Dividend recapitalization allows companies to borrow funds to pay dividends to shareholders without reducing operational cash flow, enhancing shareholder value while maintaining business stability. This financial strategy can optimize capital structure and provide liquidity, but it requires careful assessment of debt levels and future earnings potential. Discover how dividend recapitalization might impact your investment portfolio and business growth in the rest of this article.

Table of Comparison

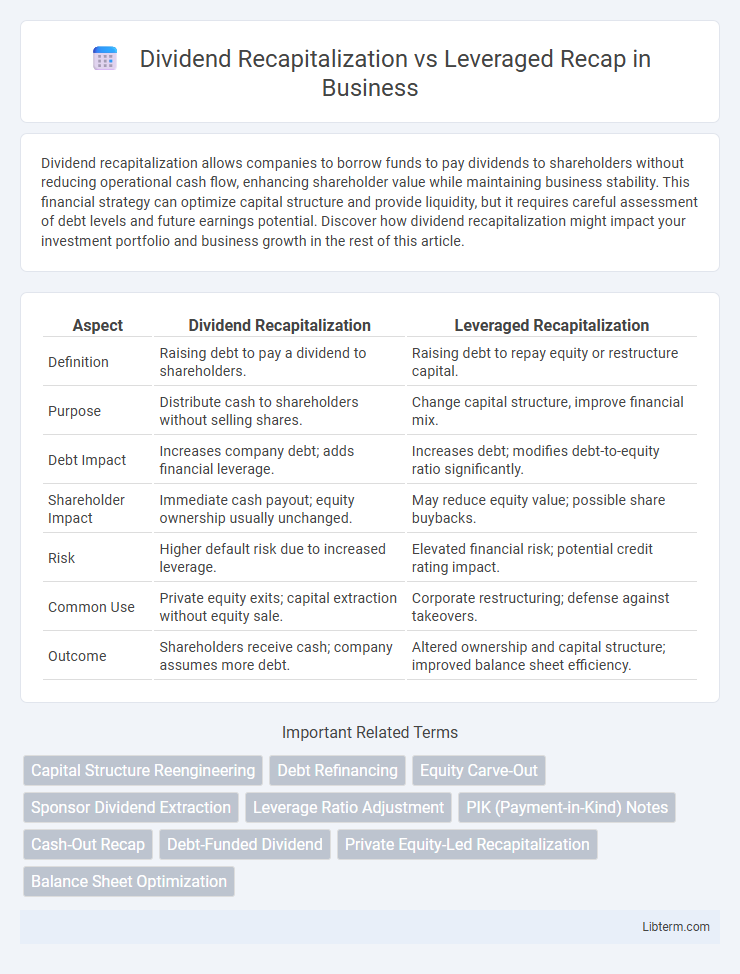

| Aspect | Dividend Recapitalization | Leveraged Recapitalization |

|---|---|---|

| Definition | Raising debt to pay a dividend to shareholders. | Raising debt to repay equity or restructure capital. |

| Purpose | Distribute cash to shareholders without selling shares. | Change capital structure, improve financial mix. |

| Debt Impact | Increases company debt; adds financial leverage. | Increases debt; modifies debt-to-equity ratio significantly. |

| Shareholder Impact | Immediate cash payout; equity ownership usually unchanged. | May reduce equity value; possible share buybacks. |

| Risk | Higher default risk due to increased leverage. | Elevated financial risk; potential credit rating impact. |

| Common Use | Private equity exits; capital extraction without equity sale. | Corporate restructuring; defense against takeovers. |

| Outcome | Shareholders receive cash; company assumes more debt. | Altered ownership and capital structure; improved balance sheet efficiency. |

Introduction to Recapitalization Strategies

Dividend recapitalization and leveraged recapitalization are key recapitalization strategies used by companies to optimize their capital structure. Dividend recapitalization involves issuing new debt to pay a special dividend to shareholders, enhancing shareholder value without selling equity. Leveraged recapitalization entails replacing existing equity with a significant amount of debt to finance buybacks or dividends, often increasing financial leverage and potentially improving return on equity.

Defining Dividend Recapitalization

Dividend recapitalization is a financial strategy where a company incurs new debt specifically to pay a special dividend to shareholders, enabling equity extraction without selling ownership stakes. Leveraged recapitalization broadly refers to restructuring a company's capital by increasing debt to buy back shares, pay dividends, or fund other initiatives, often to optimize capital structure. Dividend recapitalization is a subset of leveraged recapitalization with a distinct focus on shareholder dividend payout funded through debt.

Understanding Leveraged Recapitalization

Leveraged recapitalization involves restructuring a company's balance sheet by replacing equity with debt to increase leverage, often to finance shareholder payouts or acquisitions. This strategy contrasts with dividend recapitalization, which specifically uses debt to pay dividends to shareholders without necessarily altering the ownership structure. Leveraged recapitalizations can improve return on equity but increase financial risk due to higher debt obligations.

Key Differences Between Dividend and Leveraged Recap

Dividend recapitalization involves a company taking on new debt to pay a special dividend to shareholders, enhancing shareholder returns without changing ownership stakes. Leveraged recapitalization also entails raising substantial debt but is primarily used to restructure the company's capital structure, often to deter hostile takeovers or reallocate equity. Key differences include the purpose of the debt issuance--dividend recaps focus on cash distribution to shareholders, while leveraged recaps emphasize balance sheet restructuring and strategic defense mechanisms.

Strategic Objectives of Dividend Recaps

Dividend recapitalization primarily focuses on returning capital to shareholders by increasing debt to pay a special dividend without changing ownership stakes. This strategy enables private equity firms to extract cash while retaining control and signaling confidence in the company's cash flow stability. In contrast, leveraged recapitalization often aims to restructure capital by increasing leverage to support growth initiatives or buy out shareholders, aligning with broader financial optimization goals.

Use Cases for Leveraged Recapitalization

Leveraged recapitalization is primarily used to restructure a company's capital by replacing equity with debt, enabling shareholders to extract value without a full sale. This approach is common in mature companies seeking to optimize their capital structure, finance acquisitions, or fend off hostile takeovers via increased leverage. Unlike dividend recapitalization, which distributes cash to shareholders, leveraged recapitalization focuses on long-term strategic financial adjustments to improve shareholder returns and corporate flexibility.

Impact on Company Financial Structure

Dividend recapitalization increases a company's leverage by issuing new debt to pay shareholders, resulting in higher financial risk due to elevated debt levels on the balance sheet. Leveraged recapitalization restructures the company's capital by replacing equity with debt, often involving significant leverage that enhances the debt-to-equity ratio and impacts cash flow due to increased interest obligations. Both strategies fundamentally alter the financial structure by amplifying leverage, which can constrain future funding flexibility and affect credit ratings.

Risks and Benefits for Shareholders

Dividend recapitalization allows shareholders to receive immediate cash payouts by increasing a company's debt, enhancing liquidity without diluting ownership, but it raises financial risk due to higher leverage and potential credit rating downgrades. Leveraged recapitalization involves restructuring debt to buy back shares or pay dividends, benefiting shareholders through increased ownership value and tax advantages, yet it exposes the company to refinancing risks and potential operational constraints from debt covenants. Both strategies can improve shareholder returns but require careful balance between leveraging financial benefits and managing increased default risk.

Market Trends in Recapitalizations

Market trends in recapitalizations reveal a growing preference for dividend recapitalizations, driven by companies seeking to return capital to shareholders while maintaining operational control. Leveraged recaps remain popular among firms aiming to restructure debt profiles and optimize capital structure for long-term growth. Private equity firms frequently utilize both strategies to enhance shareholder value amid fluctuating interest rates and evolving market conditions.

Choosing the Right Recapitalization Approach

Choosing the right recapitalization approach depends on the company's financial objectives and capital structure. Dividend recapitalization injects liquidity by borrowing funds to pay shareholders without altering ownership, ideal for mature firms seeking cash return. Leveraged recapitalization involves substantial debt to restructure equity and can help stabilize control while optimizing tax benefits and balance sheet leverage.

Dividend Recapitalization Infographic

libterm.com

libterm.com