Low working capital can restrict your business's ability to cover daily operational expenses and manage short-term liabilities effectively. This financial constraint may lead to delayed supplier payments, hindered inventory purchases, and challenges in seizing growth opportunities. Explore the rest of the article to learn how to identify, manage, and improve low working capital situations for a healthier financial position.

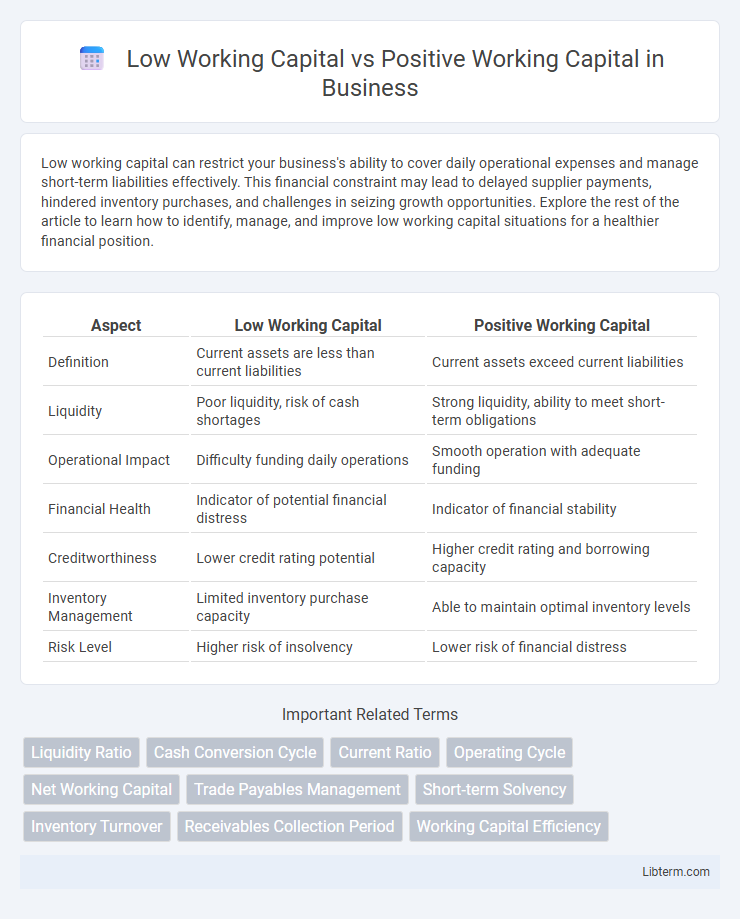

Table of Comparison

| Aspect | Low Working Capital | Positive Working Capital |

|---|---|---|

| Definition | Current assets are less than current liabilities | Current assets exceed current liabilities |

| Liquidity | Poor liquidity, risk of cash shortages | Strong liquidity, ability to meet short-term obligations |

| Operational Impact | Difficulty funding daily operations | Smooth operation with adequate funding |

| Financial Health | Indicator of potential financial distress | Indicator of financial stability |

| Creditworthiness | Lower credit rating potential | Higher credit rating and borrowing capacity |

| Inventory Management | Limited inventory purchase capacity | Able to maintain optimal inventory levels |

| Risk Level | Higher risk of insolvency | Lower risk of financial distress |

Understanding Working Capital: Definition and Importance

Working capital represents the difference between a company's current assets and current liabilities, serving as a crucial indicator of financial health and operational efficiency. Low working capital can signal potential liquidity problems, hindering a company's ability to cover short-term obligations and invest in growth opportunities. Positive working capital indicates sufficient liquidity to manage daily expenses, fund expansion, and maintain smooth business operations, making it essential for sustaining profitability and stability.

What is Low Working Capital?

Low working capital occurs when a company's current liabilities exceed its current assets, indicating potential liquidity problems and difficulty meeting short-term obligations. This situation may lead to cash flow shortages, affecting the company's ability to maintain operations and pay suppliers or employees on time. Efficient management of low working capital requires monitoring inventory levels, accelerating receivables, and controlling expenses to improve financial stability.

What is Positive Working Capital?

Positive working capital occurs when a company's current assets exceed its current liabilities, indicating sufficient liquidity to meet short-term obligations. This financial position allows businesses to invest in growth opportunities, pay off debts promptly, and maintain smooth operational cycles. Maintaining positive working capital is essential for financial stability and operational efficiency, reflecting a company's ability to manage its cash flow effectively.

Key Differences Between Low and Positive Working Capital

Low working capital indicates a shortage of current assets relative to current liabilities, often signaling potential liquidity issues and difficulty funding day-to-day operations. Positive working capital reflects a healthy buffer where current assets exceed current liabilities, enabling a company to meet short-term obligations and invest in growth. The key differences lie in liquidity status, operational flexibility, and financial stability, with positive working capital supporting smoother business cycles and low working capital increasing risk of cash flow problems.

Causes of Low Working Capital

Low working capital occurs when a company's current liabilities exceed its current assets, often caused by slow inventory turnover, extended accounts receivable periods, or excessive short-term debt. Inefficient cash flow management and unexpected expenses can also lead to low working capital, constraining the business's ability to meet immediate financial obligations. Positive working capital indicates a healthy liquidity position, enabling smoother operations and financial stability.

Benefits of Maintaining Positive Working Capital

Maintaining positive working capital ensures a company's ability to meet short-term liabilities and operational expenses, enhancing financial stability and operational efficiency. It supports uninterrupted business operations, enables timely payments to suppliers, and fosters stronger creditworthiness with lenders. Positive working capital also provides flexibility to invest in growth opportunities and absorb unexpected expenses, crucial for sustaining long-term business success.

Risks Associated with Low Working Capital

Low working capital indicates insufficient current assets to cover short-term liabilities, increasing the risk of liquidity crises and operational disruptions. Businesses with low working capital may face difficulties in meeting payroll, managing inventory, or paying suppliers on time, potentially harming supplier relationships and credit ratings. Maintaining a positive working capital ensures smoother cash flow management, reduces financial stress, and supports sustainable business growth.

Impact on Business Operations and Growth

Low working capital restricts a company's ability to cover short-term liabilities, leading to cash flow issues that can hinder day-to-day operations and delay payments to suppliers. Positive working capital ensures sufficient liquidity to manage operational expenses, invest in inventory, and capitalize on growth opportunities, boosting overall business stability. Efficient management of working capital directly influences a company's capacity to expand, maintain supplier relationships, and sustain competitive advantage.

Strategies to Improve Working Capital Position

Low working capital requires strategies such as improving accounts receivable collection, negotiating extended payment terms with suppliers, and optimizing inventory management to enhance liquidity. Positive working capital benefits from maintaining a balanced cash conversion cycle by efficiently managing payables and receivables while investing surplus funds in short-term assets. Implementing these financial controls improves operational efficiency and strengthens the company's overall financial health.

Conclusion: Choosing the Right Working Capital Level for Your Business

Selecting the optimal working capital level depends on your business's operational needs and financial health. Low working capital can boost short-term efficiency but may increase liquidity risks, whereas positive working capital ensures smoother operations and financial stability. Businesses must balance these factors to maintain adequate cash flow while minimizing costs and risks.

Low Working Capital Infographic

libterm.com

libterm.com