Minority interest represents the portion of a subsidiary company's equity that is not owned by the parent company, reflecting the claims of minority shareholders. Understanding how minority interest affects consolidated financial statements is crucial for accurate assessment of a company's financial health. Explore the rest of the article to learn how minority interest influences your investment analysis and reporting.

Table of Comparison

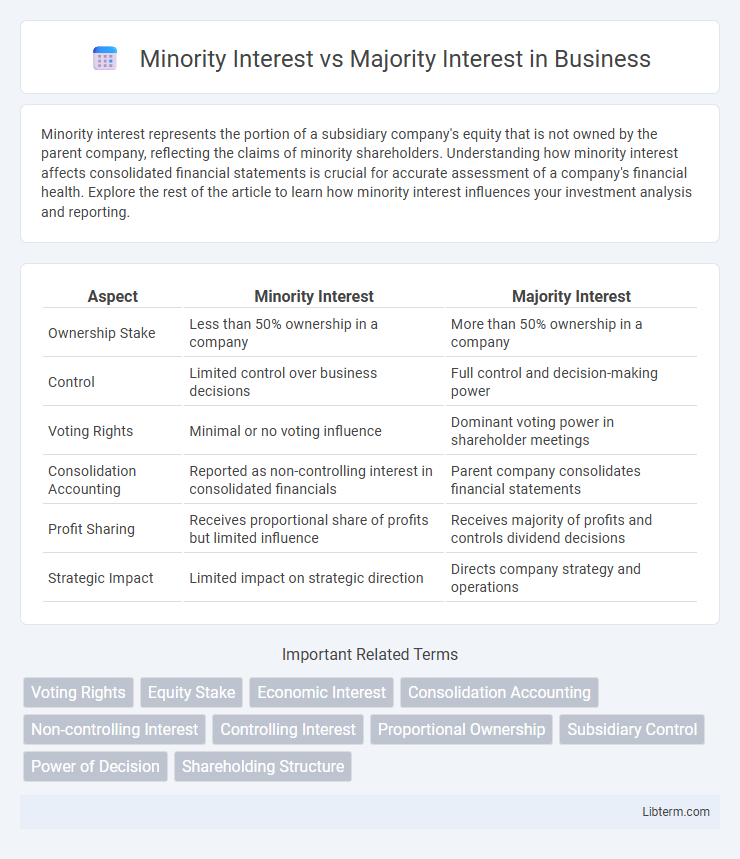

| Aspect | Minority Interest | Majority Interest |

|---|---|---|

| Ownership Stake | Less than 50% ownership in a company | More than 50% ownership in a company |

| Control | Limited control over business decisions | Full control and decision-making power |

| Voting Rights | Minimal or no voting influence | Dominant voting power in shareholder meetings |

| Consolidation Accounting | Reported as non-controlling interest in consolidated financials | Parent company consolidates financial statements |

| Profit Sharing | Receives proportional share of profits but limited influence | Receives majority of profits and controls dividend decisions |

| Strategic Impact | Limited impact on strategic direction | Directs company strategy and operations |

Definition of Minority Interest

Minority interest refers to the ownership stake held by shareholders who own less than 50% of a company's voting shares, lacking control over corporate decisions. It represents the portion of equity in a subsidiary not attributable to the parent company in consolidated financial statements. This ownership can influence financial reporting and reflects the rights and claims of non-controlling shareholders on the subsidiary's assets and earnings.

Definition of Majority Interest

Majority interest refers to ownership of more than 50% of a company's voting stock, granting control over corporate decisions and policy-making. This controlling stake enables majority shareholders to influence the election of the board of directors and guide strategic business directions. Understanding majority interest is crucial when analyzing corporate governance and shareholder power dynamics.

Key Differences Between Minority and Majority Interest

Minority interest represents ownership of less than 50% in a company, limiting control and voting power, while majority interest exceeds 50%, granting full control and decision-making authority. Minority investors typically have limited influence on company policies, whereas majority shareholders can dictate strategic direction, appoint management, and approve major corporate actions. Financially, majority interest holders consolidate financial statements, whereas minority interests are reported as non-controlling interests on the balance sheet.

Legal Rights of Minority Shareholders

Minority shareholders possess specific legal rights designed to protect their interests from potential misuse of power by majority shareholders, including the right to vote on significant corporate matters and to access important company information. They are also entitled to remedies such as seeking injunctions against unfair prejudicial conduct and pursuing derivative actions on behalf of the corporation. These protections help balance power within the company and ensure accountability in corporate governance.

Powers and Responsibilities of Majority Shareholders

Majority shareholders hold significant control over corporate decisions, including the power to appoint board members, influence strategic direction, and approve major transactions such as mergers or acquisitions. Their responsibilities include acting in the best interest of the company and minority shareholders by exercising their voting rights judiciously and ensuring transparency in governance. Majority interest enables effective management oversight but requires balancing firm value maximization with minority shareholder protection.

Protection Mechanisms for Minority Interests

Protection mechanisms for minority interests include preemptive rights, which allow minority shareholders to purchase additional shares before the company offers them to outside investors, helping maintain their ownership percentage. Voting agreements and cumulative voting enable minority shareholders to influence board composition and major decisions despite limited shareholding. Legal frameworks in many jurisdictions provide safeguards such as derivative suits and oppression remedies to prevent abuse by majority shareholders and ensure fair treatment of minority interests.

Impact on Corporate Decision-Making

Minority interest holds less influence on corporate decision-making due to limited voting power, often resulting in reduced control over strategic directions and corporate policies. Majority interest grants substantial control, enabling dominant shareholders to drive decisions, approve mergers, and influence board composition effectively. This power imbalance shapes governance dynamics, potentially marginalizing minority stakeholders in crucial corporate resolutions.

Financial Implications for Investors

Minority interest represents ownership stakes less than 50%, limiting control but allowing investors to benefit from a company's profits and growth potential without full liability. Majority interest, exceeding 50%, grants decision-making power and consolidated financial control, influencing dividend policies and strategic direction. For investors, majority interest involves greater influence and responsibility, while minority interest offers exposure with reduced risk and limited say in corporate governance.

Common Conflicts Between Minority and Majority Interests

Conflicts between minority and majority interests typically arise from differing priorities in corporate control and profit distribution, where majority shareholders may push decisions that marginalize minority interests, such as dividend policies or strategic direction. Minority shareholders often face challenges like lack of voting power, limited access to information, and potential dilution of their ownership through new share issuances by majority holders. Legal disputes frequently emerge around issues of fiduciary duty breaches, oppression claims, and disagreements over buyout valuations or exit strategies.

Best Practices for Balancing Shareholder Interests

Balancing shareholder interests requires transparent communication and fair allocation of voting rights between minority and majority interests to ensure equitable influence in corporate decisions. Implementing protective mechanisms such as buy-sell agreements and minority rights provisions safeguards minority shareholders from potential dominance by majority stakeholders. Regularly reviewing governance policies promotes alignment of goals and mitigates conflicts, fostering a collaborative environment that supports sustainable business growth.

Minority Interest Infographic

libterm.com

libterm.com