Upfront payment refers to the full amount paid at the beginning of a transaction or service, ensuring immediate commitment from both parties. This practice is common in industries where securing funds before work begins minimizes risk and guarantees resource allocation. Discover how upfront payment can benefit your financial planning and contractual agreements by reading the full article.

Table of Comparison

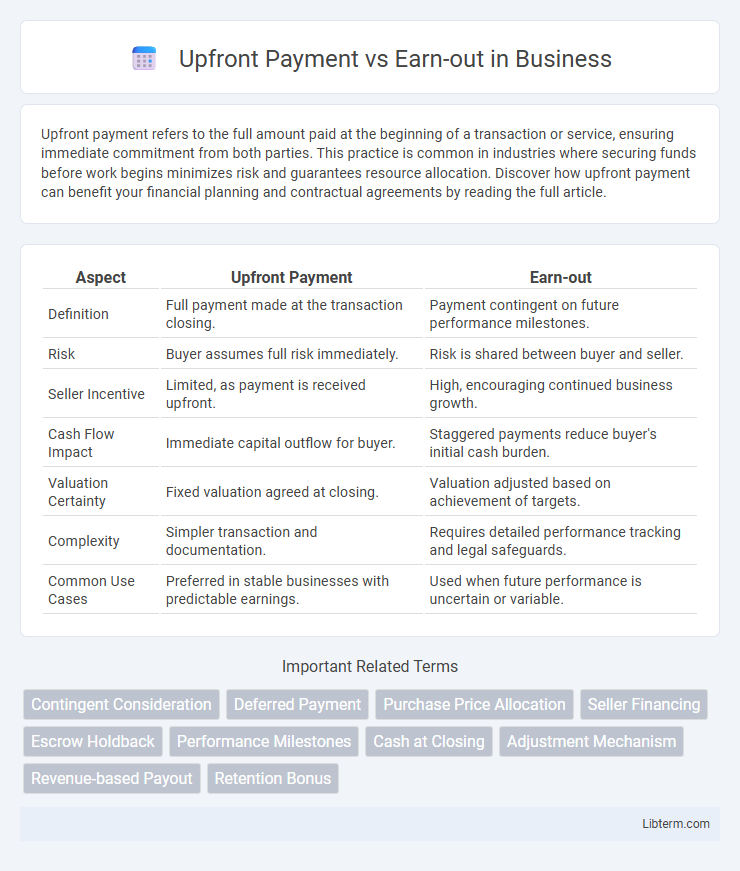

| Aspect | Upfront Payment | Earn-out |

|---|---|---|

| Definition | Full payment made at the transaction closing. | Payment contingent on future performance milestones. |

| Risk | Buyer assumes full risk immediately. | Risk is shared between buyer and seller. |

| Seller Incentive | Limited, as payment is received upfront. | High, encouraging continued business growth. |

| Cash Flow Impact | Immediate capital outflow for buyer. | Staggered payments reduce buyer's initial cash burden. |

| Valuation Certainty | Fixed valuation agreed at closing. | Valuation adjusted based on achievement of targets. |

| Complexity | Simpler transaction and documentation. | Requires detailed performance tracking and legal safeguards. |

| Common Use Cases | Preferred in stable businesses with predictable earnings. | Used when future performance is uncertain or variable. |

Introduction to Upfront Payment and Earn-out

Upfront payment refers to the immediate transfer of funds from the buyer to the seller at the closing of a transaction, securing full ownership and mitigating future risks. Earn-out structures defer a portion of the purchase price contingent on the business achieving specific performance targets, aligning incentives between both parties. These payment methods impact valuation, risk allocation, and negotiation dynamics in mergers and acquisitions.

Key Definitions and Core Concepts

Upfront payment refers to a fixed sum paid at the start of a transaction, providing immediate capital transfer and reducing risk for the seller. Earn-out is a contingent payment based on future performance metrics, aligning interests by linking compensation to post-acquisition success. Understanding these concepts is crucial for structuring deals that balance risk, valuation, and incentive alignment between buyer and seller.

How Upfront Payments Work

Upfront payments are fixed sums paid at the closing of a transaction, providing immediate compensation to the seller. This payment method reduces uncertainty by delivering a guaranteed amount regardless of the future performance of the acquired business. Upfront payments help streamline deal closure and simplify the valuation process by eliminating contingent liabilities associated with earn-outs.

Earn-out Structures Explained

Earn-out structures typically involve seller payments contingent upon future performance metrics such as revenue targets, EBITDA, or customer retention rates within a specified period post-acquisition. These agreements align buyer and seller interests by mitigating risks associated with valuation discrepancies and uncertain future growth. Common earn-out models include fixed milestones, percentage-based payouts, or capped maximum amounts to balance incentive and protection for both parties.

Pros and Cons of Upfront Payments

Upfront payments provide immediate capital, reducing financial uncertainty for sellers and enabling quicker reinvestment or debt repayment. However, they carry risks of overvaluation, potentially leading to buyer losses if future performance disappoints, and may limit seller participation in future upside growth. This fixed payment structure simplifies negotiations but can disadvantage sellers missing out on potential earn-out benefits linked to company performance.

Advantages and Disadvantages of Earn-outs

Earn-outs align seller and buyer interests by tying part of the payment to future performance, reducing upfront financial risk and incentivizing continued growth post-acquisition. However, earn-outs can create conflicts due to differing performance measurement criteria, operational disagreements, and potential delays in full payment, complicating the transaction process. Clear contractual terms and transparent reporting systems are essential to mitigate disputes and ensure mutual benefit.

Common Scenarios for Each Payment Structure

Upfront payments are common in transactions where the buyer has sufficient capital and desires immediate ownership, often seen in smaller deals or when the target company has stable, predictable cash flows. Earn-outs are typical in acquisitions involving startups or businesses with uncertain future performance, aligning seller incentives with post-transaction success by tying part of the purchase price to achieving specific milestones. This structure mitigates risk for buyers and helps bridge valuation gaps when there is disagreement on the target's future growth potential.

Legal and Financial Implications

Upfront payments provide immediate financial certainty and simplify transaction accounting but may increase risk exposure if the target underperforms. Earn-outs align incentives by linking a portion of the purchase price to future performance milestones, reducing initial cash outflow and mitigating overpayment risk. Legally, earn-out agreements require precise drafting to define measurable criteria and dispute resolution mechanisms, protecting both parties from ambiguous interpretations and potential litigation.

Choosing the Right Approach: Factors to Consider

Choosing between an upfront payment and an earn-out involves evaluating factors such as the seller's risk tolerance, the buyer's confidence in future business performance, and the alignment of incentives post-transaction. Upfront payments provide immediate liquidity and reduce post-deal complexities, while earn-outs can bridge valuation gaps by tying compensation to specific financial milestones or operational targets. Consider market volatility, deal size, and the predictability of future cash flows to determine the most appropriate structure for maximizing value and ensuring equitable risk distribution.

Final Thoughts: Making an Informed Decision

Choosing between an upfront payment and an earn-out requires careful evaluation of financial goals, risk tolerance, and the business's future performance potential. Upfront payments provide immediate capital but carry the risk of overvaluation, while earn-outs align seller compensation with future success, mitigating some uncertainty but possibly delaying full payment. An informed decision balances cash flow needs, market conditions, and negotiation leverage to optimize transaction value and minimize financial exposure.

Upfront Payment Infographic

libterm.com

libterm.com