A merger combines two or more companies into a single entity to enhance market share, reduce costs, and increase competitive advantage. Understanding the types, benefits, and challenges of mergers can help you navigate this complex business strategy effectively. Explore the rest of the article to learn how mergers can impact your company's growth and future.

Table of Comparison

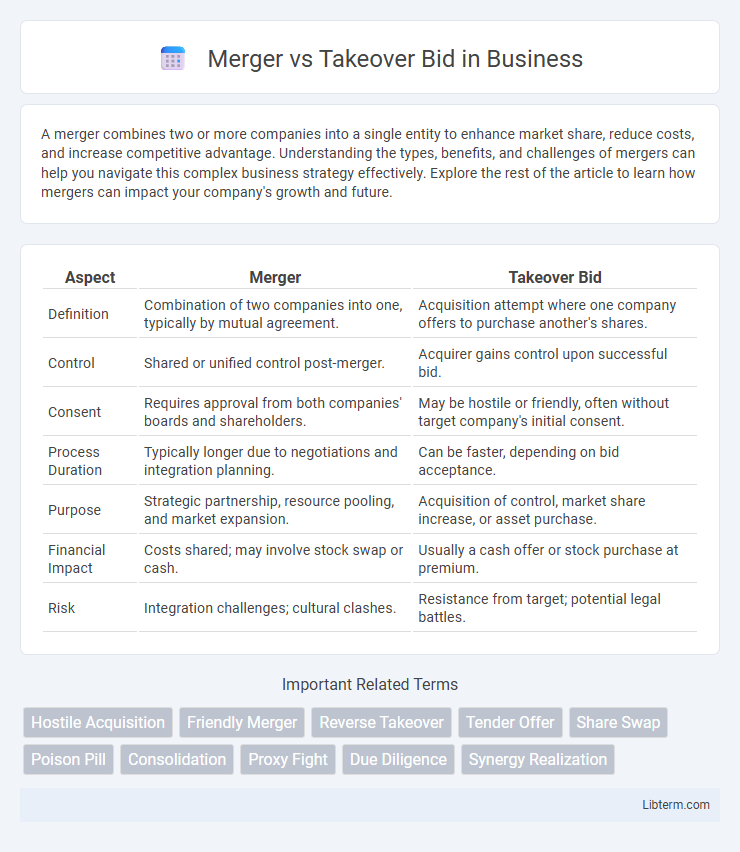

| Aspect | Merger | Takeover Bid |

|---|---|---|

| Definition | Combination of two companies into one, typically by mutual agreement. | Acquisition attempt where one company offers to purchase another's shares. |

| Control | Shared or unified control post-merger. | Acquirer gains control upon successful bid. |

| Consent | Requires approval from both companies' boards and shareholders. | May be hostile or friendly, often without target company's initial consent. |

| Process Duration | Typically longer due to negotiations and integration planning. | Can be faster, depending on bid acceptance. |

| Purpose | Strategic partnership, resource pooling, and market expansion. | Acquisition of control, market share increase, or asset purchase. |

| Financial Impact | Costs shared; may involve stock swap or cash. | Usually a cash offer or stock purchase at premium. |

| Risk | Integration challenges; cultural clashes. | Resistance from target; potential legal battles. |

Understanding Mergers and Takeover Bids

Mergers involve the combination of two companies to form a single new entity, typically aimed at achieving synergies, expanding market share, or enhancing competitive advantage. Takeover bids occur when one company makes a direct offer to acquire another company's shares to gain control, often without the target's initial consent. Understanding these distinctions is crucial for evaluating corporate restructuring strategies and their impact on stakeholders and market dynamics.

Key Differences Between Mergers and Takeovers

Mergers involve the mutual agreement of two companies to combine resources and operations, often resulting in a new entity, while takeover bids occur when one company attempts to acquire control of another, typically without mutual consent. Mergers emphasize strategic partnerships and synergy creation, whereas takeovers focus on ownership transfer and control acquisition, often leading to hostile scenarios. Financial terms in mergers are usually negotiated collaboratively, contrasting with takeover bids where the acquiring company offers a premium price directly to shareholders.

Types of Mergers and Takeover Bids

Types of mergers include horizontal, vertical, and conglomerate mergers, where horizontal involves companies in the same industry, vertical involves companies at different stages of production, and conglomerate merges unrelated businesses. Takeover bids can be classified as friendly, where the target company agrees to the bid, or hostile, where the acquirer pursues the acquisition against the target's wishes. Both mergers and takeover bids impact market structure and shareholder value but follow distinct strategic and regulatory approaches.

Strategic Motivations Behind Mergers and Takeovers

Strategic motivations behind mergers often include achieving economies of scale, expanding product lines, and entering new markets to enhance competitive advantage. Takeover bids are primarily driven by acquiring undervalued assets, gaining control over key technologies, or eliminating competition to increase market share. Both strategies aim to maximize shareholder value, but mergers emphasize synergy creation, while takeovers focus on control and rapid expansion.

Legal and Regulatory Considerations

Merger and takeover bid processes are governed by distinct legal frameworks, with mergers typically requiring shareholder approval and regulatory clearance under antitrust laws to prevent monopolistic practices. Takeover bids demand compliance with securities regulations, including disclosure obligations and fair pricing rules to protect minority shareholders. Regulatory bodies such as the SEC in the U.S. or the FCA in the UK oversee these transactions to ensure transparency and market fairness.

Financial Implications for Stakeholders

A merger typically involves combining two companies on relatively equal terms, often leading to shared financial gains, improved market share, and enhanced stakeholder value through synergy realization. A takeover bid usually implies one company acquiring control over another, which can trigger stock price fluctuations, potential premiums for shareholders, and shifts in management affecting employee and investor interests. Financial implications for stakeholders in mergers often include long-term growth prospects, while takeovers may result in immediate gains or losses depending on bid premiums and post-acquisition integration success.

Impact on Company Culture and Employees

Mergers often promote cultural integration by combining the strengths of both companies, encouraging collaboration, and fostering a shared vision among employees, which can boost morale and retention. In contrast, takeover bids may create uncertainty and anxiety as the acquiring company imposes new structures and leadership, potentially leading to resistance, decreased employee engagement, and higher turnover rates. Understanding the impact on company culture and workforce dynamics is crucial for managing change effectively in either scenario.

Risks and Challenges in Mergers vs Takeovers

Mergers involve the combination of two companies to form a single entity, but they face risks such as cultural clashes, integration difficulties, and regulatory hurdles that may delay or derail the process. Takeover bids pose challenges including hostile resistance from target management, high acquisition costs, and potential shareholder disputes that can affect deal completion and value realization. Both processes require thorough due diligence and strategic planning to mitigate financial, operational, and legal risks inherent in consolidations and acquisitions.

Real-World Examples of Mergers and Takeover Bids

The 1998 merger of Exxon and Mobil created ExxonMobil, exemplifying a strategic merger to boost market share in the oil industry, while Vodafone's 2013 takeover bid for German telecom company Kabel Deutschland highlighted an aggressive acquisition to expand network reach. In 2015, the merger between Kraft Foods and Heinz formed a powerhouse in the food industry focused on synergy, contrasting with Valeant Pharmaceuticals' hostile takeover bid for Allergan that aimed at rapid growth through asset acquisition. These cases illustrate how mergers generally aim for mutual benefit and long-term integration, while takeover bids often involve competitive, sometimes adversarial, acquisition tactics.

Choosing the Right Strategy: Merger or Takeover Bid?

Choosing the right strategy between a merger and a takeover bid depends on factors such as company size, financial health, and strategic goals. Mergers typically involve mutual agreement and integration, beneficial for creating synergies and shared value, while takeover bids are often aggressive acquisitions targeting control of the company. Assessing market conditions, shareholder interests, and regulatory implications ensures an informed decision aligned with long-term growth objectives.

Merger Infographic

libterm.com

libterm.com