Averaging up is a strategic investment technique where you buy additional shares of a stock at higher prices to increase your overall cost basis while maintaining or increasing your position in a strong-performing asset. This method can enhance gains during upward market trends but requires careful analysis to avoid overexposure. Explore the rest of the article to learn how averaging up can optimize your investment portfolio.

Table of Comparison

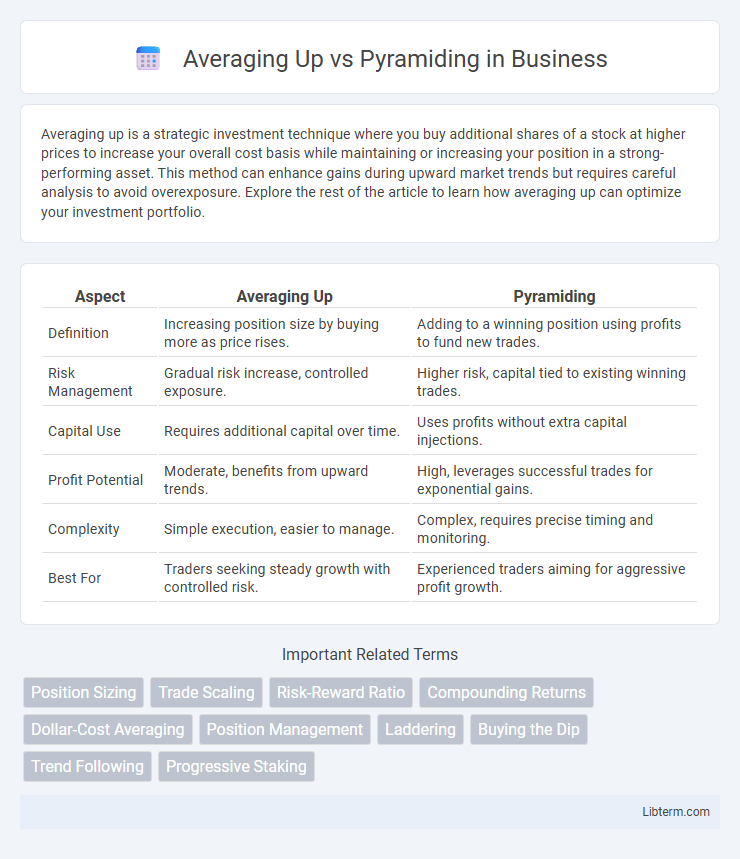

| Aspect | Averaging Up | Pyramiding |

|---|---|---|

| Definition | Increasing position size by buying more as price rises. | Adding to a winning position using profits to fund new trades. |

| Risk Management | Gradual risk increase, controlled exposure. | Higher risk, capital tied to existing winning trades. |

| Capital Use | Requires additional capital over time. | Uses profits without extra capital injections. |

| Profit Potential | Moderate, benefits from upward trends. | High, leverages successful trades for exponential gains. |

| Complexity | Simple execution, easier to manage. | Complex, requires precise timing and monitoring. |

| Best For | Traders seeking steady growth with controlled risk. | Experienced traders aiming for aggressive profit growth. |

Understanding Averaging Up

Averaging up involves increasing a position size by purchasing additional shares or contracts at higher prices as the asset's value rises, emphasizing disciplined risk management and reinforcing conviction in the trade. This strategy differs from pyramiding, which systematically adds to positions using unrealized profits while strictly managing leverage to optimize gains without significantly increasing risk exposure. Traders employing averaging up rely on strong trend confirmation and market momentum to maximize profit potential while avoiding the pitfalls of overexposure.

What is Pyramiding in Trading?

Pyramiding in trading is a strategy where investors increase their position size by using unrealized profits from existing trades to buy more shares or contracts. This technique allows traders to capitalize on profitable trends by gradually adding to their initial position while managing risk through incremental investments. Pyramiding contrasts with averaging up, as it relies on gains rather than dollar cost averaging to scale into winning positions.

Key Differences Between Averaging Up and Pyramiding

Averaging up involves gradually increasing a position by buying additional shares as the asset price rises, aiming to reduce the average cost per share. Pyramiding, however, refers to using unrealized profits from existing positions as collateral to take on larger trades, scaling exposure more aggressively. The key difference lies in risk management: averaging up adds positions incrementally with new capital, while pyramiding leverages gains, potentially amplifying both profits and losses.

Pros and Cons of Averaging Up

Averaging up involves increasing a position size by buying more shares as the price rises, helping to reduce the average cost per share and capitalize on a strong trend. A key advantage of averaging up is that it confirms momentum, minimizing the risk of adding to losing positions, but it requires significant capital and can amplify losses if the trend reverses suddenly. The main drawback is the potential for overexposure in one asset, which can limit diversification and increase portfolio risk during market downturns.

Advantages and Risks of Pyramiding

Pyramiding offers traders the advantage of maximizing profits by progressively increasing position size using unrealized gains, thus leveraging winning trades without additional capital investment. This strategy enhances potential returns but carries significant risk as losses can amplify quickly if the market reverses, potentially eroding all accrued profits. Effective risk management, including setting tight stop-loss orders and monitoring market trends, is crucial to mitigate the heightened exposure inherent in pyramiding.

Ideal Market Conditions for Each Strategy

Averaging up performs best in strong, steadily rising markets where price momentum confirms the strength of an initial position, minimizing downside risk while maximizing gains. Pyramiding thrives in volatile but trending markets by adding incremental positions on pullbacks, capitalizing on price fluctuations without overexposing capital early. Both strategies require clear trend identification and disciplined risk management to optimize returns under their respective ideal market conditions.

Psychological Factors in Position Sizing

Averaging up and pyramiding both leverage increasing position sizes in winning trades, yet they differ in psychological impact. Averaging up nurtures trader confidence by only adding to profitable positions, which can reduce stress and increase discipline. Pyramiding demands careful risk control as adding multiple layers can amplify emotions like greed or fear, challenging traders to maintain rational decision-making throughout.

Risk Management with Averaging Up and Pyramiding

Averaging Up involves increasing position size by buying more shares as the price rises, lowering the average cost and enhancing profit potential while maintaining controlled risk through strategic entry points. Pyramiding builds upon existing winning positions by adding incremental trades financed by unrealized gains, which intensifies exposure but requires strict risk management to prevent significant drawdowns. Both methods demand disciplined stop-loss placements and position sizing to optimize risk-reward balance and preserve capital during market volatility.

Real-World Examples: Averaging Up vs Pyramiding

Averaging up involves increasing a position size by buying more shares as the stock price rises, exemplified by Warren Buffett's strategy of adding to Apple stock during its upward trend. Pyramiding, on the other hand, uses unrealized gains from initial positions as collateral to buy additional shares, popularized by Jesse Livermore in momentum trading. Both techniques enhance returns but differ in risk management and capital allocation, with averaging up relying on fresh capital and pyramiding leveraging accumulated profits.

Choosing the Right Strategy for Your Trading Style

Averaging up involves increasing your position size as a trade moves in your favor, helping to maximize gains in trending markets, while pyramiding adds to winning positions incrementally, reducing risk exposure with each addition. Traders with a high-risk tolerance and trend-following style often prefer pyramiding for its structured growth, whereas averaging up suits those willing to capitalize aggressively on strong momentum. Selecting the right strategy depends on your risk management preferences, trading experience, and market conditions to align with your overall trading objectives.

Averaging Up Infographic

libterm.com

libterm.com