Corporate tax impacts your business's profitability by determining the amount of taxes paid on earnings. Understanding tax rates, deductions, and credits can optimize financial planning and compliance. Explore the full article to learn strategies for minimizing corporate tax liabilities and maximizing your business growth.

Table of Comparison

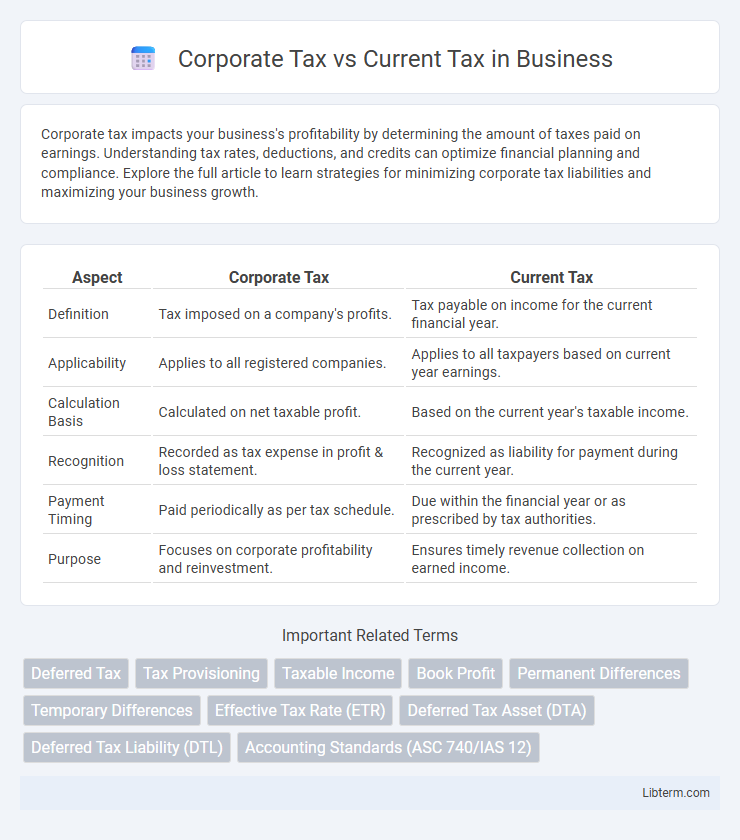

| Aspect | Corporate Tax | Current Tax |

|---|---|---|

| Definition | Tax imposed on a company's profits. | Tax payable on income for the current financial year. |

| Applicability | Applies to all registered companies. | Applies to all taxpayers based on current year earnings. |

| Calculation Basis | Calculated on net taxable profit. | Based on the current year's taxable income. |

| Recognition | Recorded as tax expense in profit & loss statement. | Recognized as liability for payment during the current year. |

| Payment Timing | Paid periodically as per tax schedule. | Due within the financial year or as prescribed by tax authorities. |

| Purpose | Focuses on corporate profitability and reinvestment. | Ensures timely revenue collection on earned income. |

Introduction to Corporate Tax and Current Tax

Corporate tax refers to the tax imposed on the profits earned by companies and corporations, calculated based on taxable income according to prevailing tax laws. Current tax represents the amount of income tax payable or refundable for a specific accounting period, determined by applying the relevant tax rates to taxable profits. Understanding the distinction between corporate tax as a general concept and current tax as the actual tax liability ensures accurate financial reporting and compliance with tax regulations.

Defining Corporate Tax

Corporate tax is a government-imposed levy on a company's profits, calculated based on taxable income reported in financial statements. Current tax reflects the actual tax liability payable or refundable for the fiscal year, derived from corporate tax computations and adjusted for prepayments or credits. Differentiating corporate tax as the theoretical tax expense and current tax as the charge settled within the reporting period is essential for accurate financial reporting.

What is Current Tax?

Current tax represents the amount of income tax payable or recoverable for the current accounting period based on taxable profits calculated under tax laws. It is recognized as a liability or asset in the balance sheet and directly impacts a company's cash flows during the fiscal year. Corporate tax includes this current tax but also considers deferred tax arising from temporary differences between accounting profit and taxable profit.

Key Differences Between Corporate Tax and Current Tax

Corporate tax is a tax on a company's profits imposed by the government, calculated based on accounting income adjusted for tax rules, while current tax refers specifically to the amount payable for the current fiscal year as per tax authorities. Corporate tax encompasses all taxes a corporation owes over a period, reflecting both current tax liabilities and deferred tax amounts, whereas current tax is a subset representing immediate tax obligations. The key difference lies in timing and scope: corporate tax considers total tax expense within financial statements, including deferred taxes, whereas current tax pertains only to taxes due within the reporting period.

Calculation Methods for Corporate vs Current Tax

Corporate tax calculation involves determining taxable income by adjusting accounting profits with non-deductible expenses, tax exemptions, and allowances, applying the corporate tax rate to the resulting figure. Current tax calculation is based on taxable profit for the period, reflecting amounts payable to tax authorities according to tax laws, often adjusted for tax credits and prepayments. Differences arise as corporate tax calculations consider deferred tax effects and accounting standards, while current tax focuses solely on the immediate tax liability for the fiscal year.

Impacts on Financial Statements

Corporate tax affects the overall profitability reported on the income statement by reducing the net income, while current tax represents the tax payable for the period based on taxable income. Current tax liabilities appear on the balance sheet as a short-term obligation, influencing the company's liquidity and working capital management. Differences between corporate tax expense and current tax payable may result in deferred tax assets or liabilities, impacting future financial statement periods and tax expense recognition.

Compliance and Regulatory Requirements

Corporate tax compliance involves adhering to statutory regulations set by tax authorities, ensuring accurate reporting of taxable income and timely payment according to jurisdictional laws. Current tax refers specifically to the tax expense recognized for the reporting period based on taxable profits, requiring alignment with local tax codes and consistent documentation. Meeting regulatory requirements demands detailed record-keeping, prompt filing of tax returns, and abiding by audit protocols to avoid penalties and maintain corporate transparency.

Common Challenges in Tax Reporting

Corporate tax and current tax often present challenges in tax reporting due to differences in recognition timing and calculation methods. Companies struggle with reconciling temporary differences between accounting profit and taxable income, leading to complexities in deferred tax accounting. Accurate estimation of current tax liabilities requires thorough understanding of evolving tax regulations and careful alignment with financial statements.

Strategies for Managing Corporate and Current Taxes

Effective strategies for managing corporate tax involve leveraging tax credits, deductions, and incentives to minimize taxable income and optimize cash flow. Current tax management requires accurate estimation and timely payment to avoid penalties and interest, ensuring compliance with regulatory requirements. Integrating real-time tax software and expert consultation helps align corporate tax planning with current tax obligations for efficient fiscal management.

Conclusion: Choosing the Right Tax Approach

Choosing the right tax approach depends on accurate assessment of corporate profitability and compliance with jurisdictional tax laws. Corporate tax allows companies to plan long-term financial strategies by considering deferred tax liabilities and assets, while current tax reflects the immediate tax payable based on taxable income. A balanced understanding of both ensures optimized tax planning and minimizes potential legal risks in financial reporting.

Corporate Tax Infographic

libterm.com

libterm.com