Retained earnings represent the portion of a company's net income that is kept within the business rather than distributed to shareholders as dividends, serving as a key indicator of financial health and growth potential. This accumulated profit is crucial for funding new projects, reducing debt, or reinvesting in operations without needing external financing. Discover how understanding retained earnings can provide you with deeper insights into your company's long-term sustainability and strategic planning in the full article.

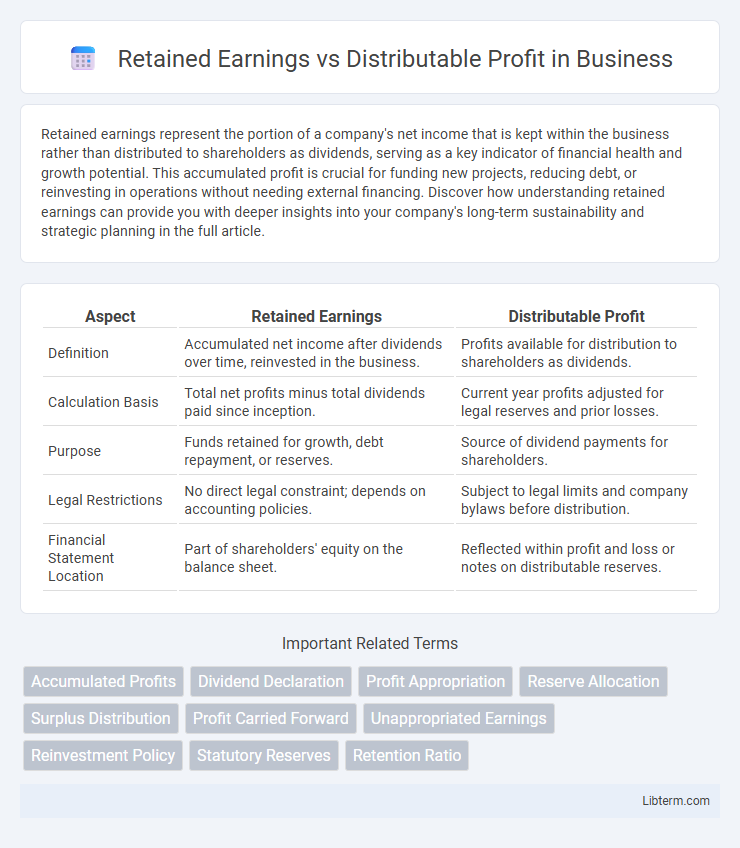

Table of Comparison

| Aspect | Retained Earnings | Distributable Profit |

|---|---|---|

| Definition | Accumulated net income after dividends over time, reinvested in the business. | Profits available for distribution to shareholders as dividends. |

| Calculation Basis | Total net profits minus total dividends paid since inception. | Current year profits adjusted for legal reserves and prior losses. |

| Purpose | Funds retained for growth, debt repayment, or reserves. | Source of dividend payments for shareholders. |

| Legal Restrictions | No direct legal constraint; depends on accounting policies. | Subject to legal limits and company bylaws before distribution. |

| Financial Statement Location | Part of shareholders' equity on the balance sheet. | Reflected within profit and loss or notes on distributable reserves. |

Understanding Retained Earnings

Retained earnings represent the cumulative net income a company has reinvested in the business rather than distributing to shareholders as dividends, serving as a key indicator of financial health and growth potential. Distributable profit, however, reflects the portion of earnings legally available for dividend payouts after accounting for statutory reserves and previous losses. Understanding retained earnings helps investors and management assess how much profit is reinvested versus available for distribution, influencing long-term strategic decisions and shareholder value.

What Are Distributable Profits?

Distributable profits refer to the portion of a company's accumulated earnings that are legally available for distribution to shareholders as dividends after covering all liabilities and maintaining required reserves. These profits differ from retained earnings, which represent total accumulated net income not distributed and reinvested in the business. Understanding distributable profits is crucial for ensuring compliance with corporate laws and maintaining financial stability while rewarding shareholders.

Key Differences Between Retained Earnings and Distributable Profit

Retained earnings represent the cumulative net income that a company has reinvested in the business after paying dividends, reflecting the total profit retained over time. Distributable profit refers to the portion of a company's earnings legally available for dividend distribution, calculated after adjusting retained earnings for non-distributable reserves and prior losses. The key difference lies in retained earnings being a broader historical accumulation of profits, while distributable profit is a legally restricted figure that determines the maximum dividends payable to shareholders.

The Role of Retained Earnings in Financial Strategy

Retained earnings represent the accumulated net income that a company reinvests to fuel growth, pay down debt, or improve operational capacity, making it a pivotal element in long-term financial strategy. Distributable profit, derived from retained earnings and adjusted for legal and statutory reserves, defines the actual portion available for shareholder dividends, ensuring compliance with financial regulations and maintaining corporate stability. Effective management of retained earnings balances reinvestment opportunities with shareholder expectations, driving sustainable value creation and enhancing overall financial health.

How Distributable Profits Impact Dividend Policies

Distributable profits directly influence dividend policies by defining the maximum amount a company can legally pay out to shareholders without compromising capital integrity. Retained earnings reflect accumulated profits, but only the portion classified as distributable profit is available for dividends, ensuring compliance with regulatory frameworks. Companies must assess distributable profits carefully to balance shareholder returns with reinvestment and financial stability.

Legal and Accounting Treatment: Retained Earnings vs Distributable Profit

Retained earnings represent the accumulated net income of a company after dividends have been paid, forming part of shareholders' equity on the balance sheet. Distributable profit refers to the portion of profit legally available for distribution to shareholders, often defined by jurisdiction-specific regulations to ensure solvency and creditor protection. Legal treatment mandates that only distributable profits can be paid out as dividends, while accounting treatment tracks retained earnings as an equity reserve, necessitating adjustments for unrealized gains and prior period errors before calculating distributable profits.

Importance for Shareholders and Investors

Retained earnings represent the accumulated net income held by a company to reinvest in growth or pay down debt, serving as a key indicator of financial health and long-term value for shareholders. Distributable profit, defined by accounting standards as the portion of net income legally available for dividends or distributions, directly impacts the income shareholders receive from their investment. Understanding the distinction between retained earnings and distributable profit is crucial for investors assessing dividend sustainability and a company's capacity to generate shareholder returns.

Calculation Methods and Financial Statement Reporting

Retained earnings are calculated by subtracting dividends and losses from net income over the company's lifetime, reflecting cumulative deferred profit reinvested in the business. Distributable profit is determined based on the current period's net profit adjusted by specific legal reserves and prior losses, representing the amount available for dividend distribution. Financial statements report retained earnings in the equity section of the balance sheet, while distributable profit is often disclosed in notes or dividend statements to inform shareholders of payout capacity.

Common Misconceptions and Pitfalls

Retained earnings represent the accumulated net income reinvested in a company, whereas distributable profit is the portion legally available for dividend payments. A common misconception is equating retained earnings with immediately accessible cash for distribution, neglecting legal restrictions and required reserves. Businesses often mistake high retained earnings as guaranteed dividend payouts, ignoring that distributable profit must comply with jurisdictional laws and accounting standards.

Best Practices for Managing Retained Earnings and Distributable Profits

Best practices for managing retained earnings and distributable profits involve maintaining accurate financial records to distinguish between accumulated profits and available distributions. Businesses should regularly review their balance sheets to ensure retained earnings are adequately reinvested for growth while ensuring distributable profits comply with legal and regulatory requirements for dividend payouts. Implementing clear policies on profit allocation helps optimize capital efficiency and sustain long-term financial health.

Retained Earnings Infographic

libterm.com

libterm.com