Divestiture refers to the process of selling off a company's assets, subsidiaries, or divisions to streamline operations or raise capital. This strategic move can improve financial health, enhance focus on core business areas, and respond to regulatory requirements. Discover how divestiture can impact Your business decisions and growth by exploring the rest of the article.

Table of Comparison

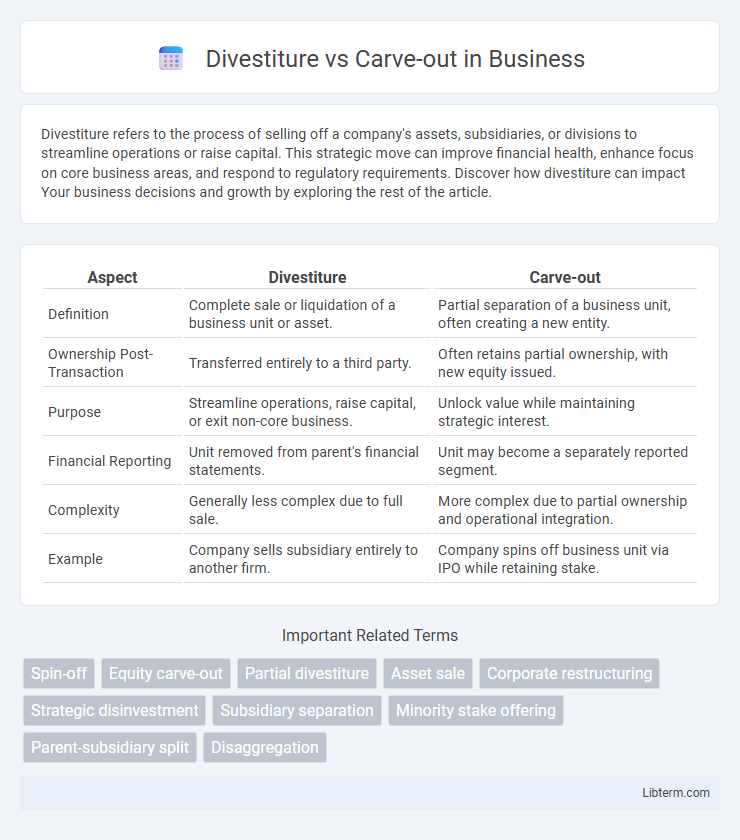

| Aspect | Divestiture | Carve-out |

|---|---|---|

| Definition | Complete sale or liquidation of a business unit or asset. | Partial separation of a business unit, often creating a new entity. |

| Ownership Post-Transaction | Transferred entirely to a third party. | Often retains partial ownership, with new equity issued. |

| Purpose | Streamline operations, raise capital, or exit non-core business. | Unlock value while maintaining strategic interest. |

| Financial Reporting | Unit removed from parent's financial statements. | Unit may become a separately reported segment. |

| Complexity | Generally less complex due to full sale. | More complex due to partial ownership and operational integration. |

| Example | Company sells subsidiary entirely to another firm. | Company spins off business unit via IPO while retaining stake. |

Introduction to Divestiture and Carve-Out

Divestiture involves the sale or liquidation of a business unit, asset, or subsidiary to streamline operations or raise capital, often resulting in a complete separation from the parent company. Carve-out refers to the process of separating a specific division or asset into a new, standalone entity while the parent company retains partial ownership, often through an initial public offering (IPO) or sale of minority stakes. Both strategies are used for corporate restructuring, but divestitures lead to full divestment, whereas carve-outs maintain some degree of parent company involvement.

Defining Divestiture: Scope and Purpose

Divestiture involves the complete or partial sale of a business unit or asset to streamline operations, improve financial health, or comply with regulatory requirements. It encompasses the transfer of ownership and control, often aimed at refocusing core business activities or raising capital. The purpose of divestiture is to optimize the company's portfolio by shedding non-core or underperforming segments.

Understanding Carve-Out: Key Characteristics

A carve-out involves a company selling a minority stake in a subsidiary or business unit while retaining control, allowing investors to participate in specific segments without acquiring full ownership. This strategy enables the parent company to unlock capital and increase the subsidiary's market value through specialized management and operational focus. Key characteristics include partial divestiture, creation of a distinct legal entity, and continued strategic alignment with the parent company.

Strategic Reasons for Divestitures

Divestitures are pursued primarily to enhance corporate focus by shedding non-core or underperforming business units, thereby improving overall financial performance and resource allocation. Strategic reasons for divestitures include streamlining operations to concentrate on high-growth areas, raising capital to reduce debt or fund acquisitions, and responding to regulatory pressures or antitrust concerns. This targeted realignment facilitates greater agility and competitiveness in dynamic market environments compared to carve-outs, which often serve as intermediate steps before full separation.

When to Consider a Carve-Out

A carve-out is ideal when a parent company aims to separate a specific business unit while retaining partial ownership, allowing for focused management and potential future value realization. It suits situations where the unit has distinct operations or financials that can stand alone but benefits from ongoing strategic support from the parent. Companies often consider carve-outs during restructuring or when preparing a segment for an eventual full divestiture or public offering.

Process Differences: Divestiture vs Carve-Out

Divestiture involves the complete sale or spin-off of a business unit, requiring comprehensive asset transfer, regulatory approvals, and often complex valuation and negotiation processes. Carve-out focuses on creating a separate legal entity within the parent company, where partial assets, liabilities, and operations are isolated while maintaining parent company control during restructuring. The divestiture process emphasizes final ownership transfer and separation, whereas carve-out concentrates on operational segregation and preparing the unit for potential future transactions or independent performance.

Financial Implications of Each Strategy

Divestiture involves selling off a business unit or asset entirely, generating immediate cash inflow and potentially improving the company's balance sheet by reducing liabilities, but it may result in loss of future revenue streams. Carve-out creates a new, partially independent entity through the sale of minority stakes or spin-offs, providing capital infusion while retaining some control and ongoing revenue benefits, yet it can involve higher operational costs and complex financial reporting. Both strategies impact tax obligations differently, where divestitures often trigger capital gains taxes, whereas carve-outs may offer more favorable tax structures depending on jurisdiction and transaction design.

Impact on Stakeholders and Operations

Divestitures often lead to significant changes in ownership that impact stakeholders by shifting control and potentially altering employee roles, while operational continuity may face disruptions due to the complexity of separating assets. Carve-outs typically maintain partial ownership, providing stakeholders some stability, but operational adjustments are necessary to establish independent financial reporting and governance structures. Both strategies require careful communication to manage stakeholder expectations and minimize operational risks during the transition.

Common Challenges in Execution

Divestitures and carve-outs often face common execution challenges such as maintaining operational continuity while separating business units, managing complex regulatory approvals, and addressing cultural integration issues among remaining and divested teams. Accurate valuation and asset delineation pose significant hurdles due to overlapping resources and shared services within the parent company. Ensuring clear communication and employee retention strategies are essential to minimize disruption and preserve stakeholder confidence during the transition.

Choosing the Right Approach for Your Business

Choosing between divestiture and carve-out hinges on your company's strategic goals and financial needs; divestiture involves selling off an entire business unit to improve focus or raise capital, while a carve-out creates a new standalone entity by selling a partial stake, preserving some control. Divestitures generate immediate cash flow and simplify operations, making them ideal for businesses seeking full exit or rapid liquidity. Carve-outs optimize value extraction by tapping into capital markets or strategic investors, allowing partial divestment while maintaining influence and operational continuity.

Divestiture Infographic

libterm.com

libterm.com