A profit center is a distinct unit within a company responsible for generating revenue and managing its own expenses to evaluate financial performance. Understanding how profit centers operate can help your business optimize resource allocation and improve overall profitability. Explore the rest of the article to learn how to effectively implement and manage profit centers.

Table of Comparison

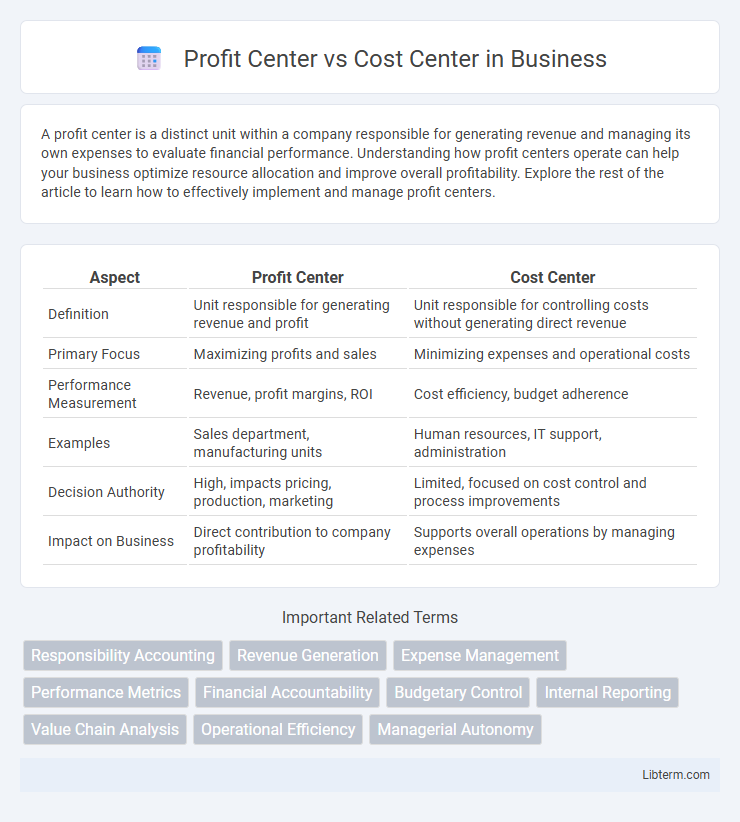

| Aspect | Profit Center | Cost Center |

|---|---|---|

| Definition | Unit responsible for generating revenue and profit | Unit responsible for controlling costs without generating direct revenue |

| Primary Focus | Maximizing profits and sales | Minimizing expenses and operational costs |

| Performance Measurement | Revenue, profit margins, ROI | Cost efficiency, budget adherence |

| Examples | Sales department, manufacturing units | Human resources, IT support, administration |

| Decision Authority | High, impacts pricing, production, marketing | Limited, focused on cost control and process improvements |

| Impact on Business | Direct contribution to company profitability | Supports overall operations by managing expenses |

Introduction to Profit Centers and Cost Centers

Profit centers are business segments or departments responsible for generating revenue and profits, enabling organizations to assess financial performance and make strategic decisions. Cost centers focus on controlling and minimizing expenses without directly generating revenue, often supporting core business functions such as administration, maintenance, or customer service. Understanding the distinction between profit centers and cost centers is crucial for effective budgeting, performance evaluation, and resource allocation within companies.

Defining Profit Centers

Profit centers are organizational units responsible for generating revenue and controlling costs, directly impacting overall profitability. They operate like mini-businesses within a company, with performance measured based on profit margins, sales targets, and cost efficiency. Defining profit centers involves assigning accountability for both revenues and expenses, enabling precise financial tracking and strategic decision-making.

Defining Cost Centers

A cost center is a department or unit within an organization responsible solely for controlling costs without generating direct revenue, such as IT, HR, or maintenance departments. Its primary function is to track and manage expenses to ensure efficient resource usage, helping to maintain budget compliance and operational control. Unlike profit centers, cost centers do not directly contribute to profit generation but play a crucial role in supporting overall business operations through cost management.

Key Differences Between Profit Centers and Cost Centers

Profit centers generate revenue and are evaluated based on profitability, while cost centers incur expenses without directly producing income, focusing on cost control and efficiency. Profit centers have responsibility for both revenue and cost management, enabling performance measurement through profit margins, whereas cost centers primarily manage operational expenses to support overall business functions. Decision-making in profit centers aims at maximizing profit, whereas cost centers seek to minimize costs and optimize resource allocation.

Roles and Responsibilities in Each Center

Profit centers are responsible for generating revenue and managing both income and expenses to maximize profitability, with roles focused on sales, marketing, and financial performance analysis. Cost centers concentrate on controlling and minimizing operational expenses while supporting other departments, with responsibilities centered on budget management, cost tracking, and process efficiency. Each center plays a crucial role in organizational financial health, with profit centers driving growth and cost centers ensuring resource optimization.

Performance Measurement Methods

Profit centers are evaluated primarily through profit-based performance metrics such as return on investment (ROI) and net profit margin, which measure both revenue generation and cost control. Cost centers focus on efficiency and cost management, using metrics like budget variance analysis and cost per unit to assess their ability to control expenses while maintaining output quality. Performance measurement in profit centers emphasizes profitability and revenue growth, whereas cost centers prioritize minimizing costs and operational efficiency.

Advantages of Profit Centers

Profit centers enhance organizational accountability by tracking revenue and profit generation, allowing precise performance measurement and incentivizing managers to optimize financial outcomes. They promote cost efficiency alongside revenue growth, driving business units to focus on both increasing income and controlling expenses. Profit centers enable better resource allocation decisions by providing clear insights into each unit's profitability contribution.

Advantages of Cost Centers

Cost centers enable organizations to precisely track and control operational expenses, leading to improved budget management and cost efficiency. By focusing on cost reduction and resource optimization, cost centers support better financial accountability without the complexities of revenue tracking. This targeted oversight enhances managerial decision-making, driving overall organizational profitability through disciplined cost control.

Strategic Importance in Business Structures

Profit centers directly contribute to a company's revenue generation by managing both costs and income, making them critical for strategic growth and competitive positioning. Cost centers focus primarily on controlling expenses without generating revenue, serving as essential support units that enhance operational efficiency and resource allocation. Understanding the strategic role of each center helps organizations optimize decision-making, improve financial performance, and align business structures with long-term goals.

Choosing Between Profit Center and Cost Center Models

Choosing between profit center and cost center models depends on organizational goals and management focus. Profit centers emphasize revenue generation and profitability, ideal for units directly involved in sales or market-driven activities. Cost centers concentrate on controlling and minimizing expenses, suitable for support functions where cost efficiency is critical.

Profit Center Infographic

libterm.com

libterm.com