Basel III is a comprehensive set of reform measures developed to strengthen regulation, supervision, and risk management within the banking sector. It enhances capital requirements, introduces new liquidity standards, and improves the resilience of banks to financial stress. Explore the article to understand how Basel III impacts your financial institution and the global banking landscape.

Table of Comparison

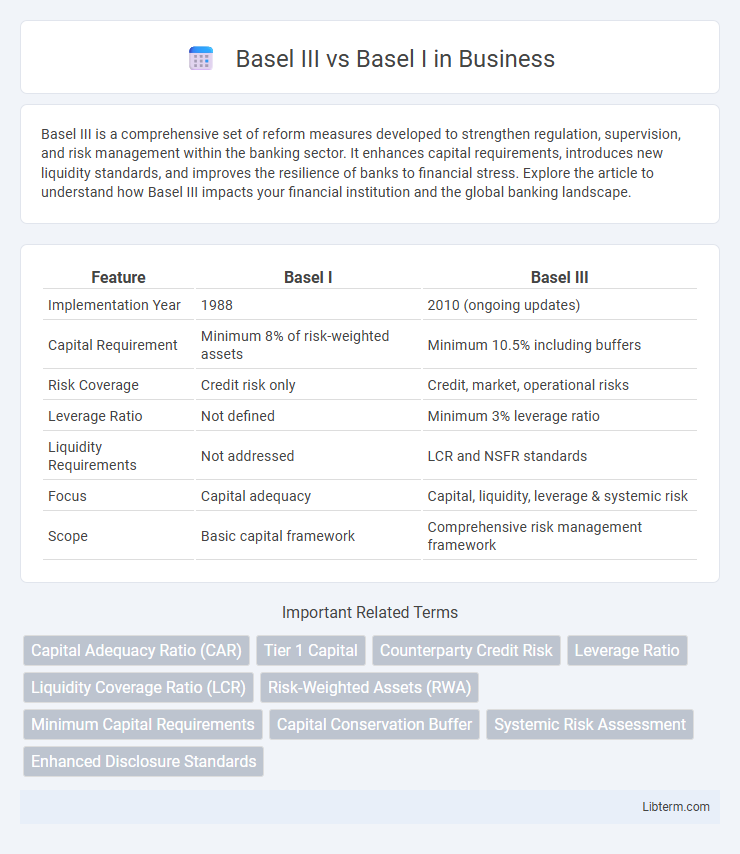

| Feature | Basel I | Basel III |

|---|---|---|

| Implementation Year | 1988 | 2010 (ongoing updates) |

| Capital Requirement | Minimum 8% of risk-weighted assets | Minimum 10.5% including buffers |

| Risk Coverage | Credit risk only | Credit, market, operational risks |

| Leverage Ratio | Not defined | Minimum 3% leverage ratio |

| Liquidity Requirements | Not addressed | LCR and NSFR standards |

| Focus | Capital adequacy | Capital, liquidity, leverage & systemic risk |

| Scope | Basic capital framework | Comprehensive risk management framework |

Overview of Basel I and Basel III

Basel I, introduced in 1988 by the Basel Committee on Banking Supervision, established the first global regulatory framework for banking capital adequacy, focusing primarily on credit risk with a minimum capital requirement of 8%. Basel III, developed in response to the 2008 financial crisis and finalized in 2017, significantly enhanced regulatory standards by introducing stricter capital requirements, including higher quality capital such as Common Equity Tier 1 (CET1), leverage ratios, and comprehensive liquidity measures like the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR). Basel III's framework aims to improve bank resilience, risk management, and transparency, addressing limitations of Basel I's simpler, risk-weighted asset model.

Historical Context and Evolution

Basel III emerged as a comprehensive response to the 2008 global financial crisis, addressing the shortcomings of Basel I, which was introduced in 1988 as the first international banking regulation focusing primarily on credit risk. While Basel I established basic capital adequacy standards, Basel III expanded the framework by incorporating more stringent capital requirements, liquidity ratios, and leverage limits to enhance the resilience of financial institutions. The evolution from Basel I to Basel III reflects a significant shift towards a more risk-sensitive and comprehensive regulatory approach in global banking supervision.

Core Objectives of Basel I and Basel III

Basel I primarily focused on establishing minimum capital requirements to strengthen the stability of the international banking system by addressing credit risk through standardized risk weights. Basel III expanded the core objectives to enhance bank resilience by introducing stricter capital adequacy ratios, leverage ratios, and liquidity requirements, targeting credit, market, and operational risks. Basel III also aimed to improve risk management and governance frameworks, promoting the overall soundness and transparency of banks globally.

Key Differences in Capital Requirements

Basel III introduces more stringent capital requirements compared to Basel I, emphasizing higher quality capital such as common equity tier 1 (CET1) at a minimum of 4.5% of risk-weighted assets (RWA), whereas Basel I primarily focused on total capital with a minimum ratio of 8%. Basel III also mandates additional capital buffers, including the conservation buffer of 2.5% and the countercyclical buffer up to 2.5%, absent in Basel I. The risk-weighting framework under Basel III is more risk-sensitive, incorporating credit, market, and operational risks with enhanced risk measurement approaches, contrasting with Basel I's simpler and less risk-sensitive credit risk assessment.

Risk Measurement Approaches

Basel III introduces advanced risk measurement approaches compared to Basel I by incorporating comprehensive frameworks like the Internal Ratings-Based (IRB) approach for credit risk, replacing Basel I's simplistic, standardized risk weights. Basel III also expands risk coverage to include market risk and operational risk with specific capital requirements based on more granular risk quantification models. These enhancements improve capital adequacy assessment by aligning regulatory capital more closely with underlying risk profiles.

Leverage Ratio: Introduction and Impact

Basel III introduced the leverage ratio as a non-risk-based measure to limit excessive build-up of leverage in the banking sector, set at a minimum of 3%, compared to Basel I which lacked such a requirement. The leverage ratio under Basel III enhances bank resilience by restricting total exposure relative to Tier 1 capital, addressing weaknesses exposed during the 2008 financial crisis. Implementation of this ratio has led to improved capital discipline and reduced systemic risk, marking a significant regulatory advancement from Basel I's risk-weighted capital framework.

Liquidity Standards Comparison

Basel III significantly enhances liquidity standards compared to Basel I by introducing the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), which ensure banks maintain sufficient high-quality liquid assets to withstand short-term and long-term liquidity stress. Basel I primarily focused on capital adequacy without specific liquidity requirements, leaving banks vulnerable during financial crises. The stricter liquidity frameworks under Basel III promote greater resilience and stability in the banking sector by addressing funding mismatches and liquidity risk management.

Supervisory Review and Market Discipline

Basel III introduces enhanced frameworks for Supervisory Review and Market Discipline compared to Basel I, emphasizing stricter capital adequacy requirements and risk management practices. Basel III mandates comprehensive Supervisory Review Processes (SRP) to evaluate banks' internal risk assessments and capital planning, ensuring resilience against financial shocks. It strengthens Market Discipline by requiring greater transparency through detailed disclosures on risk exposures, capital structure, and risk mitigation techniques, fostering investor and stakeholder confidence.

Implementation Challenges and Global Impact

Basel III's implementation posed significant challenges due to its complex capital and liquidity requirements, demanding extensive regulatory adjustments and increased transparency across global banks compared to Basel I's simpler framework. The transition required banks worldwide to enhance risk management systems, leading to substantial compliance costs and operational restructuring. Despite these difficulties, Basel III has strengthened global financial stability by promoting higher capital standards and mitigating systemic risks more effectively than Basel I.

Future Outlook for Basel Regulations

Basel III introduces more stringent capital and liquidity requirements compared to Basel I, emphasizing risk sensitivity and financial stability. Future Basel regulations are expected to integrate advanced risk assessment models and incorporate environmental, social, and governance (ESG) factors alongside technological innovations like AI in regulatory compliance. Ongoing revisions aim to enhance resilience against emerging financial threats while promoting sustainable banking practices globally.

Basel III Infographic

libterm.com

libterm.com