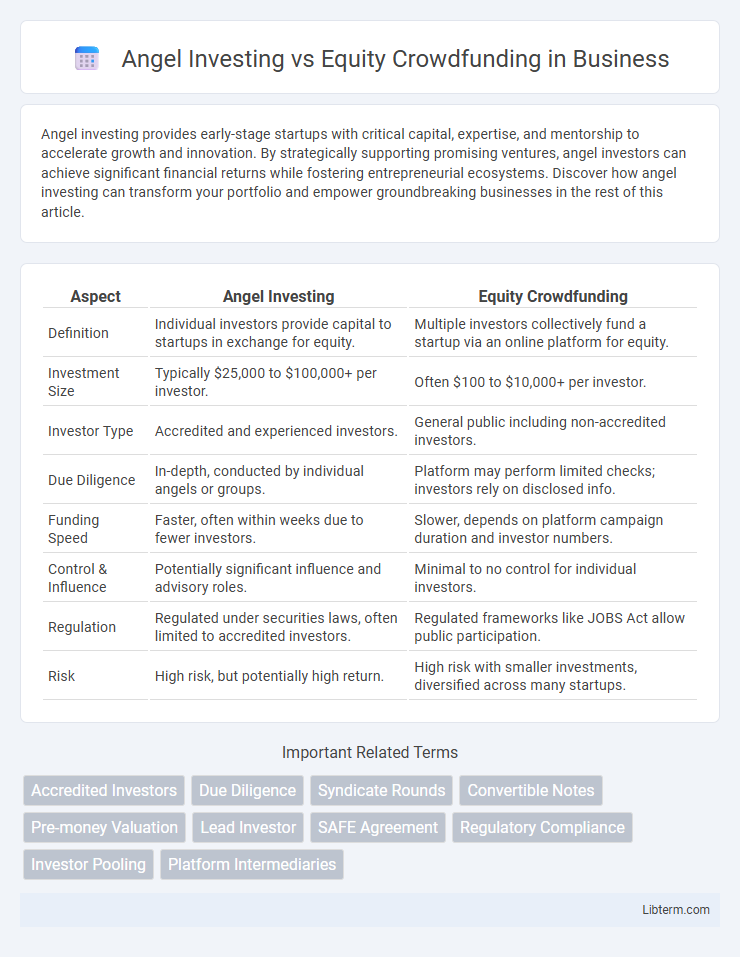

Table of Comparison

| Aspect | Angel Investing | Equity Crowdfunding |

|---|---|---|

| Definition | Individual investors provide capital to startups in exchange for equity. | Multiple investors collectively fund a startup via an online platform for equity. |

| Investment Size | Typically $25,000 to $100,000+ per investor. | Often $100 to $10,000+ per investor. |

| Investor Type | Accredited and experienced investors. | General public including non-accredited investors. |

| Due Diligence | In-depth, conducted by individual angels or groups. | Platform may perform limited checks; investors rely on disclosed info. |

| Funding Speed | Faster, often within weeks due to fewer investors. | Slower, depends on platform campaign duration and investor numbers. |

| Control & Influence | Potentially significant influence and advisory roles. | Minimal to no control for individual investors. |

| Regulation | Regulated under securities laws, often limited to accredited investors. | Regulated frameworks like JOBS Act allow public participation. |

| Risk | High risk, but potentially high return. | High risk with smaller investments, diversified across many startups. |

Understanding Angel Investing: An Overview

Angel investing involves high-net-worth individuals providing capital to early-stage startups in exchange for equity ownership, offering not only funds but also mentorship and strategic guidance. This method typically requires substantial personal investment, often ranging from $25,000 to $100,000 or more per deal, targeting innovative companies with high growth potential. Angel investors play a crucial role in bridging the financing gap between friends and family funding and formal venture capital rounds, contributing to startup scalability and market entry.

What is Equity Crowdfunding?

Equity crowdfunding is a method of raising capital where numerous investors contribute small amounts of money in exchange for equity shares in a company, typically facilitated through online platforms. This approach democratizes investment opportunities, allowing startups and small businesses to access funding from a diverse pool of investors rather than relying solely on traditional angel investors or venture capitalists. Equity crowdfunding platforms such as SeedInvest, Republic, and Crowdcube enable entrepreneurs to reach a broader audience while providing investors with potential ownership stakes and returns.

Key Differences Between Angel Investing and Equity Crowdfunding

Angel investing involves high-net-worth individuals providing capital to startups in exchange for equity, often bringing expertise and mentorship, while equity crowdfunding allows multiple investors to collectively fund a company through online platforms with smaller individual contributions. Angel investors typically engage in earlier-stage funding rounds with higher risk tolerance, whereas equity crowdfunding targets a broader audience and may include more regulated, later-stage investments. The level of involvement and due diligence varies significantly, with angel investors conducting thorough evaluations and equity crowdfunding relying on platform disclosures and investor accessibility.

Investment Process: How Each Method Works

Angel investing typically involves high-net-worth individuals providing capital directly to startups in exchange for equity, with a thorough due diligence phase and personalized negotiation of terms. Equity crowdfunding allows multiple investors to pool smaller amounts through online platforms, which standardize documentation and regulatory compliance to streamline the investment process. Both methods require careful evaluation of business potential and financial risks but differ in investor involvement and scale of capital raised.

Risk Factors: Comparing Potential Losses

Angel investing carries higher risk due to concentrated investments in early-stage startups with limited operating history and high failure rates, potentially resulting in total capital loss. Equity crowdfunding offers diversification by pooling smaller amounts across multiple ventures, reducing the impact of any single failure but still exposing investors to illiquidity and startup volatility. Understanding these risk profiles helps investors balance potential losses against expected returns based on their risk tolerance and investment strategy.

Return on Investment: What to Expect

Angel investing usually offers higher potential returns because investors gain early access to startups with significant growth opportunities, often securing sizable equity stakes and influence in the company's trajectory. Equity crowdfunding provides more diversified, lower-risk exposure by pooling smaller investments across multiple companies, but individual returns tend to be more modest and less predictable. Expect angel investments to have longer lock-in periods and higher volatility, while equity crowdfunding allows for greater liquidity and participation with smaller capital requirements.

Accessibility for Investors

Angel investing typically requires substantial capital and accreditation, limiting participation to high-net-worth individuals or experienced investors. Equity crowdfunding offers broader accessibility, enabling retail investors to fund startups with smaller amounts through online platforms regulated by authorities like the SEC. This democratization of investment opportunities allows a diverse range of investors to engage in early-stage ventures previously exclusive to angel networks.

Control and Involvement in the Startup

Angel investing typically offers investors significant control and involvement in the startup, including board seats and active decision-making roles, due to larger equity stakes and direct relationships with founders. Equity crowdfunding, in contrast, usually provides smaller equity shares to a broad base of investors, limiting individual control and involvement, as decisions are often reserved for founders or lead investors. This makes angel investing more suitable for those seeking hands-on influence in a startup's strategic direction, while equity crowdfunding appeals to those preferring a passive investment approach.

Legal and Regulatory Considerations

Angel investing involves direct equity purchases in startups, typically requiring accredited investor status and compliance with SEC regulations under Regulation D exemptions. Equity crowdfunding operates under Regulation CF, allowing non-accredited investors to participate but imposes funding limits and mandatory disclosures by issuers to the SEC and investors. Both frameworks mandate strict adherence to anti-fraud rules and ongoing reporting, with equity crowdfunding subject to platform registration and SEC oversight.

Choosing the Right Investment Approach

Angel investing offers high-net-worth individuals the chance to invest directly in startups, often providing strategic guidance in exchange for equity stakes. Equity crowdfunding allows a broader range of investors to participate in early-stage companies by pooling smaller amounts of capital through online platforms. Choosing the right investment approach depends on factors such as investment size, desired level of involvement, risk tolerance, and targeted industry sectors.

Angel Investing Infographic

libterm.com

libterm.com