Tax avoidance involves legally minimizing your tax liability through strategic financial planning and utilizing deductions, credits, and loopholes within the law. Understanding the difference between tax avoidance and tax evasion is crucial to ensure compliance while maximizing savings. Explore the rest of this article to discover effective tax avoidance strategies and tips to keep more of your income.

Table of Comparison

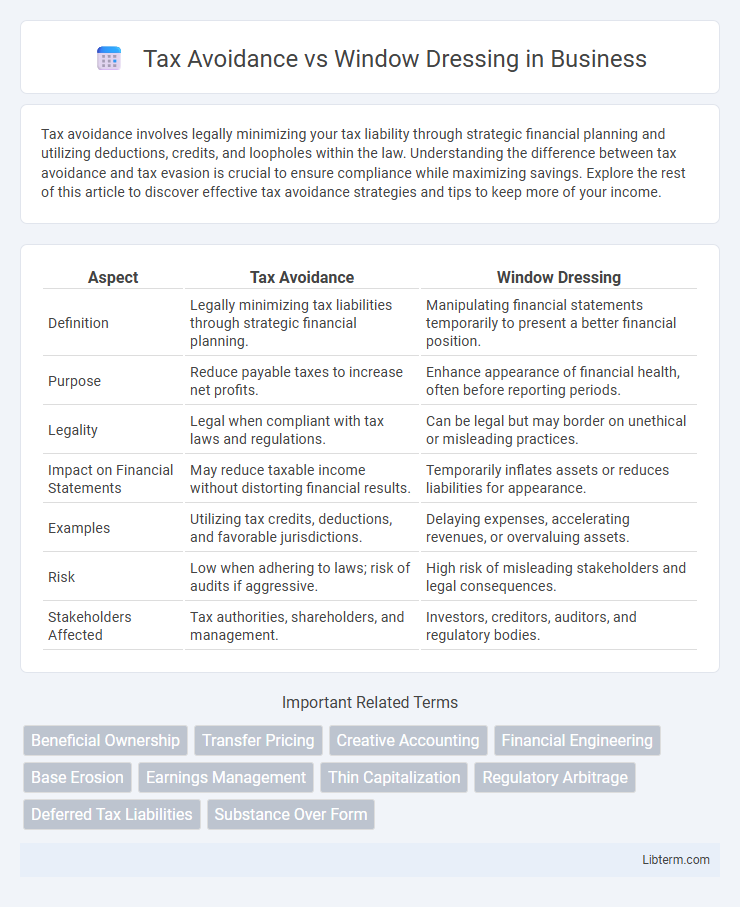

| Aspect | Tax Avoidance | Window Dressing |

|---|---|---|

| Definition | Legally minimizing tax liabilities through strategic financial planning. | Manipulating financial statements temporarily to present a better financial position. |

| Purpose | Reduce payable taxes to increase net profits. | Enhance appearance of financial health, often before reporting periods. |

| Legality | Legal when compliant with tax laws and regulations. | Can be legal but may border on unethical or misleading practices. |

| Impact on Financial Statements | May reduce taxable income without distorting financial results. | Temporarily inflates assets or reduces liabilities for appearance. |

| Examples | Utilizing tax credits, deductions, and favorable jurisdictions. | Delaying expenses, accelerating revenues, or overvaluing assets. |

| Risk | Low when adhering to laws; risk of audits if aggressive. | High risk of misleading stakeholders and legal consequences. |

| Stakeholders Affected | Tax authorities, shareholders, and management. | Investors, creditors, auditors, and regulatory bodies. |

Understanding Tax Avoidance: Key Concepts

Tax avoidance involves legally structuring financial activities to minimize tax liability by exploiting loopholes and incentives within tax laws, whereas window dressing aims to manipulate financial statements to present a more favorable image without necessarily altering actual tax outcomes. Key concepts in tax avoidance include transfer pricing, income shifting, and the use of tax havens, which companies employ to reduce their taxable income. Understanding these strategies highlights the importance of distinguishing genuine tax planning from unethical or illegal tax evasion practices.

Defining Window Dressing in Financial Reporting

Window dressing in financial reporting refers to techniques used by companies to improve the appearance of their financial statements temporarily, often at the end of a reporting period. These practices may involve altering asset valuations, manipulating expenses, or timing revenue recognition to present a more favorable financial position. Unlike tax avoidance, which aims to minimize tax liability within legal boundaries, window dressing focuses on influencing stakeholders' perceptions of the company's financial health.

Legal Framework Surrounding Tax Avoidance

Tax avoidance involves using legal methods to minimize tax liabilities within the framework established by tax authorities, whereas window dressing refers to accounting techniques designed to present financial statements more favorably without necessarily complying with tax regulations' intent. The legal framework surrounding tax avoidance includes statutes, regulations, and guidelines set by governments and tax agencies like the IRS or HMRC, which define permissible tax planning activities and identify abusive practices. Enforcement mechanisms such as audits, penalties, and anti-avoidance rules (e.g., the General Anti-Avoidance Rule) ensure compliance while distinguishing legitimate tax optimization from illegal tax evasion.

Common Techniques of Tax Avoidance

Common techniques of tax avoidance include income shifting, where taxpayers transfer income to entities in lower tax brackets, and the use of tax deductions and credits to reduce taxable income legally. Strategies such as deferring income, investing in tax-exempt securities, and exploiting loopholes in the tax code also play a significant role. These methods differ from window dressing, which primarily involves manipulating financial statements to present a healthier financial position without changing actual tax liabilities.

Window Dressing Strategies in Practice

Window dressing strategies in practice involve manipulating financial statements to present a more favorable view of a company's performance or financial position, often through short-term actions like timing transactions, altering expense recognition, or adjusting asset valuations. These techniques can include accelerating revenue recognition, deferring expenses, or temporarily reducing liabilities to enhance key ratios such as earnings per share or debt-to-equity ratio before reporting periods. While window dressing aims to improve appearance without violating accounting rules outright, it can mislead investors and stakeholders regarding the company's true financial health.

Key Differences Between Tax Avoidance and Window Dressing

Tax avoidance involves legally minimizing tax liabilities through strategic financial planning and adherence to tax laws, whereas window dressing refers to manipulating financial statements to present a more favorable position without altering underlying economic reality. Tax avoidance focuses on long-term tax efficiency within legal boundaries, while window dressing aims at short-term appearance enhancement for stakeholders. The key difference lies in tax avoidance's legality and intent to reduce tax burden versus window dressing's potential to mislead investors through cosmetic accounting practices.

Ethical Implications: Tax Avoidance vs Window Dressing

Tax avoidance involves legally exploiting tax laws to minimize tax liability but often raises ethical concerns about fairness and social responsibility, whereas window dressing manipulates financial statements to present a misleadingly favorable picture without breaking the law. Both practices can undermine stakeholder trust and contradict principles of transparency and accountability essential in corporate governance. Ethical implications center on the intent and impact of these actions on investors, regulators, and the broader economic system.

Impact on Stakeholders and Financial Statements

Tax avoidance strategically reduces taxable income through legal means, enhancing after-tax profits but potentially limiting government revenue and impacting public services. Window dressing temporarily inflates financial performance figures to mislead stakeholders, resulting in distorted financial statements and potential erosion of investor trust. Both practices undermine transparency, with tax avoidance affecting long-term fiscal policy and window dressing compromising the reliability of financial disclosures for decision-making.

Regulatory Responses and Prevention Measures

Tax avoidance involves legally exploiting tax loopholes to minimize tax liability, prompting regulatory bodies to implement stricter reporting standards and tighten anti-avoidance laws, such as the General Anti-Avoidance Rule (GAAR). Window dressing manipulates financial statements to present a more favorable picture without altering underlying transactions, leading regulators to enforce enhanced transparency through stricter accounting standards and mandatory disclosures under frameworks like IFRS and SEC regulations. Prevention measures include robust audit procedures, real-time transaction monitoring, and enhanced corporate governance to detect and deter both tax avoidance schemes and financial statement manipulation.

Best Practices for Transparent Financial Management

Effective transparent financial management involves distinguishing tax avoidance from window dressing by adhering to best practices such as thorough documentation and clear disclosure of financial strategies. Companies should implement standardized reporting frameworks like IFRS or GAAP to ensure accurate representation of financial health while maintaining compliance with tax laws to avoid aggressive tax avoidance tactics. Emphasizing ethical accounting practices and regular internal audits promotes transparency, enabling stakeholders to trust the integrity of financial statements and corporate governance.

Tax Avoidance Infographic

libterm.com

libterm.com