Reserves represent the stored assets or resources a company or individual maintains to secure future obligations or uncertainties. These funds often play a crucial role in financial stability and risk management by providing a safety net during economic fluctuations. Explore the rest of this article to understand how effective reserve management can protect and enhance your financial outlook.

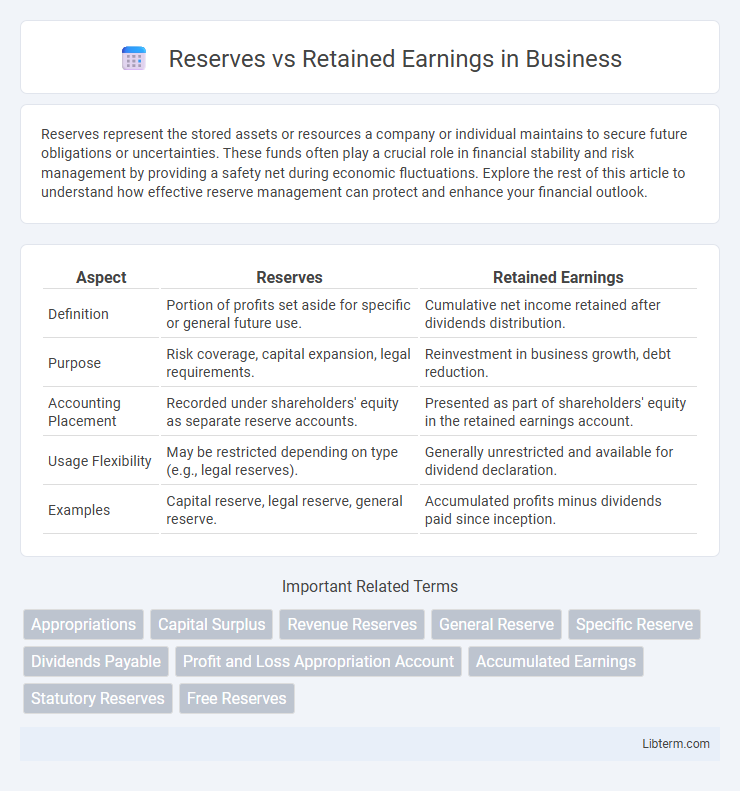

Table of Comparison

| Aspect | Reserves | Retained Earnings |

|---|---|---|

| Definition | Portion of profits set aside for specific or general future use. | Cumulative net income retained after dividends distribution. |

| Purpose | Risk coverage, capital expansion, legal requirements. | Reinvestment in business growth, debt reduction. |

| Accounting Placement | Recorded under shareholders' equity as separate reserve accounts. | Presented as part of shareholders' equity in the retained earnings account. |

| Usage Flexibility | May be restricted depending on type (e.g., legal reserves). | Generally unrestricted and available for dividend declaration. |

| Examples | Capital reserve, legal reserve, general reserve. | Accumulated profits minus dividends paid since inception. |

Introduction to Reserves and Retained Earnings

Reserves and retained earnings represent key components of a company's equity, capturing profits set aside for specific purposes or reinvestment. Reserves are portions of retained earnings allocated to strengthen financial stability, fund future projects, or comply with statutory requirements. Retained earnings reflect accumulated net income that remains after dividends are paid, serving as a source for business growth and debt reduction.

Definition of Reserves

Reserves are portions of a company's profits set aside and retained for specific purposes such as contingencies, future expansions, or debt repayment, enhancing financial stability. Unlike retained earnings, which represent cumulative net profits not distributed as dividends, reserves are explicitly allocated from retained earnings or profits. These reserves improve the company's creditworthiness and provide a buffer against unforeseen financial challenges.

Definition of Retained Earnings

Retained earnings represent the cumulative net income a company retains after distributing dividends to shareholders, serving as a key source of internal financing for growth and debt reduction. Unlike reserves, which are specific allocations of retained earnings for designated purposes such as contingencies or asset replacement, retained earnings reflect the overall undistributed profit reinvested into the business. This financial metric is crucial for assessing a company's ability to fund operations, invest in capital projects, and enhance shareholder value over time.

Key Differences Between Reserves and Retained Earnings

Reserves represent portions of profit set aside for specific purposes such as contingencies or future investments, while retained earnings are the accumulated net profits kept in the business after dividends are paid. Reserves can be statutory, capital, or revenue-based, reflecting regulatory requirements or management decisions, whereas retained earnings primarily indicate the company's cumulative profitability and capacity for reinvestment. The key difference lies in their purpose and classification: reserves are earmarked funds for particular uses, while retained earnings serve as a general reserve for growth and operational needs.

Types of Reserves in Corporate Finance

Types of reserves in corporate finance include revenue reserves, capital reserves, and statutory reserves, each serving distinct purposes in safeguarding a company's financial health. Revenue reserves, like general and specific reserves, are created from profits to support business operations and future contingencies, while capital reserves arise from capital profits such as asset revaluation or share premiums, often restricted from dividend distribution. Statutory reserves are mandated by law, ensuring companies maintain a minimum reserve balance to protect creditors and maintain regulatory compliance.

Importance of Retained Earnings in Business Growth

Retained earnings represent the cumulative net income reinvested in the business, playing a crucial role in funding expansion, research and development, and debt reduction without relying on external financing. Unlike reserves, which are earmarked for specific future liabilities or contingencies, retained earnings provide flexibility for strategic growth initiatives and operational improvements. Efficient management of retained earnings strengthens a company's financial stability and supports sustainable long-term development.

How Reserves Are Created and Used

Reserves are created by appropriating profits from retained earnings, earmarked for specific purposes such as contingencies, expansions, or debt repayment, enhancing financial stability and creditworthiness. These funds are not distributed as dividends but are retained to strengthen the company's capital base or meet future liabilities. Unlike retained earnings, which represent cumulative net income available to shareholders, reserves serve as a strategic financial buffer supporting long-term operational sustainability.

How Retained Earnings Are Calculated

Retained earnings are calculated by taking the beginning retained earnings balance, adding net income or subtracting net loss for the period, and then deducting any dividends paid to shareholders. This calculation reflects the cumulative amount of profit that a company has reinvested in the business rather than distributed as dividends. Unlike reserves, which are specific allocations of retained earnings for particular purposes, retained earnings represent the total undistributed profits available to finance growth or pay off liabilities.

Impact on Financial Statements

Reserves reduce the distributable profits on the balance sheet by earmarking specific amounts for future contingencies, enhancing financial stability and investor confidence. Retained earnings represent accumulated net profits after dividends, directly increasing shareholders' equity and providing funds for business growth. Both reserves and retained earnings influence key financial ratios, such as return on equity (ROE) and debt-to-equity ratio, affecting the company's valuation and creditworthiness.

Strategic Role in Corporate Decision-Making

Reserves and retained earnings play pivotal roles in corporate strategic decision-making by influencing financial stability and investment capacity. Reserves, often earmarked for specific purposes like debt repayment or expansions, provide a buffer that supports long-term planning and risk management. Retained earnings, representing accumulated profits, offer companies internal funding for growth initiatives, dividend distribution, and rewarding shareholders without external financing.

Reserves Infographic

libterm.com

libterm.com