A swap contract is a financial derivative allowing two parties to exchange cash flows or liabilities based on specified terms, often to hedge risks or speculate on market movements. Common types include interest rate swaps, currency swaps, and commodity swaps, each tailored to address specific financial needs. Discover how a swap contract can optimize your investment strategy and manage risk effectively in the full article.

Table of Comparison

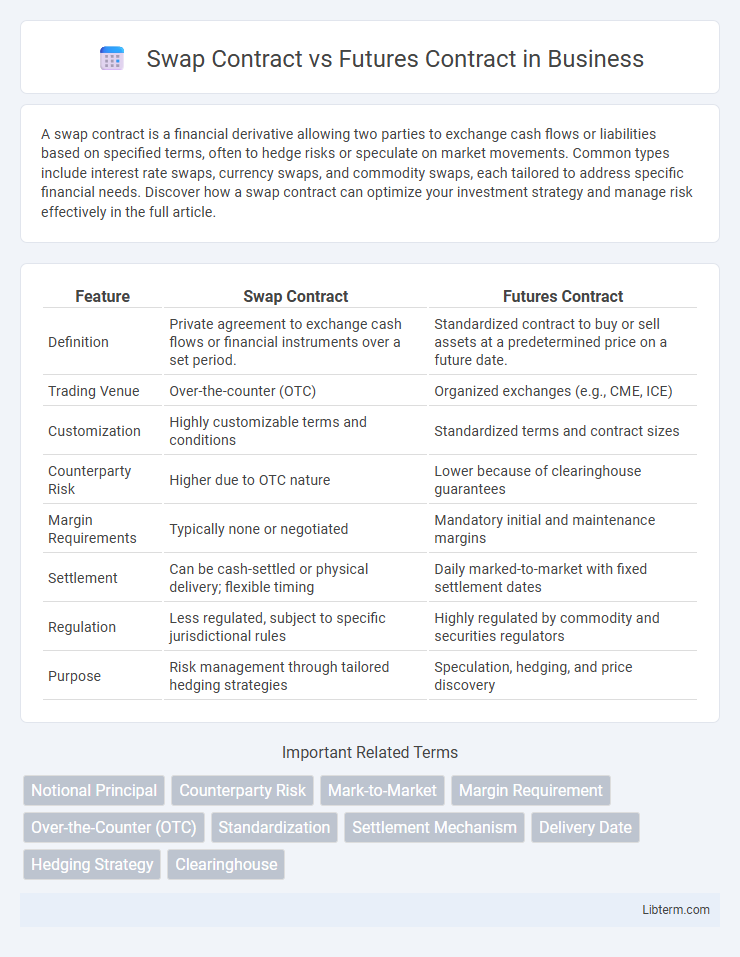

| Feature | Swap Contract | Futures Contract |

|---|---|---|

| Definition | Private agreement to exchange cash flows or financial instruments over a set period. | Standardized contract to buy or sell assets at a predetermined price on a future date. |

| Trading Venue | Over-the-counter (OTC) | Organized exchanges (e.g., CME, ICE) |

| Customization | Highly customizable terms and conditions | Standardized terms and contract sizes |

| Counterparty Risk | Higher due to OTC nature | Lower because of clearinghouse guarantees |

| Margin Requirements | Typically none or negotiated | Mandatory initial and maintenance margins |

| Settlement | Can be cash-settled or physical delivery; flexible timing | Daily marked-to-market with fixed settlement dates |

| Regulation | Less regulated, subject to specific jurisdictional rules | Highly regulated by commodity and securities regulators |

| Purpose | Risk management through tailored hedging strategies | Speculation, hedging, and price discovery |

Introduction to Swap and Futures Contracts

Swap contracts are over-the-counter derivatives where two parties exchange cash flows based on underlying assets or rates, commonly interest rates or currencies, to hedge risk or speculate. Futures contracts are standardized agreements traded on exchanges to buy or sell assets at a predefined price on a specified future date, offering liquidity and price transparency. Both instruments serve risk management and speculative purposes but differ in trading mechanisms, standardization, and counterparty exposure.

Key Definitions: Swap vs Futures

A swap contract is a derivative agreement where two parties exchange cash flows or liabilities based on underlying assets such as interest rates, currencies, or commodities for a specified period, often used for hedging or risk management. A futures contract is a standardized agreement traded on exchanges, obligating the buyer to purchase and the seller to deliver an asset at a predetermined price on a set future date. While swaps are typically customized and traded over-the-counter (OTC), futures are standardized and traded on regulated exchanges, offering greater liquidity and transparency.

Structure and Mechanism of Swap Contracts

Swap contracts involve two parties exchanging cash flows or financial instruments based on predetermined terms, often linked to interest rates, currencies, or commodities, over a specified period. The structure of swap contracts typically includes a notional principal amount, payment dates, and floating or fixed reference rates, with no initial exchange of principal. Unlike futures contracts standardized and traded on exchanges, swaps are customizable, over-the-counter agreements designed for hedging or speculating tailored risk exposures.

Structure and Mechanism of Futures Contracts

Futures contracts are standardized agreements traded on regulated exchanges, obligating parties to buy or sell an asset at a predetermined price on a specified future date, with daily mark-to-market settlements ensuring price transparency and reducing counterparty risk. Unlike swap contracts, futures require margin deposits and are marked daily to reflect market movements, enabling rapid price discovery and liquidity. The standardized terms and centralized clearing houses differentiate futures contracts by offering greater market accessibility and lower default risk.

Main Differences Between Swaps and Futures

Swaps are over-the-counter (OTC) derivatives that involve private agreements to exchange cash flows or financial instruments based on underlying assets, whereas futures are standardized contracts traded on regulated exchanges with specific contract terms. Swaps typically allow customization for maturity dates, notional amounts, and payment structures, while futures have standardized sizes, expiration dates, and settlement procedures. Risk management differs as swaps carry counterparty credit risk due to bilateral agreements, whereas futures benefit from clearinghouses that mitigate default risk through daily margining.

Risk Management in Swaps and Futures

Swap contracts offer customized risk management by allowing parties to exchange specific cash flows, such as interest rates or currencies, tailored to their unique exposure and hedging needs. Futures contracts provide standardized risk management tools with marked-to-market daily settlements, reducing counterparty risk and ensuring liquidity through centralized exchanges. Both instruments enable effective risk mitigation, but swaps typically involve higher counterparty risk, while futures contracts offer greater transparency and ease of exit.

Use Cases and Applications in Financial Markets

Swap contracts are primarily used by institutions to exchange cash flows or hedge interest rate, currency, or commodity exposure, providing tailored solutions for risk management and long-term financial planning. Futures contracts serve traders and investors in hedging price risk or speculating on standardized contracts for commodities, currencies, or financial instruments, offering liquidity and price transparency through regulated exchanges. Both instruments play crucial roles in financial markets by enabling risk transfer, price discovery, and portfolio diversification strategies.

Contract Settlement and Maturity

Swap contracts typically involve periodic settlement of cash flows based on underlying asset performance or interest rates, with the final settlement occurring at maturity, which can range from months to several years depending on the agreement. Futures contracts have a standardized maturity date and undergo daily mark-to-market settlement, ensuring gains and losses are realized and margin accounts adjusted before contract expiration. This fundamental difference in settlement frequency and contract duration influences risk management and liquidity between swaps and futures.

Liquidity and Market Accessibility

Swap contracts typically exhibit lower liquidity due to their over-the-counter (OTC) trading environment, limiting market accessibility primarily to institutional investors and sophisticated traders. Futures contracts are standardized, exchange-traded instruments that offer higher liquidity and greater market accessibility, allowing retail and institutional participants to enter and exit positions easily. The exchange trading framework of futures ensures transparent pricing and continuous market access, contrasting with the bespoke, less liquid nature of swaps.

Choosing Between Swap and Futures Contracts

Choosing between swap contracts and futures contracts depends on the specific risk management needs and market exposure of the investor. Swaps offer customizable terms for exchanging cash flows, making them ideal for hedging interest rate or currency fluctuations over longer periods. Futures contracts provide standardized, exchange-traded agreements with daily settlement, suitable for short-term speculation or hedging with standardized price and quantity.

Swap Contract Infographic

libterm.com

libterm.com