A unitary board combines executive and non-executive directors into a single group responsible for corporate governance and strategic decisions. This structure enhances accountability and facilitates cohesive leadership within your organization. Explore the article to understand how a unitary board can impact your company's performance and compliance.

Table of Comparison

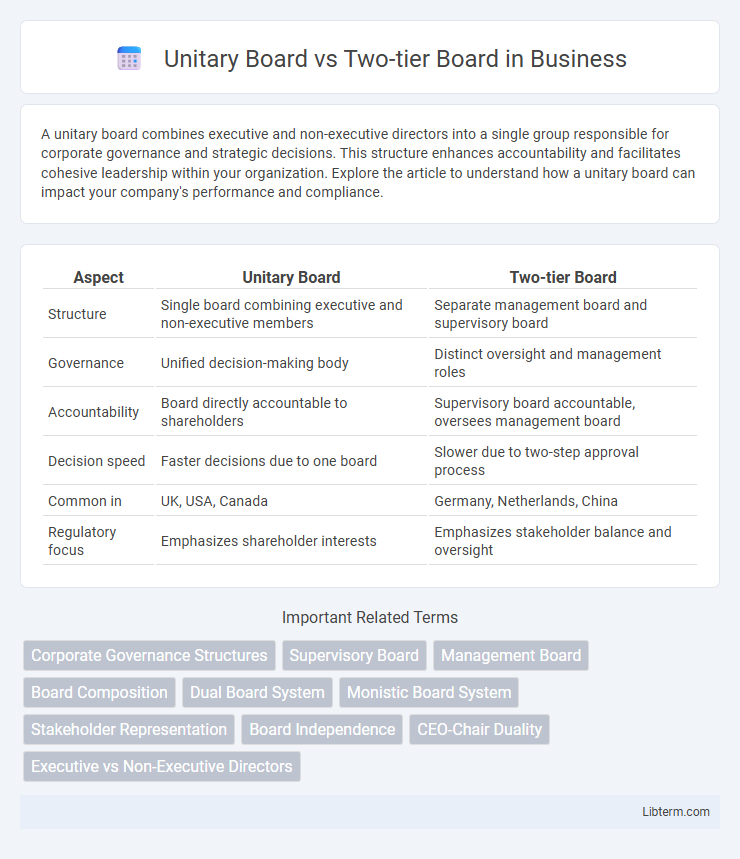

| Aspect | Unitary Board | Two-tier Board |

|---|---|---|

| Structure | Single board combining executive and non-executive members | Separate management board and supervisory board |

| Governance | Unified decision-making body | Distinct oversight and management roles |

| Accountability | Board directly accountable to shareholders | Supervisory board accountable, oversees management board |

| Decision speed | Faster decisions due to one board | Slower due to two-step approval process |

| Common in | UK, USA, Canada | Germany, Netherlands, China |

| Regulatory focus | Emphasizes shareholder interests | Emphasizes stakeholder balance and oversight |

Introduction to Board Structures

Unitary boards consist of a single group of directors responsible for both management oversight and strategic decision-making, blending executive and non-executive roles within one body. Two-tier boards separate supervisory and management functions into distinct entities: a supervisory board oversees the management board, ensuring checks and balances. This structural differentiation affects corporate governance, accountability, and regulatory compliance across jurisdictions.

What is a Unitary Board?

A Unitary Board consists of a single tier of directors combining executive and non-executive members who jointly oversee company management and strategy. This governance structure enables more streamlined decision-making and accountability by integrating supervisory and managerial roles within one board. Common in countries like the United States and the United Kingdom, unitary boards promote balanced oversight and direct involvement in operational matters.

What is a Two-Tier Board?

A Two-Tier Board is a corporate governance structure consisting of a separate supervisory board and management board, designed to enhance oversight and accountability. The supervisory board is responsible for overseeing and appointing the management board, which handles daily operations. This system is commonly used in countries like Germany and the Netherlands, promoting clear separation between control and management functions.

Key Differences Between Unitary and Two-Tier Boards

Unitary boards combine executive and non-executive directors within a single board, enabling direct oversight and faster decision-making, commonly used in countries like the United States and the United Kingdom. Two-tier boards separate management and supervisory functions into distinct boards: the management board handles daily operations, while the supervisory board oversees and controls the management board, a structure prevalent in Germany and the Netherlands. Key differences include the level of separation between oversight and management, the complexity of governance, and jurisdictional preferences influencing board efficacy and accountability.

Legal Frameworks and Jurisdictions

Unitary boards, commonly found in common law jurisdictions such as the United States and the United Kingdom, operate under a single-tier structure where executive and non-executive directors serve on one board, providing integrated oversight under corporate governance codes like the UK's Companies Act 2006. Two-tier boards, prevalent in civil law countries like Germany and the Netherlands, feature a separate management board and supervisory board, mandated by legal frameworks such as the German Stock Corporation Act (AktG), ensuring distinct oversight and management roles. Jurisdictional differences influence fiduciary duties, board composition, and shareholder rights, with unitary systems emphasizing flexibility and responsiveness, while two-tier systems prioritize stakeholder representation and independent supervision.

Advantages of Unitary Boards

Unitary boards streamline decision-making by consolidating oversight and management functions into a single body, enhancing accountability and responsiveness. This structure facilitates better communication between executive and non-executive directors, promoting unified strategic direction and faster implementation of corporate policies. Companies with unitary boards often benefit from reduced administrative costs and simpler governance frameworks compared to two-tier systems.

Advantages of Two-Tier Boards

Two-tier boards provide enhanced oversight by separating management and supervisory functions, which reduces conflicts of interest and promotes independent monitoring. This structure encourages diverse expertise on the supervisory board, leading to improved strategic guidance and risk management. European corporate governance models often favor two-tier boards for their transparency and stakeholder protection benefits.

Challenges and Criticisms of Each Model

Unitary boards face challenges related to potential conflicts of interest as executive and non-executive directors share decision-making authority, which may compromise board independence and oversight. Two-tier boards often encounter criticism for slower decision-making due to the separation of management and supervisory functions, creating complexity in communication and coordination between the management board and supervisory board. Both models struggle with issues of transparency and accountability, impacting corporate governance effectiveness in varied regulatory and cultural environments.

Choosing the Right Board Structure for Your Organization

Choosing the right board structure depends on your organization's size, governance style, and regulatory environment. A Unitary Board combines executive and non-executive directors, promoting faster decision-making and clearer accountability. In contrast, a Two-tier Board separates management and oversight into distinct supervisory and management boards, enhancing checks and balances but potentially slowing communication.

Future Trends in Corporate Governance

Future trends in corporate governance increasingly favor hybrid board models that merge the advantages of both Unitary Boards and Two-tier Boards to enhance transparency and strategic oversight. Advances in digital governance tools enable more dynamic stakeholder engagement and real-time performance monitoring, driving shifts towards adaptable board structures. Regulatory frameworks globally are trending towards mandating greater board diversity and sustainability accountability, impacting the evolution of board composition and decision-making processes.

Unitary Board Infographic

libterm.com

libterm.com