Fixed costs remain constant regardless of production levels, encompassing expenses like rent, salaries, and insurance. These costs are crucial for budgeting and financial planning, as they impact overall profitability. Explore the detailed analysis of fixed costs and how managing them can improve your business performance in the rest of the article.

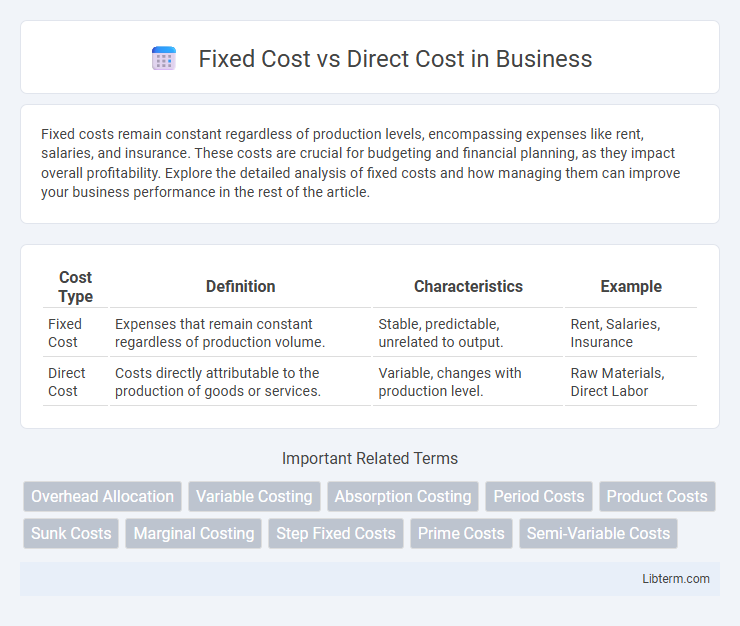

Table of Comparison

| Cost Type | Definition | Characteristics | Example |

|---|---|---|---|

| Fixed Cost | Expenses that remain constant regardless of production volume. | Stable, predictable, unrelated to output. | Rent, Salaries, Insurance |

| Direct Cost | Costs directly attributable to the production of goods or services. | Variable, changes with production level. | Raw Materials, Direct Labor |

Introduction to Fixed Costs and Direct Costs

Fixed costs remain constant regardless of production levels, including expenses such as rent, salaries, and insurance, which do not fluctuate with business activity. Direct costs vary directly with production volume, encompassing materials, labor, and manufacturing supplies directly tied to product creation. Understanding the distinction between fixed and direct costs is essential for accurate budgeting, cost control, and profitability analysis in business management.

Definitions: Fixed Costs vs Direct Costs

Fixed costs are expenses that remain constant regardless of production levels, such as rent, salaries, and insurance. Direct costs are expenses that can be directly attributed to the production of goods or services, including raw materials and direct labor. Understanding the distinction helps in accurate budgeting and cost management for businesses.

Key Differences Between Fixed and Direct Costs

Fixed costs remain constant regardless of production volume, exemplified by expenses like rent, salaries, and insurance that do not fluctuate with output levels. Direct costs vary directly with production and include materials, labor, and expenses directly tied to manufacturing a product or delivering a service. The key difference lies in cost behavior and traceability: fixed costs are period expenses linked to capacity, while direct costs are variable and easily traceable to specific products or services.

Examples of Fixed Costs in Business

Fixed costs in business include expenses such as rent for office or factory space, salaries of permanent employees, and insurance premiums that remain constant regardless of production levels. These costs differ from direct costs, which fluctuate with production volume, like raw materials and direct labor. Examples of fixed costs help businesses maintain operational stability even during periods of low sales.

Examples of Direct Costs in Business

Direct costs in business refer to expenses that can be directly attributed to the production of goods or services, such as raw materials, labor wages for production staff, and manufacturing supplies. Examples include the cost of wood for furniture manufacturing, wages paid to assembly line workers, and purchased components used in electronics assembly. These costs vary directly with production volume, unlike fixed costs such as rent or salaries of administrative staff.

How Fixed and Direct Costs Impact Profitability

Fixed costs, such as rent and salaries, remain constant regardless of production levels, creating a baseline expense that impacts overall profitability. Direct costs, including raw materials and labor directly tied to production, fluctuate with output volume, directly influencing the gross profit margin. Effective management of both cost types is crucial for maximizing profitability, as minimizing fixed costs lowers break-even points while controlling direct costs enhances contribution margins.

The Role of Cost Classification in Budgeting

Cost classification into fixed and direct costs plays a crucial role in budgeting by enabling precise allocation and control of expenses. Fixed costs, such as rent and salaries, remain constant regardless of production levels, providing stability in budget forecasts. Direct costs, including raw materials and labor directly tied to production, allow for flexible adjustments in variable spending to optimize resource allocation.

Fixed and Direct Costs in Various Industries

Fixed costs refer to expenses that remain constant regardless of production levels, such as rent and salaries, commonly seen in industries like manufacturing and retail for budgeting stability. Direct costs, including raw materials and labor directly involved in production, vary with output and are critical in sectors like construction and apparel for cost control. Understanding the distinction between fixed and direct costs enables businesses in diverse industries to optimize pricing strategies and improve profitability.

Importance of Separating Fixed and Direct Costs

Separating fixed costs from direct costs is essential for accurate financial analysis and effective budgeting in business operations. Fixed costs, such as rent and salaries, remain constant regardless of production levels, while direct costs like raw materials and labor vary directly with output. Clear distinction between these costs enables precise cost control, pricing strategies, and profitability forecasting.

Conclusion: Choosing the Right Costing Approach

Choosing the right costing approach depends on the nature of the business and the decision-making context. Fixed costs remain constant regardless of production volume, making them essential for long-term budgeting and capacity planning, while direct costs vary directly with output and are crucial for pricing and cost control. An effective costing strategy combines both fixed and direct cost analysis to optimize profitability and resource allocation.

Fixed Cost Infographic

libterm.com

libterm.com