Franchising offers entrepreneurs a proven business model with established brand recognition, reducing the risks associated with startups. It provides access to comprehensive training, marketing support, and ongoing operational guidance to help you succeed. Explore the full article to understand how franchising can transform your business aspirations into reality.

Table of Comparison

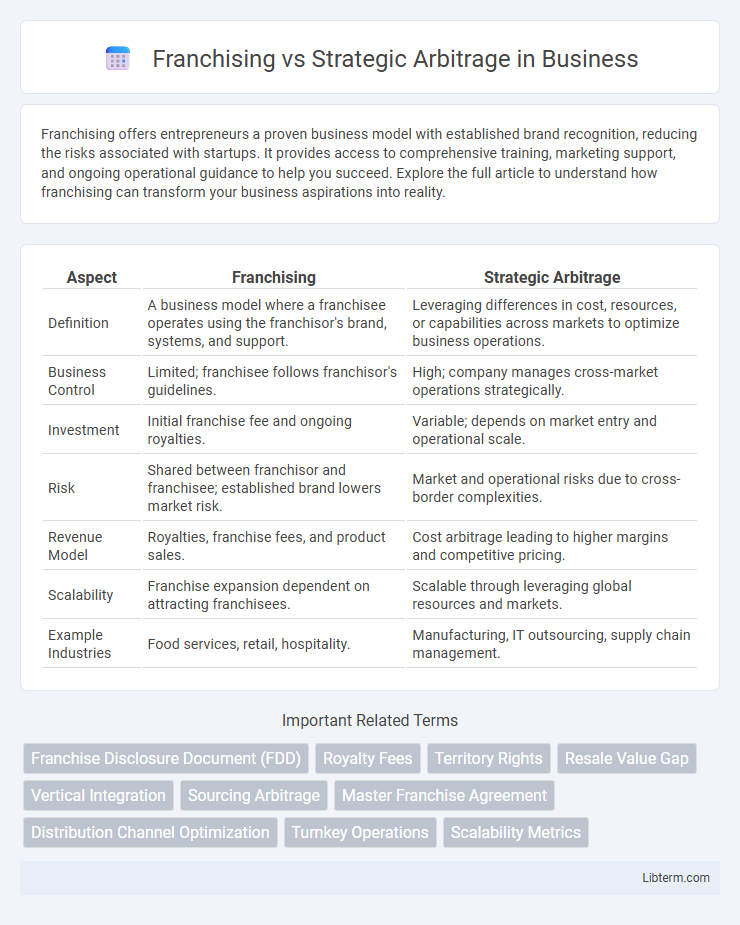

| Aspect | Franchising | Strategic Arbitrage |

|---|---|---|

| Definition | A business model where a franchisee operates using the franchisor's brand, systems, and support. | Leveraging differences in cost, resources, or capabilities across markets to optimize business operations. |

| Business Control | Limited; franchisee follows franchisor's guidelines. | High; company manages cross-market operations strategically. |

| Investment | Initial franchise fee and ongoing royalties. | Variable; depends on market entry and operational scale. |

| Risk | Shared between franchisor and franchisee; established brand lowers market risk. | Market and operational risks due to cross-border complexities. |

| Revenue Model | Royalties, franchise fees, and product sales. | Cost arbitrage leading to higher margins and competitive pricing. |

| Scalability | Franchise expansion dependent on attracting franchisees. | Scalable through leveraging global resources and markets. |

| Example Industries | Food services, retail, hospitality. | Manufacturing, IT outsourcing, supply chain management. |

Introduction to Franchising vs Strategic Arbitrage

Franchising involves replicating a successful business model through licensing, enabling rapid market expansion by leveraging brand recognition and operational systems. Strategic arbitrage capitalizes on global resource differences by outsourcing or relocating business processes to maximize efficiency and cost advantages. Both approaches drive growth but differ fundamentally in methodology, with franchising emphasizing brand consistency and strategic arbitrage focusing on optimizing cross-border opportunities.

Defining Franchising: Key Features and Models

Franchising is a business model where a franchisor licenses its brand, products, and operational methods to a franchisee in exchange for fees or royalties, enabling rapid market expansion with reduced capital risk. Key features include brand consistency, ongoing support, and standardized training, ensuring uniform customer experience across locations. Popular franchising models comprise product distribution, business format franchising, and manufacturing franchising, each offering varying degrees of control and operational involvement.

What is Strategic Arbitrage? Core Concepts Explained

Strategic arbitrage refers to the business practice of leveraging differences in cost, expertise, or market conditions across locations to create competitive advantages, often by outsourcing or offshoring tasks to regions with lower costs. Core concepts include exploiting geographical, economic, or regulatory disparities to optimize resource allocation, improve efficiency, and increase profitability. Unlike franchising, which replicates a proven model for brand consistency and expansion, strategic arbitrage focuses on maximizing returns through strategic resource utilization across diverse markets.

Investment and Startup Costs: A Comparative Analysis

Franchising requires a significant upfront investment, typically ranging from $100,000 to $500,000, which includes franchise fees, initial inventory, and real estate costs, providing a proven brand and operational model. Strategic arbitrage involves lower startup costs, often under $50,000, by leveraging global talent and cost differentials to optimize business processes without heavy capital expenditure. Comparing investment scales, franchising demands substantial financial commitment with predictable expenses, whereas strategic arbitrage emphasizes agility and cost efficiency through minimal initial outlay and scalable operations.

Risk Factors and Profit Potential

Franchising typically involves lower risk due to established brand recognition and standardized operations, but its profit potential is often limited by franchise fees and royalty payments. Strategic arbitrage carries higher risks stemming from market volatility, operational complexity, and regulatory challenges, yet it offers greater profit potential by capitalizing on regional cost differentials and market inefficiencies. Evaluating these risk factors alongside expected returns is crucial for investors choosing between the steady income of franchising and the high-reward opportunities in strategic arbitrage.

Scalability and Long-Term Growth Prospects

Franchising offers rapid scalability through standardized business models and brand recognition, enabling consistent quality and customer experience across multiple locations. Strategic arbitrage leverages geographic or market inefficiencies to maximize profitability but often faces challenges in sustaining long-term growth due to market volatility and operational complexities. Franchising's adaptable framework supports sustained expansion and revenue streams, while strategic arbitrage requires continuous market analysis and agility to maintain competitive advantage over time.

Support, Training, and Resources: What’s Provided?

Franchising offers comprehensive support including extensive training programs, ongoing operational assistance, and access to established marketing resources to ensure consistent brand standards. Strategic arbitrage relies more on individualized resource management, often requiring entrepreneurs to independently source training and support tailored to local market conditions. Franchises provide structured frameworks and proven systems, whereas strategic arbitrage depends on adaptability and personal expertise in leveraging cost and market differences.

Market Entry Barriers: Franchising vs Arbitrage

Franchising involves significant market entry barriers including strict brand regulations, upfront franchise fees, and ongoing royalty payments that protect brand consistency but limit flexibility. Strategic arbitrage leverages differences in labor costs, regulations, and resource availability across countries, allowing firms to enter markets with lower financial obligations and fewer formal restrictions. Firms using strategic arbitrage can bypass traditional entry barriers by exploiting geographic and economic inefficiencies, while franchising relies heavily on established systems and local market adherence.

Legal and Regulatory Considerations

Franchising requires compliance with specific disclosure laws and franchise registration regulations in many jurisdictions, including adherence to the Federal Trade Commission's Franchise Rule in the United States. Strategic arbitrage involves leveraging geographic and labor cost differences, often necessitating adherence to international trade laws, tax regulations, and varying employment standards. Both models demand careful navigation of intellectual property rights and contract law to mitigate legal risks and ensure regulatory compliance.

Choosing the Right Model: Factors to Consider

Choosing the right business model between franchising and strategic arbitrage depends on factors such as control, scalability, and market knowledge. Franchising offers a proven system with brand recognition and support but requires adherence to strict operational guidelines, while strategic arbitrage leverages geographical cost differences to optimize resource allocation and profit margins. Evaluating industry type, investment capacity, and long-term growth objectives is essential to determine which model aligns best with business goals and risk tolerance.

Franchising Infographic

libterm.com

libterm.com