Step cost refers to the fixed cost incurred every time a particular step or activity is performed in a process, regardless of the volume of output. Understanding step costs is crucial for accurate budgeting and cost control, as it impacts decision-making in production and operational efficiency. Explore the rest of the article to learn how managing step costs can improve your business profitability.

Table of Comparison

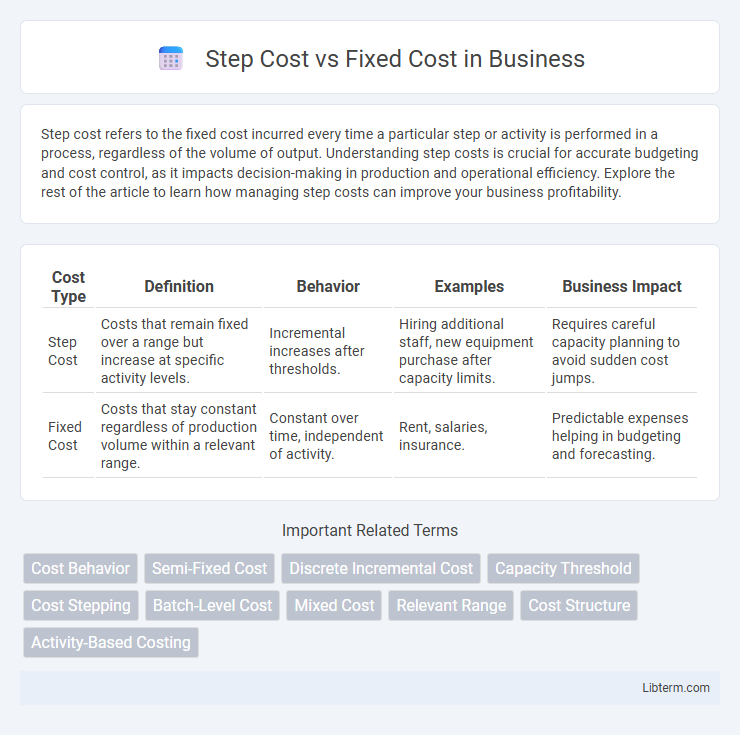

| Cost Type | Definition | Behavior | Examples | Business Impact |

|---|---|---|---|---|

| Step Cost | Costs that remain fixed over a range but increase at specific activity levels. | Incremental increases after thresholds. | Hiring additional staff, new equipment purchase after capacity limits. | Requires careful capacity planning to avoid sudden cost jumps. |

| Fixed Cost | Costs that stay constant regardless of production volume within a relevant range. | Constant over time, independent of activity. | Rent, salaries, insurance. | Predictable expenses helping in budgeting and forecasting. |

Introduction to Step Costs and Fixed Costs

Step costs remain constant over a specific activity range but increase in discrete jumps once that range is exceeded, making them semi-variable in nature. Fixed costs, such as rent or salaries, remain unchanged regardless of production volume within a relevant range, providing stability in budgeting. Understanding the distinction between step costs and fixed costs is essential for accurate cost management and financial forecasting.

Defining Step Costs

Step costs are expenses that remain constant over a specific range of activity but increase to a new fixed amount when activity exceeds that range, such as hiring additional staff after reaching a certain production volume. Unlike fixed costs that remain unchanged regardless of activity levels, step costs adjust in discrete increments, reflecting changes in resource requirements. Understanding step costs is essential for accurate budgeting and forecasting in scenarios with varying operational scales.

Understanding Fixed Costs

Fixed costs remain constant regardless of production volume, including expenses like rent, salaries, and insurance. These costs must be paid even when output is zero, providing a baseline for total expenses. Understanding fixed costs is essential for businesses to determine break-even points and set pricing strategies effectively.

Key Differences Between Step Costs and Fixed Costs

Step costs increase in discrete increments when activity levels reach specific thresholds, whereas fixed costs remain constant regardless of activity volume within a relevant range. Step costs resemble a staircase pattern, rising abruptly at certain points due to capacity or resource increments, while fixed costs maintain a steady amount over the same intervals. Understanding these differences is critical for accurate budgeting and cost behavior analysis in managerial accounting.

Real-World Examples of Step Costs

Step costs increase in discrete increments as activity levels reach certain thresholds, reflecting real-world expenses like hiring additional staff when production surpasses current workforce capacity. Facilities often encounter step costs when expanding production space, such as leasing an extra warehouse once existing space is fully utilized. Utility expenses can also exhibit step cost behavior, for example, when a business moves to a higher tariff bracket after exceeding a certain consumption level.

Practical Examples of Fixed Costs

Fixed costs remain constant regardless of production levels, such as rent for factory space, salaried employee wages, and insurance premiums. These expenses must be paid even if a company produces zero units, ensuring predictable budgeting and financial planning. Conversely, step costs change in predefined increments, such as hiring additional staff when production exceeds certain thresholds.

Impact on Budgeting and Financial Planning

Step costs create budgeting challenges due to their sudden increases once activity thresholds are crossed, requiring precise forecasting to avoid unexpected expenses. Fixed costs offer stability in financial planning, remaining constant regardless of production volume, which simplifies cash flow management. Understanding the behavior of step costs versus fixed costs enables more accurate budget allocation and financial forecasting for organizations.

Step Costs vs Fixed Costs in Decision Making

Step costs remain constant over a specific activity range but increase sharply once that range is exceeded, unlike fixed costs which stay constant regardless of activity level. In decision making, understanding step costs helps managers anticipate when additional resources or capacity will be required as business volume grows, avoiding sudden budget overruns. Fixed costs provide stability for long-term planning, while step costs require more flexible budgeting to adjust to incremental changes in operational scale.

When to Use Step Costs and Fixed Costs

Step costs are ideal for expenses that increase in discrete increments, such as hiring additional employees or expanding production capacity, allowing for better cost control during gradual growth. Fixed costs are best used when expenses remain constant regardless of activity level, like rent or salaried wages, providing predictable budgeting and financial stability. Choosing between step costs and fixed costs depends on the nature of the expense and the firm's operational flexibility requirements.

Conclusion: Choosing the Right Cost Structure

Selecting the appropriate cost structure depends on the business's operational scale and flexibility requirements. Step costs provide scalability with periodic increases at specific activity levels, ideal for growing enterprises needing gradual resource expansion. Fixed costs offer predictability and stability, benefiting companies with consistent production volumes and long-term budgeting needs.

Step Cost Infographic

libterm.com

libterm.com