Employee Stock Purchase Plans offer a valuable opportunity for employees to acquire company shares at a discounted price, enhancing personal financial growth and fostering a sense of ownership. By participating in these plans, you can benefit from potential stock appreciation while contributing to your retirement savings. Explore the rest of this article to understand how you can maximize the advantages of your Employee Stock Purchase Plan.

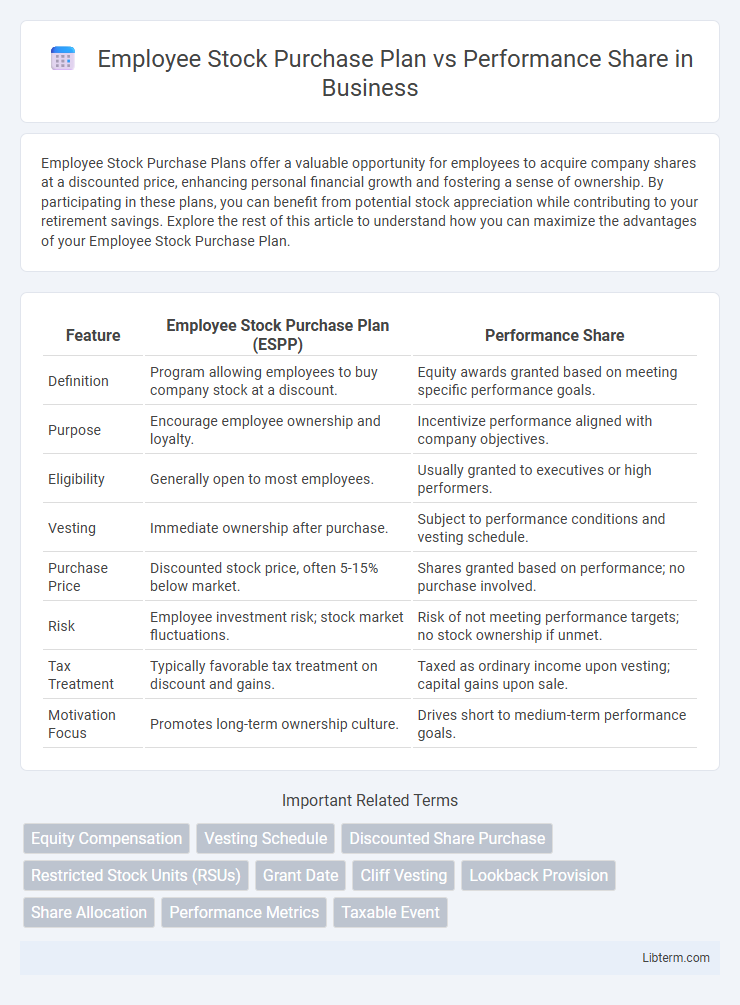

Table of Comparison

| Feature | Employee Stock Purchase Plan (ESPP) | Performance Share |

|---|---|---|

| Definition | Program allowing employees to buy company stock at a discount. | Equity awards granted based on meeting specific performance goals. |

| Purpose | Encourage employee ownership and loyalty. | Incentivize performance aligned with company objectives. |

| Eligibility | Generally open to most employees. | Usually granted to executives or high performers. |

| Vesting | Immediate ownership after purchase. | Subject to performance conditions and vesting schedule. |

| Purchase Price | Discounted stock price, often 5-15% below market. | Shares granted based on performance; no purchase involved. |

| Risk | Employee investment risk; stock market fluctuations. | Risk of not meeting performance targets; no stock ownership if unmet. |

| Tax Treatment | Typically favorable tax treatment on discount and gains. | Taxed as ordinary income upon vesting; capital gains upon sale. |

| Motivation Focus | Promotes long-term ownership culture. | Drives short to medium-term performance goals. |

Introduction to Employee Stock Purchase Plans and Performance Shares

Employee Stock Purchase Plans (ESPPs) allow employees to buy company stock often at a discounted price, promoting ownership and long-term investment. Performance Shares are equity awards granted based on meeting specific financial or operational goals, aligning employees' incentives with company performance. Both tools serve to motivate employee engagement but differ in structure, eligibility, and the timing of stock acquisition.

Key Differences Between ESPPs and Performance Shares

Employee Stock Purchase Plans (ESPPs) allow employees to purchase company stock at a discounted price, typically through payroll deductions, promoting employee ownership and long-term investment in the company. Performance Shares are equity awards granted based on meeting specific performance targets, aligning employee rewards with company financial or operational goals. The key differences lie in ESPPs requiring employee investment and offering discounted purchases, while Performance Shares are conditional grants directly tied to achieving predetermined metrics.

How Employee Stock Purchase Plans Work

Employee Stock Purchase Plans (ESPPs) allow employees to purchase company shares often at a discounted price through payroll deductions, promoting ownership and aligning employee interests with corporate performance. Employees accumulate contributions during an offering period and then buy stock at a discount, typically up to 15%, which can lead to immediate or long-term financial gains depending on stock price appreciation. Unlike Performance Shares, which are awarded based on achieving specific company goals, ESPPs provide all participating employees the opportunity to invest directly in the company's equity.

How Performance Shares Function

Performance shares function as equity compensation awarded based on achieving specific company performance targets, typically measured over a multi-year period, aligning employee incentives with long-term business goals. Unlike Employee Stock Purchase Plans, which allow employees to buy shares often at a discounted price, performance shares are granted contingent on meeting metrics such as earnings per share, return on equity, or total shareholder return. This structure motivates employees to drive sustained company growth, with share payouts varying according to the degree of target achievement.

Eligibility Criteria for ESPP vs Performance Shares

Employee Stock Purchase Plans (ESPP) typically extend eligibility to a broad group of employees, including full-time and part-time staff, subject to company-specific tenure requirements and maximum purchase limits. Performance Shares are usually granted selectively, targeting key executives and high performers based on stringent criteria like individual performance metrics and organizational objectives. The ESPP emphasizes broad employee participation to encourage ownership, while Performance Shares focus on incentivizing leadership aligned with long-term company success.

Tax Implications: ESPP vs Performance Shares

Employee Stock Purchase Plans (ESPPs) typically offer tax advantages such as deferred taxation until the stock is sold, often qualifying for favorable long-term capital gains rates if holding period requirements are met. Performance shares are generally taxed as ordinary income upon vesting, based on the fair market value of the shares, which can result in higher immediate tax liability compared to ESPPs. Understanding the distinct tax treatment of ESPPs and performance shares is crucial for optimizing after-tax returns in equity compensation strategies.

Financial Benefits to Employees

Employee Stock Purchase Plans (ESPP) allow employees to buy company shares at a discounted price, offering immediate financial gains through capital appreciation and dividend income. Performance Shares grant employees company stock based on meeting specific financial or operational targets, aligning rewards with company success and providing potential for significant value growth. Both plans enhance employee wealth, but ESPPs offer more predictable upfront savings while Performance Shares offer higher upside linked to company performance.

Risks and Limitations of Each Plan

Employee Stock Purchase Plans (ESPPs) carry risks such as market volatility, which can reduce the value of purchased shares, and limitations like mandatory holding periods that may restrict liquidity. Performance Shares pose risks tied to achieving set performance targets, meaning failure to meet goals results in no shares awarded, and they often include vesting schedules that delay ownership. Both plans also face potential tax implications and company-specific restrictions that can impact the overall benefit to employees.

Choosing the Right Plan: Factors to Consider

Choosing the right equity compensation plan requires evaluating factors such as risk tolerance, financial goals, and company growth potential. Employee Stock Purchase Plans (ESPPs) offer discounted stock purchases with lower risk and liquidity, while Performance Shares align compensation with specific performance targets, appealing to employees seeking potentially higher rewards tied to company success. Consider tax implications, vesting schedules, and the nature of the equity when deciding between these plans for optimal long-term value.

Conclusion: ESPP or Performance Shares – Which Suits You?

Choosing between an Employee Stock Purchase Plan (ESPP) and Performance Shares depends on your financial goals and risk tolerance. ESPPs offer a straightforward way to buy company stock at a discount, ideal for employees seeking steady long-term investment with moderate risk. Performance Shares link rewards to company performance metrics, suiting those focused on higher potential returns tied to meeting specific business targets.

Employee Stock Purchase Plan Infographic

libterm.com

libterm.com