Stars are massive celestial bodies composed primarily of hydrogen and helium that generate energy through nuclear fusion, producing light and heat essential for life on planets like Earth. Understanding the life cycle of stars, from their formation in nebulae to their possible fates as white dwarfs, neutron stars, or black holes, reveals much about the universe's evolution. Dive deeper into the fascinating world of stars and discover how they influence Your cosmic neighborhood in the full article.

Table of Comparison

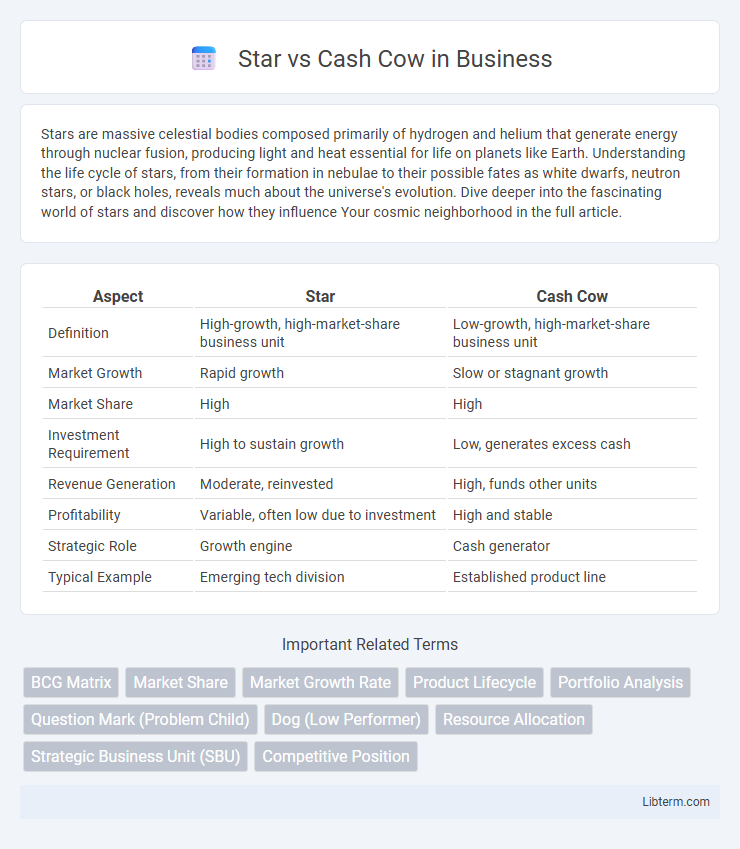

| Aspect | Star | Cash Cow |

|---|---|---|

| Definition | High-growth, high-market-share business unit | Low-growth, high-market-share business unit |

| Market Growth | Rapid growth | Slow or stagnant growth |

| Market Share | High | High |

| Investment Requirement | High to sustain growth | Low, generates excess cash |

| Revenue Generation | Moderate, reinvested | High, funds other units |

| Profitability | Variable, often low due to investment | High and stable |

| Strategic Role | Growth engine | Cash generator |

| Typical Example | Emerging tech division | Established product line |

Understanding the Star and Cash Cow Concepts

The Star and Cash Cow concepts are key components of the BCG Matrix, a strategic tool developed by the Boston Consulting Group to evaluate business units or products based on market growth rate and relative market share. Stars represent high-growth, high-market-share products that require significant investment to sustain their growth, often generating substantial revenue but consuming resources to maintain competitive advantage. Cash Cows are low-growth, high-market-share products that generate stable and significant cash flow with minimal investment, funding other business segments and driving overall profitability.

Key Differences Between Star and Cash Cow

Stars represent business units or products with high market growth and high market share, generating significant revenue but requiring substantial investment to sustain growth. Cash Cows hold a dominant market share in a low-growth market, producing consistent, stable profits with minimal investment needed for maintenance. The primary difference lies in growth potential and investment needs, where Stars drive future growth while Cash Cows fund other segments with their steady cash flow.

Growth Rate and Market Share Comparison

Stars exhibit high market share and rapid growth rate, driving substantial revenue expansion within their market segments. Cash Cows maintain dominant market share but experience low growth rates, generating steady, reliable cash flow due to established consumer bases. The key difference lies in Stars' potential for market leadership growth, whereas Cash Cows provide financial stability through market saturation.

Investment Strategies for Stars and Cash Cows

Investment strategies for Stars prioritize aggressive growth and market penetration, often requiring significant capital to maintain competitive advantage and capitalize on high market share within rapidly expanding industries. Cash Cows demand a focus on efficiency and profitability, emphasizing cost control and steady cash flow generation to fund other business units or investments with less risk. Balancing resource allocation between Stars and Cash Cows ensures sustainable growth and financial stability across the product portfolio.

Managing Resource Allocation

Effectively managing resource allocation between Star and Cash Cow products requires prioritizing investment in Stars to capitalize on their high growth potential while maintaining steady cash flow from Cash Cows through optimized operational efficiency. Strategic resource distribution involves channeling marketing, R&D, and capital expenditures towards Stars to accelerate market leadership, whereas Cash Cows support the portfolio by funding these growth initiatives and stabilizing long-term profitability. Balancing resources ensures sustained competitive advantage by leveraging the high returns of Cash Cows to fuel the expansion and innovation of Stars within the product lifecycle.

Risks and Rewards in Stars vs Cash Cows

Stars exhibit high growth potential and market share, driving substantial revenue but requiring significant investment to sustain growth. Cash Cows generate stable, consistent cash flow with minimal investment, supporting other business segments but offering limited growth opportunities. The primary risk with Stars involves heavy capital requirements and market volatility, whereas Cash Cows face risks of market saturation and declining demand.

Lifecycle Transition: From Star to Cash Cow

The lifecycle transition from Star to Cash Cow occurs when a product or business unit moves from high market growth to a mature market with dominant market share. During this phase, revenue stabilizes as growth slows, while profitability remains strong due to established market leadership and economies of scale. Effective management of resources is crucial to maintain Cash Cow status and fund other business units in the portfolio.

Real-World Examples of Stars and Cash Cows

Amazon Web Services (AWS) serves as a prime example of a Star business unit for Amazon, demonstrating rapid market growth and substantial market share within the cloud computing industry. Coca-Cola's flagship beverage represents a classic Cash Cow, maintaining a dominant market share in the mature soft drink market with consistent revenue and profitability. Apple's iPhone line also illustrates the Cash Cow category by generating steady cash flow from a well-established product in a saturated smartphone market.

Impact on Business Portfolio Decisions

Stars, characterized by high market growth and strong market share, demand significant investment to sustain their leadership but offer substantial revenue potential, influencing companies to prioritize them in resource allocation. Cash cows generate stable and significant cash flow with low market growth, enabling businesses to fund other segments like stars or question marks without requiring heavy investments. Balancing stars and cash cows in a portfolio ensures optimized capital distribution, supporting long-term growth and financial stability in strategic business decisions.

Optimizing Performance for Stars and Cash Cows

Optimizing performance for Stars involves investing in innovation and marketing to capitalize on high market growth and strong market share, ensuring sustained leadership and revenue growth. For Cash Cows, focus on maintaining operational efficiency and cost control to maximize cash flow from stable, low-growth markets, which can fund investments in Stars. Strategic resource allocation balances maximizing profitability in Cash Cows while fueling growth opportunities in Stars to drive long-term business success.

Star Infographic

libterm.com

libterm.com