Collateral refers to an asset pledged by a borrower to secure a loan, reducing the lender's risk in case of default. It can include real estate, vehicles, equipment, or other valuable property, ensuring loan repayment through repossession if necessary. Explore the full article to understand how collateral impacts your borrowing options and financial strategy.

Table of Comparison

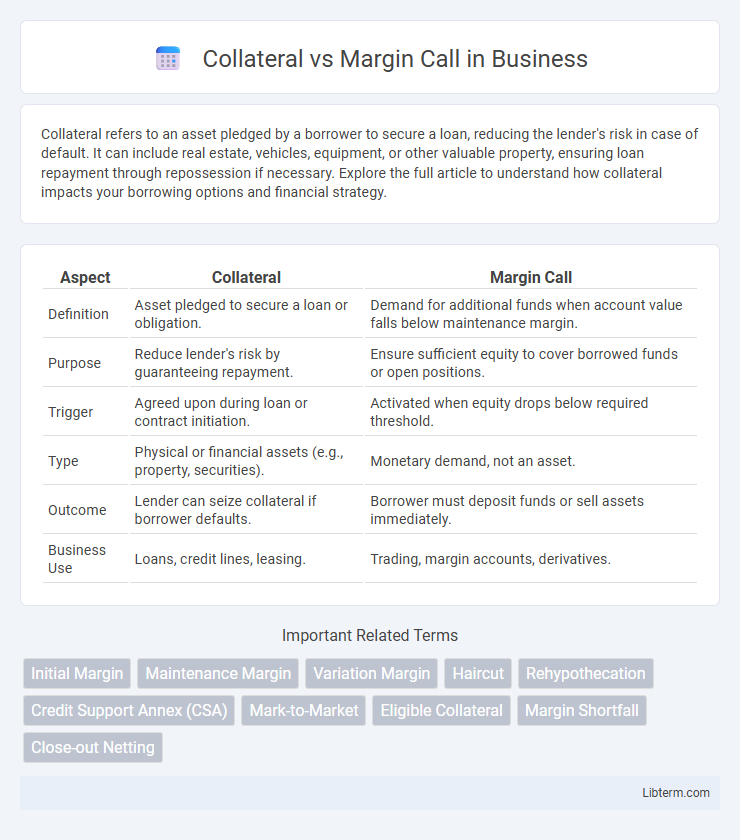

| Aspect | Collateral | Margin Call |

|---|---|---|

| Definition | Asset pledged to secure a loan or obligation. | Demand for additional funds when account value falls below maintenance margin. |

| Purpose | Reduce lender's risk by guaranteeing repayment. | Ensure sufficient equity to cover borrowed funds or open positions. |

| Trigger | Agreed upon during loan or contract initiation. | Activated when equity drops below required threshold. |

| Type | Physical or financial assets (e.g., property, securities). | Monetary demand, not an asset. |

| Outcome | Lender can seize collateral if borrower defaults. | Borrower must deposit funds or sell assets immediately. |

| Business Use | Loans, credit lines, leasing. | Trading, margin accounts, derivatives. |

Understanding Collateral in Financial Transactions

Collateral in financial transactions serves as a security asset pledged by a borrower to a lender, reducing the lender's risk by providing a claim on the asset if the borrower defaults. Common forms of collateral include real estate, securities, and cash equivalents, which help facilitate loans, derivatives, and margin trading by ensuring repayment. Understanding collateral enables investors and financial institutions to better assess credit risk and maintain market stability during volatile conditions.

What is a Margin Call?

A margin call occurs when the value of an investor's margin account falls below the broker's required minimum, prompting the investor to deposit additional funds or securities to cover potential losses. It serves as a protective measure for brokers to ensure that the borrowed amount used for trading is adequately collateralized. Failure to meet a margin call can result in forced liquidation of assets to restore the required margin level.

Key Differences Between Collateral and Margin Calls

Collateral refers to assets pledged by a borrower to secure a loan or derivative position, serving as a risk control measure for lenders or counterparties. A margin call occurs when the value of the collateral or margin account falls below a broker's required threshold, prompting the borrower to deposit additional funds or securities to maintain the position. The key difference lies in collateral representing the actual support for credit exposure, while a margin call is the notification triggered by insufficient collateral to cover potential losses.

Types of Collateral Used in Trading

Common types of collateral used in trading include cash, government securities, and highly liquid assets like gold or corporate bonds, providing traders with the means to meet margin requirements and reduce counterparty risk. Collateral quality and liquidity are critical factors influencing margin calls, as low-quality or illiquid collateral can trigger margin calls when asset values decline. Futures traders often post initial margin in cash or U.S. Treasuries, while derivative contracts may accept a broader range of collateral, including approved equities and letters of credit.

How Margin Calls Work in Practice

Margin calls occur when the equity in a trader's margin account falls below the broker's required maintenance margin, prompting the trader to deposit additional funds or securities to restore the minimum balance. Brokers monitor collateral value daily, and if market volatility causes asset prices to drop, the margin call ensures the loan-to-value ratio remains secure. Failure to meet a margin call can result in forced liquidation of assets to cover the deficit and protect the broker's exposure.

Importance of Collateral Management

Collateral management plays a critical role in mitigating counterparty risk and ensuring liquidity in financial transactions by securing assets that back loans or derivative positions. Effective collateral management reduces the likelihood of margin calls, which occur when the value of collateral falls below required thresholds, prompting additional funds to be deposited. Maintaining accurate valuation and timely margin calls preserves market stability and protects financial institutions from default-related losses.

Risks Associated with Margin Calls

Margin calls pose significant financial risks, requiring traders to deposit additional funds or liquidate assets to maintain minimum margin levels, which can lead to forced losses if market prices move unfavorably. Insufficient collateral heightens the risk of position liquidation, potentially amplifying losses beyond the initial investment and exacerbating financial strain. Failure to meet margin calls promptly may result in broker intervention, including closing positions without consent, increasing vulnerability to market volatility and rapid capital depletion.

Regulatory Requirements for Collateral and Margins

Regulatory requirements for collateral and margin calls are established to mitigate counterparty credit risk in financial transactions and maintain market stability. Collateral must adhere to specific standards regarding eligibility, valuation, and custody, as mandated by regulations such as EMIR in Europe and the Dodd-Frank Act in the United States. Margin calls require timely adjustment of collateral to meet minimum margin thresholds set by regulatory frameworks, ensuring sufficient coverage against potential losses in derivative positions and other marginable assets.

Strategies to Avoid Margin Calls

Maintaining sufficient collateral through regular portfolio monitoring and timely asset rebalancing effectively minimizes the risk of margin calls in leveraged trading. Employing stop-loss orders and diversifying investments reduces volatility exposure, thus preserving margin requirements. Utilizing conservative leverage ratios aligns with risk tolerance and prevents collateral depletion that triggers margin calls.

Collateral and Margin Calls in Volatile Markets

Collateral serves as a security deposit to mitigate lender risk during volatile market fluctuations, ensuring loan protection when asset values decline sharply. Margin calls occur when the market value of collateral falls below the required maintenance margin, compelling investors to either deposit additional funds or liquidate assets to restore the account balance. In highly volatile markets, frequent margin calls increase liquidity demands and can trigger rapid asset sell-offs, exacerbating market instability and amplifying financial risk.

Collateral Infographic

libterm.com

libterm.com