A callable bond allows the issuer to redeem the bond before its maturity date, usually at a premium, providing flexibility to refinance debt if interest rates decline. This feature introduces reinvestment risk for investors, as they may receive their principal earlier than expected and need to reinvest at lower rates. Explore the rest of this article to understand how callable bonds impact your investment strategy and risk profile.

Table of Comparison

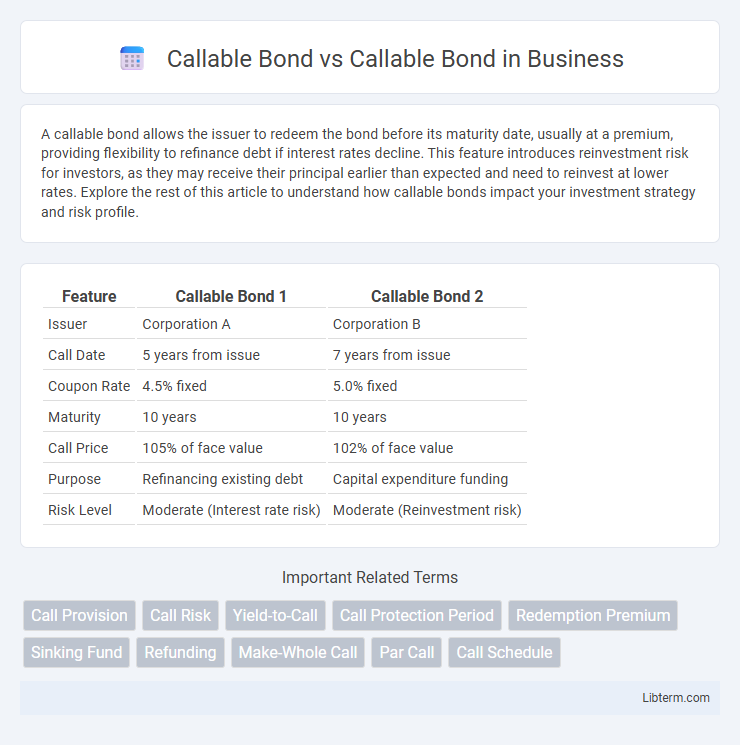

| Feature | Callable Bond 1 | Callable Bond 2 |

|---|---|---|

| Issuer | Corporation A | Corporation B |

| Call Date | 5 years from issue | 7 years from issue |

| Coupon Rate | 4.5% fixed | 5.0% fixed |

| Maturity | 10 years | 10 years |

| Call Price | 105% of face value | 102% of face value |

| Purpose | Refinancing existing debt | Capital expenditure funding |

| Risk Level | Moderate (Interest rate risk) | Moderate (Reinvestment risk) |

Introduction to Callable Bonds

Callable bonds grant issuers the right to redeem the bond before maturity, often at a premium, enabling flexibility in managing debt amid fluctuating interest rates. Investors face reinvestment risk due to the possibility of bonds being called when rates drop, impacting expected returns. The embedded call option typically results in higher yields compared to non-callable bonds to compensate investors for this added risk.

Key Features of Callable Bonds

Callable bonds provide issuers the flexibility to redeem the bond before maturity, typically at a premium, allowing them to manage interest rate risk and refinance debt at lower costs. Key features include a call price, call schedule, and call protection period, which limits when and at what price the bond can be called. Investors face reinvestment risk and potentially lower yields compared to non-callable bonds due to the possibility of early redemption.

Types of Callable Bonds

Types of callable bonds include make-whole callable bonds, where issuers pay a premium based on the bond's value when calling early, and Bermuda callable bonds, which allow calls only on specific dates after an initial lockout period. Another common type is the American callable bond, offering issuers the flexibility to call the bond at any time after the call protection expires. These variations impact investor risk profiles and influence yield spreads in fixed-income markets.

Advantages of Callable Bonds for Issuers

Callable bonds offer issuers significant financial flexibility by allowing them to redeem the bonds before maturity, typically when interest rates decline. This feature enables issuers to refinance debt at lower costs, reducing overall interest expenses and improving capital structure efficiency. Furthermore, callable bonds can attract investors through higher coupon rates, compensating them for the call risk while providing issuers with long-term borrowing options.

Disadvantages of Callable Bonds for Investors

Callable bonds expose investors to reinvestment risk as issuers may redeem the bonds before maturity when interest rates decline, forcing investors to reinvest at lower yields. These bonds often offer lower coupon rates compared to non-callable bonds to compensate issuers for call options, reducing potential income for investors. Furthermore, price appreciation potential is limited since the bond's price rarely exceeds the call price, constraining capital gains during periods of falling interest rates.

Factors Influencing Callable Bond Pricing

Interest rate fluctuations significantly impact callable bond pricing, as issuers are more likely to call bonds when rates decline to refinance at lower costs. Call premiums and call protection periods also affect the bond's value, providing investors compensation for the call risk and limiting the timeframe during which the bond can be redeemed early. Credit risk and market volatility further influence the callable bond's yield spread, reflecting the issuer's likelihood to exercise the call option.

Risk Considerations in Callable Bonds

Callable bonds expose investors to reinvestment risk, as issuers may redeem the bonds early when interest rates decline, forcing bondholders to reinvest at lower yields. The call feature also introduces price risk, limiting price appreciation potential since the bond price usually approaches the call price rather than rising with falling interest rates. Credit risk remains significant if the issuer defaults, but the primary concern for callable bonds is the timing risk and uncertain cash flows caused by the issuer's option to call the bond before maturity.

Callable Bond Yield Calculations

Callable bond yield calculations require adjusting for the bond's call feature, which allows the issuer to redeem the bond before maturity, affecting expected cash flows and yield estimates. Yield to call (YTC) is commonly used, representing the yield assuming the bond is called at the earliest call date, and differs from yield to maturity (YTM) by factoring in the call price and call date. Accurate valuation of callable bond yields incorporates the probability of call events, often utilizing option-adjusted spread (OAS) models to measure embedded call risk and its impact on total return.

Comparing Callable Bonds with Non-Callable Bonds

Callable bonds allow issuers to redeem the bond before maturity, offering flexibility to refinance debt when interest rates decline. Non-callable bonds provide investors with predictable cash flows and protection from early redemption risk, typically resulting in lower yields compared to callable bonds. The trade-off between callable and non-callable bonds centers on higher yield compensation for callable bonds due to call risk versus greater certainty and lower yield in non-callable bonds.

Conclusion: Is a Callable Bond Right for You?

Callable bonds offer issuers flexibility to refinance debt when interest rates drop, but investors face reinvestment risk and potential call risk that can limit returns. Evaluating your risk tolerance, income needs, and market outlook helps determine if callable bonds align with your investment goals. For those prioritizing higher yields and willing to accept call risk, callable bonds can be a suitable choice, whereas conservative investors may prefer non-callable alternatives.

Callable Bond Infographic

libterm.com

libterm.com