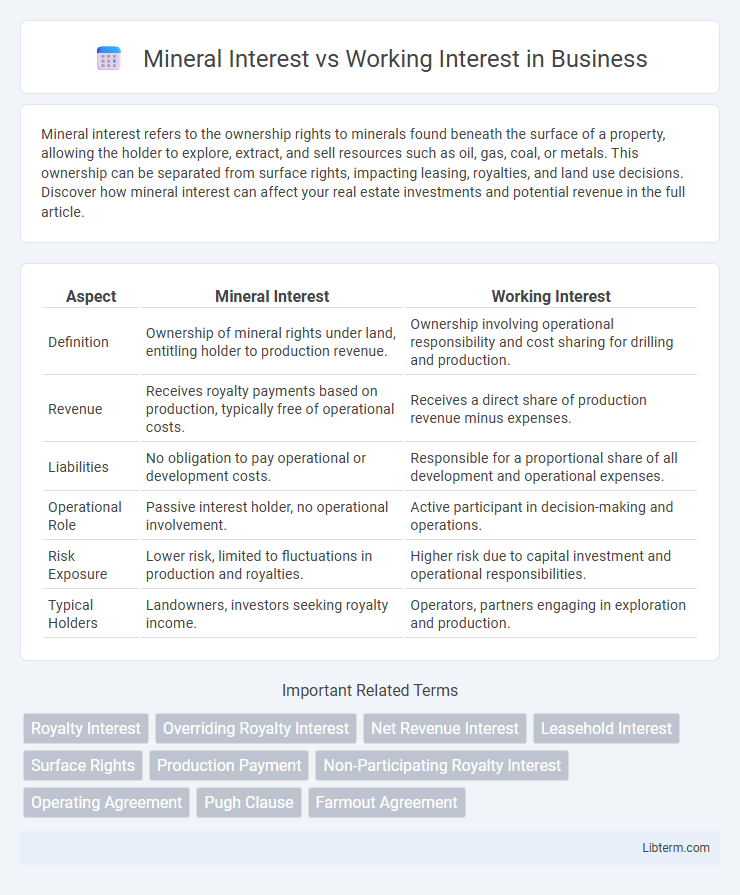

Mineral interest refers to the ownership rights to minerals found beneath the surface of a property, allowing the holder to explore, extract, and sell resources such as oil, gas, coal, or metals. This ownership can be separated from surface rights, impacting leasing, royalties, and land use decisions. Discover how mineral interest can affect your real estate investments and potential revenue in the full article.

Table of Comparison

| Aspect | Mineral Interest | Working Interest |

|---|---|---|

| Definition | Ownership of mineral rights under land, entitling holder to production revenue. | Ownership involving operational responsibility and cost sharing for drilling and production. |

| Revenue | Receives royalty payments based on production, typically free of operational costs. | Receives a direct share of production revenue minus expenses. |

| Liabilities | No obligation to pay operational or development costs. | Responsible for a proportional share of all development and operational expenses. |

| Operational Role | Passive interest holder, no operational involvement. | Active participant in decision-making and operations. |

| Risk Exposure | Lower risk, limited to fluctuations in production and royalties. | Higher risk due to capital investment and operational responsibilities. |

| Typical Holders | Landowners, investors seeking royalty income. | Operators, partners engaging in exploration and production. |

Understanding Mineral Interest: Key Concepts

Mineral interest represents the ownership rights to the minerals beneath the surface of a property, including the ability to lease or sell those rights and to receive royalties from production. This interest does not entail responsibility for the costs of exploration, development, or operation, distinguishing it from working interest, which involves both ownership and operational obligations. Understanding mineral interest is essential for stakeholders seeking passive income through royalty payments without incurring expenses related to drilling or production activities.

What is Working Interest? An Overview

Working interest represents the ownership stake in an oil and gas lease that entitles the holder to a percentage of production revenue after royalty payments, while also obligating them to bear a corresponding share of exploration, development, and operating costs. This interest grants the operator decision-making authority regarding drilling and production activities, differentiating it from mineral interest, which is a passive ownership focused primarily on royalty income. Understanding working interest is crucial for investors and operators involved in upstream oil and gas ventures due to its direct impact on revenue streams and financial risk exposure.

Ownership Rights: Mineral vs Working Interest

Mineral interest ownership grants rights to the subsurface minerals, allowing the owner to receive a share of production revenues without involvement in operational decisions. Working interest ownership includes both rights and responsibilities, giving the owner control over exploration, drilling, and production activities, as well as the obligation to cover costs. Distinguishing between mineral and working interests is essential for understanding revenue distribution and liability in oil and gas ventures.

Revenue Streams: How Each Interest Earns Income

Mineral Interest generates income through royalty payments derived from the production of oil, gas, or minerals, entitling the holder to a percentage of revenue without bearing operating costs. Working Interest involves a share of both revenue and expenses, requiring the interest holder to cover operational costs while receiving a proportionate share of production income. Revenue streams for Mineral Interest are passive and steady, whereas Working Interest income fluctuates based on production levels and operating efficiencies.

Responsibilities and Liabilities Compared

Mineral interest holders have ownership rights to the minerals beneath the land but bear no operational responsibilities or liabilities in extraction activities. Working interest holders are responsible for managing production, covering operational costs, and assuming liabilities such as environmental compliance and drilling risks. The division of responsibilities and liabilities directly impacts financial obligations and risk exposure between mineral and working interest owners.

Costs and Expenses: Who Pays What?

Mineral interest owners receive a portion of the production revenue without bearing any costs or expenses related to drilling, completion, or operation, while working interest owners are responsible for all costs incurred in exploration, development, and production activities. Working interest holders pay expenses such as lease acquisition, drilling, equipment, and operational costs, which are deducted from their share of the revenue. Understanding this distinction is crucial for investors evaluating risk and returns in oil and gas production agreements.

Transferability and Sale of Interests

Mineral interest owners retain the right to lease, transfer, or sell their ownership without impacting the operating responsibilities of the working interest holders. Working interest holders possess the obligation to manage and finance production operations but must agree to any sale or transfer of their interest, often requiring approval from other working interest owners. Transferability of working interests is generally more restrictive due to operational and financial commitments, whereas mineral interests offer greater flexibility for sale and inheritance.

Tax Implications for Mineral and Working Interest Owners

Mineral interest owners receive passive income from oil and gas production, subject to royalty income tax rates, while working interest owners report active income and can deduct operational expenses, including intangible drilling costs, potentially lowering taxable income. Working interest holders face self-employment taxes on their earnings, whereas mineral interest owners typically do not, affecting overall tax liabilities. Understanding these distinctions is crucial for effective tax planning and maximizing after-tax returns in oil and gas investments.

Risk Factors: Evaluating Investment Options

Mineral interest owners receive royalties from production without bearing operational costs or liabilities, minimizing their financial risk exposure. Working interest holders manage drilling and operational expenses and face significant risks including environmental liability, equipment failure, and fluctuating production costs. Investors must weigh potential returns against the risk profile of each interest type when evaluating oil and gas investment opportunities.

Choosing Between Mineral and Working Interest: Key Considerations

Choosing between mineral interest and working interest involves evaluating financial risk and operational involvement in oil and gas ventures. Mineral interest provides royalty payments without operational costs but lacks control over production decisions, whereas working interest requires capital investment and exposes the owner to operational expenses while granting decision-making authority. Key considerations include risk tolerance, desired involvement in management, potential for income, and long-term asset control.

Mineral Interest Infographic

libterm.com

libterm.com