The Price-to-Sales (P/S) ratio measures a company's stock price relative to its revenue, providing insight into how investors value each dollar of sales. This metric is particularly useful for assessing companies that may not yet be profitable but have strong sales growth, offering a clearer picture beyond earnings. To understand how the P/S ratio can impact your investment decisions, continue reading the article.

Table of Comparison

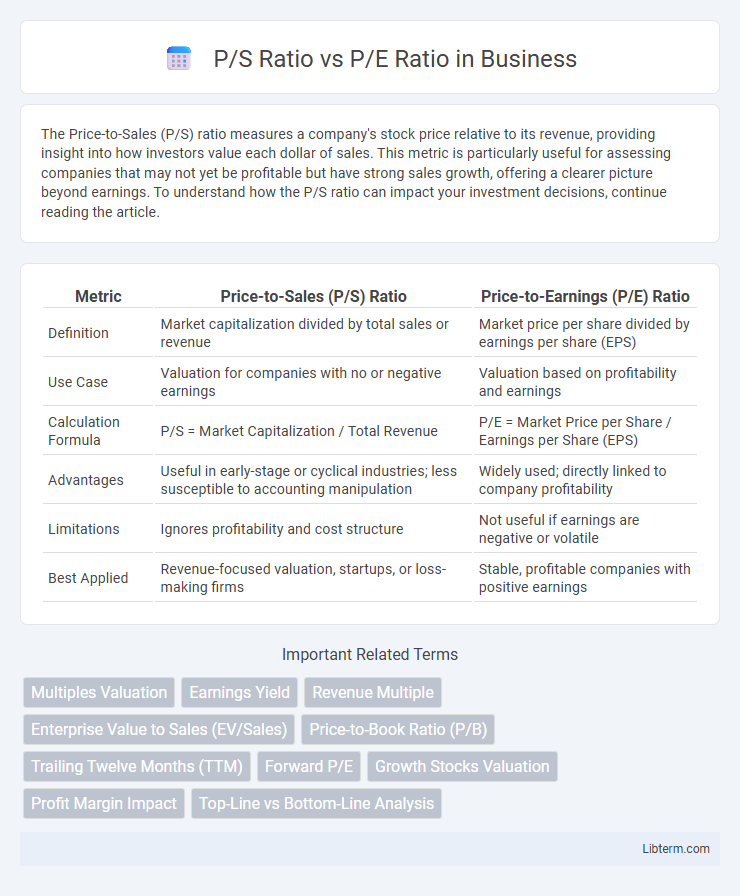

| Metric | Price-to-Sales (P/S) Ratio | Price-to-Earnings (P/E) Ratio |

|---|---|---|

| Definition | Market capitalization divided by total sales or revenue | Market price per share divided by earnings per share (EPS) |

| Use Case | Valuation for companies with no or negative earnings | Valuation based on profitability and earnings |

| Calculation Formula | P/S = Market Capitalization / Total Revenue | P/E = Market Price per Share / Earnings per Share (EPS) |

| Advantages | Useful in early-stage or cyclical industries; less susceptible to accounting manipulation | Widely used; directly linked to company profitability |

| Limitations | Ignores profitability and cost structure | Not useful if earnings are negative or volatile |

| Best Applied | Revenue-focused valuation, startups, or loss-making firms | Stable, profitable companies with positive earnings |

Introduction to Financial Ratios

The P/S ratio measures a company's stock price relative to its revenue per share, offering insights into valuation based on sales rather than earnings. The P/E ratio compares stock price to earnings per share, reflecting profitability and investor expectations. Both ratios serve as essential financial metrics to evaluate a company's market value and growth potential from different operational perspectives.

Understanding the P/S (Price-to-Sales) Ratio

The P/S (Price-to-Sales) ratio measures a company's stock price relative to its revenue per share, offering insight into how the market values each dollar of sales. Unlike the P/E (Price-to-Earnings) ratio, which depends on net income and can be influenced by accounting practices or profit volatility, the P/S ratio provides a more stable metric during periods of losses or fluctuating earnings. Investors use the P/S ratio to assess companies with inconsistent profits, especially in early-stage or cyclical industries, making it a crucial tool for evaluating growth potential and market valuation without relying on profitability.

Understanding the P/E (Price-to-Earnings) Ratio

The P/E (Price-to-Earnings) ratio measures a company's current share price relative to its earnings per share, providing insight into market expectations of future growth and profitability. Unlike the P/S (Price-to-Sales) ratio, which evaluates the value of a company's sales rather than profits, the P/E ratio highlights the company's ability to generate earnings, making it a critical metric for assessing valuation and comparing firms within the same industry. Investors rely on the P/E ratio to determine whether a stock is overvalued or undervalued based on its earnings performance and market sentiment.

Key Differences Between P/S and P/E Ratios

The Price-to-Sales (P/S) ratio measures a company's stock price relative to its revenue, while the Price-to-Earnings (P/E) ratio compares stock price to net earnings. The P/S ratio is useful for evaluating companies with negative or volatile earnings, providing insight into valuation based on sales performance. In contrast, the P/E ratio is more effective for profitable companies, reflecting investor expectations about future earnings and profitability.

When to Use the P/S Ratio

The Price-to-Sales (P/S) ratio is most useful for evaluating companies with little or no earnings, such as startups or those in cyclical industries experiencing temporary losses. Unlike the Price-to-Earnings (P/E) ratio, which relies on net income, the P/S ratio offers a valuation metric based on revenue, making it valuable when earnings are negative or highly volatile. Investors often use the P/S ratio to assess growth potential and market valuation during early stages or turnaround phases before profitability is established.

When to Use the P/E Ratio

The P/E ratio is most effective for evaluating companies with consistent earnings and stable profit margins, making it ideal for mature industries where earnings data is reliable. This metric helps investors assess how much they are paying for each dollar of earnings, providing insight into a stock's valuation relative to its historical performance and sector peers. Use the P/E ratio when profitability is stable, as it reflects a company's ability to generate earnings, unlike the P/S ratio which is better suited for firms with inconsistent or negative earnings.

Limitations of the P/S Ratio

The Price-to-Sales (P/S) ratio often overlooks profitability by ignoring profit margins, making it less effective for distinguishing between companies with vastly different cost structures. Unlike the Price-to-Earnings (P/E) ratio, P/S does not account for earnings quality or debt levels, limiting its use in assessing financial health. Investors relying solely on P/S may misinterpret sales-driven growth as value without considering operational efficiency and profitability risks.

Limitations of the P/E Ratio

The P/E ratio often fails to accurately reflect company value when earnings are volatile or negative, limiting its usefulness in evaluating firms with inconsistent profitability. It can be distorted by accounting policies and non-recurring items, which affect net income and lead to misleading valuations. In contrast, the P/S ratio provides a more stable metric by focusing on revenue, making it advantageous for assessing companies with erratic earnings or in early growth stages.

Practical Examples: P/S vs P/E in Stock Analysis

The P/S ratio is useful for evaluating companies with negative earnings by comparing stock price to sales, as seen in early-stage tech startups lacking profits but showing strong revenue growth. For example, a high P/E ratio in established firms like Apple may indicate overvaluation or strong growth expectations, while a low P/S ratio in retail companies like Walmart highlights undervaluation despite thin profit margins. Investors commonly use P/E ratios for profitability analysis, but rely on P/S ratios when earnings are volatile or non-existent, ensuring balanced stock valuation in varying industry contexts.

Conclusion: Choosing the Right Ratio for Investment Decisions

The P/S ratio is ideal for evaluating companies with volatile or negative earnings, offering insights based on sales performance rather than net income. The P/E ratio remains a critical metric for assessing profitability and earnings growth potential in established firms with consistent profits. Selecting the appropriate ratio depends on the company's financial stability, industry norms, and the specific context of the investment decision.

P/S Ratio Infographic

libterm.com

libterm.com