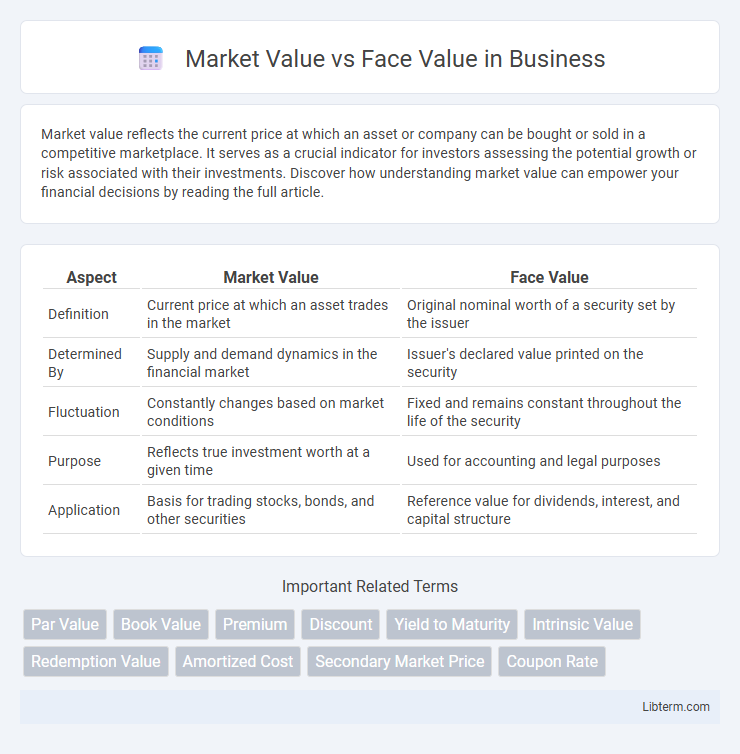

Market value reflects the current price at which an asset or company can be bought or sold in a competitive marketplace. It serves as a crucial indicator for investors assessing the potential growth or risk associated with their investments. Discover how understanding market value can empower your financial decisions by reading the full article.

Table of Comparison

| Aspect | Market Value | Face Value |

|---|---|---|

| Definition | Current price at which an asset trades in the market | Original nominal worth of a security set by the issuer |

| Determined By | Supply and demand dynamics in the financial market | Issuer's declared value printed on the security |

| Fluctuation | Constantly changes based on market conditions | Fixed and remains constant throughout the life of the security |

| Purpose | Reflects true investment worth at a given time | Used for accounting and legal purposes |

| Application | Basis for trading stocks, bonds, and other securities | Reference value for dividends, interest, and capital structure |

Understanding Market Value and Face Value

Market value represents the current price at which an asset or security can be bought or sold in the open market, reflecting real-time supply and demand dynamics. Face value, also known as par value, is the nominal or stated value printed on a financial instrument such as a bond or stock certificate, indicating its original worth at issuance. Understanding the distinction is crucial for investors, as market value fluctuates based on market conditions while face value remains fixed, influencing investment decisions and portfolio valuation.

Key Differences Between Market Value and Face Value

Market value represents the current price at which an asset or security can be bought or sold in the open market, reflecting supply, demand, and investor sentiment. Face value, also known as par value, is the original nominal value of a security stated on the certificate, typically used for bonds and shares, and does not fluctuate with market conditions. Key differences include market value's dynamic nature influenced by market forces, whereas face value remains fixed and primarily serves accounting and legal purposes.

Factors Influencing Market Value

Market value is influenced by factors such as interest rates, company performance, investor demand, and overall economic conditions, while face value remains fixed at the time of bond issuance. Changes in credit ratings, inflation expectations, and market liquidity also significantly affect market value fluctuations. Market sentiment and supply-demand dynamics in secondary markets further drive deviations between market value and face value.

Importance of Face Value in Financial Instruments

Face value is crucial in financial instruments as it represents the original cost or par value at issuance, serving as the basis for interest calculations and maturity value. Investors rely on face value to determine coupon payments in bonds and to assess the principal amount to be repaid at maturity. Clear understanding of face value ensures accurate valuation and risk assessment in investment decisions.

How Market Value is Calculated

Market value is calculated based on the current price at which an asset or security can be bought or sold in the open market, reflecting supply and demand dynamics. It incorporates factors such as investor perception, future growth potential, interest rates, and overall market conditions, making it a real-time indicator of value. Unlike face value, market value fluctuates constantly and is determined through trading activity on stock exchanges or marketplaces.

The Role of Face Value in Bonds and Stocks

Face value in bonds represents the principal amount that will be returned to the bondholder at maturity, serving as the basis for calculating interest payments. In stocks, face value is a nominal figure assigned during issuance and has minimal impact on market price or dividends. Investors rely more on market value to assess the current worth of bonds and stocks, but face value remains crucial for accounting and legal purposes.

Impact of Market Trends on Value Discrepancy

Market trends significantly influence the discrepancy between market value and face value of financial instruments such as bonds and stocks. When interest rates fluctuate or investor sentiment shifts, the market value can deviate substantially from the fixed face value, reflecting current economic conditions and risk perceptions. This dynamic impacts investment decisions and portfolio valuations by altering the perceived worth relative to the instrument's nominal amount.

Real-world Examples of Market Value vs Face Value

Market value often fluctuates around the example of corporate bonds where a bond with a face value of $1,000 might trade at $950 or $1,050 depending on interest rates and credit risk. In the stock market, a share's face value, typically a nominal amount like $1 per share, contrasts sharply with its market value, which can be hundreds of dollars influenced by company performance and investor sentiment. Real estate offers a clear example where a property's face value (assessed or purchase price) may differ considerably from its market value determined by current demand, location, and economic conditions.

Why Investors Should Know Both Values

Understanding both market value and face value is crucial for investors to accurately assess the true worth and potential profitability of a security. Market value reflects the current price investors are willing to pay, influenced by supply, demand, and market conditions, while face value represents the original issuance price and the amount to be repaid at maturity. Knowing both values allows investors to evaluate investment risks, calculate yields, and make informed decisions about buying or selling stocks and bonds.

Common Misconceptions About Market and Face Value

Market value often differs from face value because it reflects current supply and demand conditions, while face value represents the original nominal worth assigned by the issuer. A common misconception is that market value will always converge to face value at maturity, but market fluctuations can cause significant deviations during the life of an asset. Investors frequently misunderstand that face value determines the actual trading price, ignoring factors like interest rate changes, credit risk, and market sentiment that primarily drive market value.

Market Value Infographic

libterm.com

libterm.com