Insurtech and wealthtech are revolutionizing financial services by integrating advanced technology to enhance customer experience and operational efficiency. These sectors leverage AI, blockchain, and big data analytics to offer personalized insurance policies and investment solutions tailored to Your unique needs. Discover how these innovations are shaping the future of finance in the rest of the article.

Table of Comparison

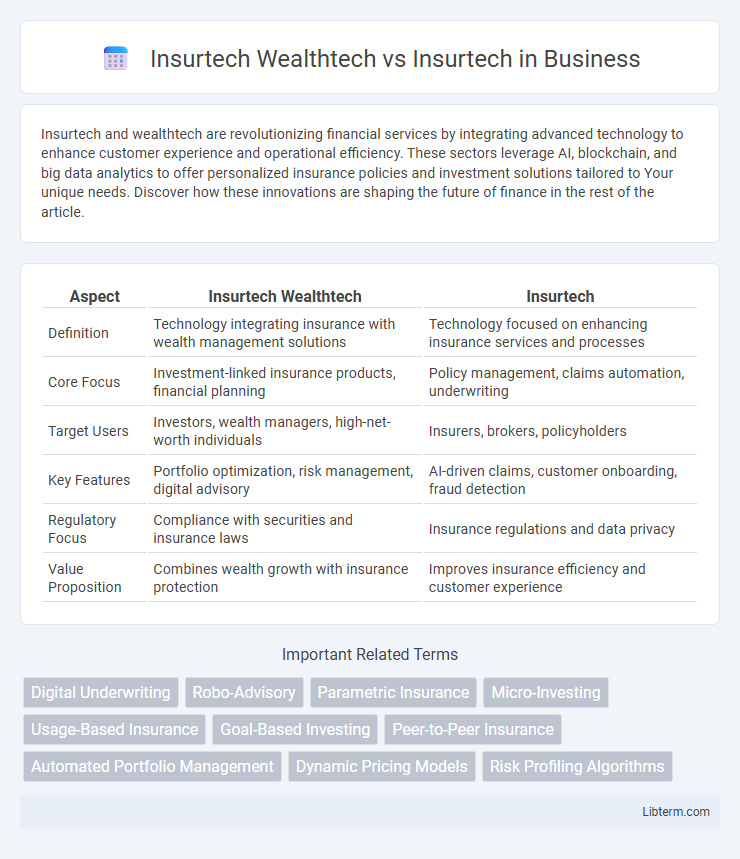

| Aspect | Insurtech Wealthtech | Insurtech |

|---|---|---|

| Definition | Technology integrating insurance with wealth management solutions | Technology focused on enhancing insurance services and processes |

| Core Focus | Investment-linked insurance products, financial planning | Policy management, claims automation, underwriting |

| Target Users | Investors, wealth managers, high-net-worth individuals | Insurers, brokers, policyholders |

| Key Features | Portfolio optimization, risk management, digital advisory | AI-driven claims, customer onboarding, fraud detection |

| Regulatory Focus | Compliance with securities and insurance laws | Insurance regulations and data privacy |

| Value Proposition | Combines wealth growth with insurance protection | Improves insurance efficiency and customer experience |

Defining Insurtech: Revolutionizing Insurance

Insurtech revolutionizes insurance by leveraging technology to streamline underwriting, claims processing, and customer experience, making services more efficient and accessible. Wealthtech overlaps with insurtech in providing digital financial solutions but focuses specifically on investment management, financial planning, and wealth advisory. Defining insurtech centers on its impact in transforming traditional insurance models through automation, data analytics, and innovative platforms.

Unveiling Wealthtech: Transforming Wealth Management

Unveiling Wealthtech reveals its pivotal role in transforming wealth management by integrating advanced digital technologies like AI, big data, and blockchain to enhance investment strategies and personalized financial planning. Unlike traditional Insurtech, which centers on automating insurance processes and claims handling, Wealthtech focuses on creating seamless, data-driven wealth advisory services and portfolio optimization. The synergy between Insurtech and Wealthtech fosters holistic financial ecosystems, accelerating innovation in both risk management and asset growth.

Core Differences Between Insurtech and Wealthtech

Insurtech centers on leveraging technology to innovate insurance services, enhancing risk assessment, claims processing, and policy management through AI, blockchain, and big data analytics. Wealthtech focuses on digital solutions for investment management, financial planning, and personalized wealth advisory using robo-advisors, algorithmic trading, and real-time portfolio optimization. Core differences lie in their target markets--insurance products versus wealth accumulation--and the specific technologies deployed to address risk mitigation for insurers versus asset growth for investors.

How Insurtech Integrates With Wealthtech Solutions

Insurtech integrates with Wealthtech solutions by leveraging advanced data analytics and AI algorithms to enhance personalized financial planning and insurance product offerings. This combination enables seamless management of insurance policies alongside investment portfolios within unified digital platforms, optimizing customer experience and financial decision-making. Collaborative APIs and blockchain technology ensure secure data exchange and transparency between insurance providers and wealth management services.

Key Insurtech Innovations in 2024

Key Insurtech innovations in 2024 emphasize AI-driven underwriting, usage-based insurance models, and blockchain integration for enhanced transparency and fraud prevention. Insurtech Wealthtech convergence fosters personalized financial planning through real-time data analytics, automated investment strategies, and seamless policy management within digital ecosystems. These advancements accelerate customer-centric services, reduce operational costs, and increase market agility in both sectors.

Wealthtech Advancements Shaping Financial Services

Wealthtech advancements leverage AI-driven portfolio management, robo-advisors, and personalized financial planning to revolutionize investment strategies within financial services. Insurtech primarily focuses on automating insurance underwriting, claims processing, and risk assessment using blockchain and IoT technologies. The convergence of Wealthtech and Insurtech promotes integrated digital ecosystems, enhancing customer experience and operational efficiency across both sectors.

Benefits of Combining Insurtech and Wealthtech

Combining Insurtech and Wealthtech creates a powerful synergy that enhances personalized financial planning and risk management through advanced data analytics and AI-driven insights. This integration enables seamless customer experiences by consolidating insurance coverage with investment portfolios, increasing transparency and optimizing asset protection. Firms leveraging both technologies achieve higher operational efficiency, improved client retention, and expanded market reach by offering comprehensive, tailored financial solutions.

Market Trends: Insurtech vs. Insurtech-Wealthtech Hybrids

Insurtech market trends reveal rapid growth driven by digital transformation and AI integration, with valuations projected to exceed $10 billion by 2026. Insurtech-Wealthtech hybrids leverage this momentum by combining insurance products with wealth management services, enhancing customer engagement and lifetime value through personalized financial ecosystems. This convergence addresses evolving consumer demands, fueling a competitive edge in a market expected to grow at a CAGR of 25% over the next five years.

Challenges Facing Insurtech and Wealthtech Collaboration

Insurtech and wealthtech collaboration faces challenges stemming from regulatory complexities, data privacy concerns, and differing industry standards, which hinder seamless integration and innovation. The disparity in risk management approaches between insurance and wealth management sectors complicates the alignment of product offerings and customer experiences. Overcoming technological interoperability issues and establishing unified frameworks for compliance are critical for successful partnerships between insurtech and wealthtech firms.

Future Outlook: The Evolution of Insurtech in Wealth Management

The future outlook of Insurtech in wealth management reveals significant growth driven by the integration of AI, blockchain, and data analytics, enhancing personalized insurance and investment solutions. Insurtech Wealthtech platforms automate risk assessment, improve underwriting accuracy, and facilitate seamless policy administration, optimizing customer experience in wealth management. Advancements in digital ecosystems will further blur the lines between Insurtech and Wealthtech, fostering innovative hybrid models focused on comprehensive financial protection and asset growth strategies.

Insurtech Wealthtech Infographic

libterm.com

libterm.com