The Supervisory Board plays a crucial role in overseeing a company's management, ensuring compliance with regulations, and protecting shareholders' interests. Responsible for strategic guidance and risk assessment, the board monitors executive decisions to foster sustainable growth. Explore the rest of the article to understand how a strong Supervisory Board can enhance your organization's governance.

Table of Comparison

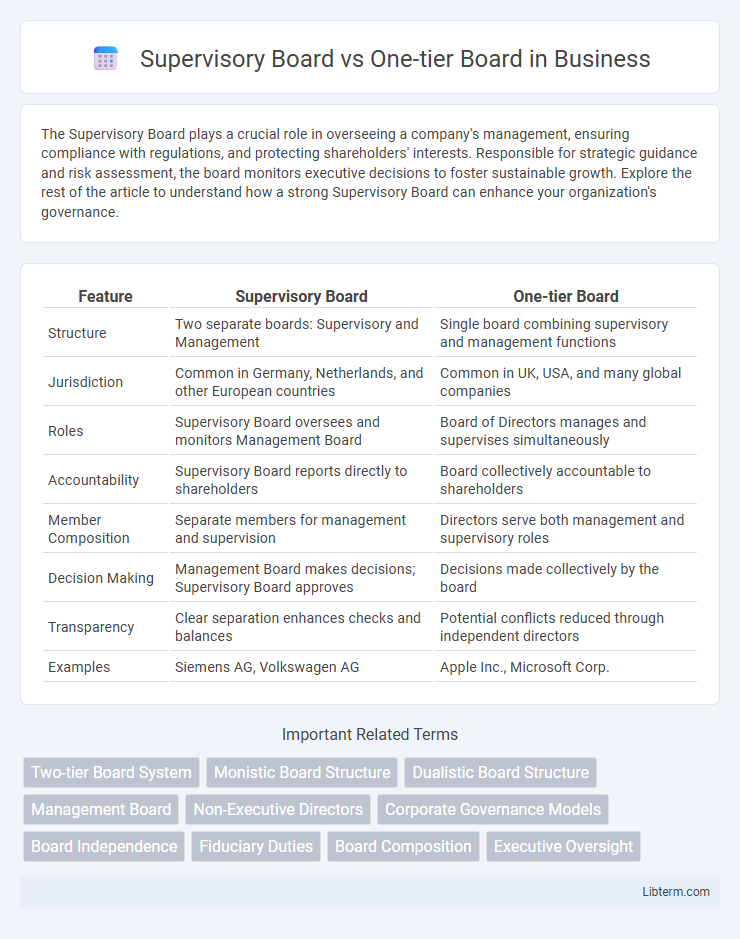

| Feature | Supervisory Board | One-tier Board |

|---|---|---|

| Structure | Two separate boards: Supervisory and Management | Single board combining supervisory and management functions |

| Jurisdiction | Common in Germany, Netherlands, and other European countries | Common in UK, USA, and many global companies |

| Roles | Supervisory Board oversees and monitors Management Board | Board of Directors manages and supervises simultaneously |

| Accountability | Supervisory Board reports directly to shareholders | Board collectively accountable to shareholders |

| Member Composition | Separate members for management and supervision | Directors serve both management and supervisory roles |

| Decision Making | Management Board makes decisions; Supervisory Board approves | Decisions made collectively by the board |

| Transparency | Clear separation enhances checks and balances | Potential conflicts reduced through independent directors |

| Examples | Siemens AG, Volkswagen AG | Apple Inc., Microsoft Corp. |

Introduction to Corporate Governance Models

The Supervisory Board model, prevalent in Germany, separates oversight and management by establishing two distinct boards: the Supervisory Board monitors the Management Board, ensuring accountability. The One-tier Board model, common in Anglo-American countries, combines executive and non-executive directors on a single board to streamline decision-making and enhance direct oversight. Each corporate governance structure reflects different regulatory environments and cultural approaches to balancing control, transparency, and stakeholder engagement.

Understanding the Supervisory Board Structure

The Supervisory Board structure, prevalent in countries like Germany, operates separately from management, focusing on oversight and strategic guidance without direct involvement in daily operations. It consists of non-executive members who monitor executive decisions and ensure compliance with corporate governance standards. This contrasts with the One-tier Board system, where supervisory and management functions are merged into a single board overseeing both management and control.

Overview of the One-tier Board System

The one-tier board system integrates executive and non-executive directors into a single board responsible for both management and supervision, enhancing direct communication and faster decision-making. This structure is prevalent in countries like the United States and the United Kingdom, promoting streamlined governance and accountability. Its design contrasts with the two-tier supervisory board system by unifying strategy and oversight functions within one entity.

Key Differences Between Supervisory and One-tier Boards

Supervisory boards consist of separate tiers, typically involving distinct supervisory and management boards, which create a clear division between oversight and executive functions, common in German corporate governance. One-tier boards integrate both supervisory and executive roles on a single board, fostering direct communication and faster decision-making, prevalent in U.S. and U.K. companies. Key differences lie in structural separation, decision-making speed, and stakeholder representation, where supervisory boards emphasize independent oversight while one-tier boards promote collaborative governance.

Roles and Responsibilities in Each Board Structure

The Supervisory Board operates in a two-tier system, primarily overseeing management and safeguarding shareholders' interests without engaging in day-to-day operations. In a One-tier Board structure, executive and non-executive directors share responsibilities, combining management functions with oversight in a single body. The duality of supervisory control and operational management is clearer in the two-tier system, whereas the one-tier board promotes integrated decision-making with direct accountability.

Legal Frameworks and Regional Practices

Supervisory boards, prevalent in German and Dutch corporate law, operate under a two-tier system separating management and oversight functions, ensuring compliance with strict legal frameworks like the German Aktiengesetz. One-tier boards, common in Anglo-American jurisdictions such as the UK and US, integrate executive and non-executive directors, governed by legal standards like the UK Companies Act 2006 and the Sarbanes-Oxley Act in the US, emphasizing direct corporate governance and accountability. Regional practices influence board structure and effectiveness, reflecting variations in shareholder rights, board independence requirements, and corporate transparency mandates across Europe, North America, and beyond.

Advantages of a Supervisory Board Model

The Supervisory Board model enhances corporate governance by providing independent oversight through a clear separation of management and supervision, reducing conflicts of interest and improving accountability. This system allows for specialized expertise within the Supervisory Board to monitor executive decisions effectively, fostering transparency and long-term strategic alignment. Companies operating under the Supervisory Board model benefit from increased stakeholder confidence and regulatory compliance, particularly in jurisdictions with complex corporate laws.

Benefits of a One-tier Board Approach

A one-tier board structure centralizes decision-making by integrating both executive and non-executive directors on a single board, enhancing communication and fostering faster strategic alignment. This unified governance framework improves accountability and transparency through direct oversight and collaborative dialogue, streamlining corporate control processes. Companies using a one-tier board often benefit from increased flexibility in decision-making and a more cohesive approach to managing risks and opportunities.

Challenges and Considerations in Board Selection

Choosing between a Supervisory Board and a One-tier Board involves challenges related to governance structure and decision-making efficiency. Supervisory Boards, common in two-tier systems, offer independent oversight but may slow communication between management and oversight functions. One-tier Boards consolidate roles, enhancing agility but raising concerns about conflicts of interest and reduced independent monitoring, requiring careful assessment of company size, regulatory environment, and stakeholder expectations.

Choosing the Right Board Structure for Your Organization

Choosing the right board structure depends on organizational size, complexity, and regulatory environment, with a Supervisory Board typically found in dual-board systems providing independent oversight separate from management. One-tier Boards combine executive and non-executive directors, facilitating faster decision-making and closer collaboration but requiring strong governance to manage conflicts of interest. Evaluating factors such as transparency needs, shareholder interests, and cultural context helps determine whether a Supervisory Board or One-tier Board better supports effective governance and strategic oversight.

Supervisory Board Infographic

libterm.com

libterm.com