A retainer is a fee paid upfront to secure professional services, often used in legal, consulting, or creative industries to guarantee availability and priority support. Understanding how retainers work can help you manage your budget and establish clear expectations with your service provider. Explore the rest of this article to learn how retainers benefit your business and what to consider before agreeing to one.

Table of Comparison

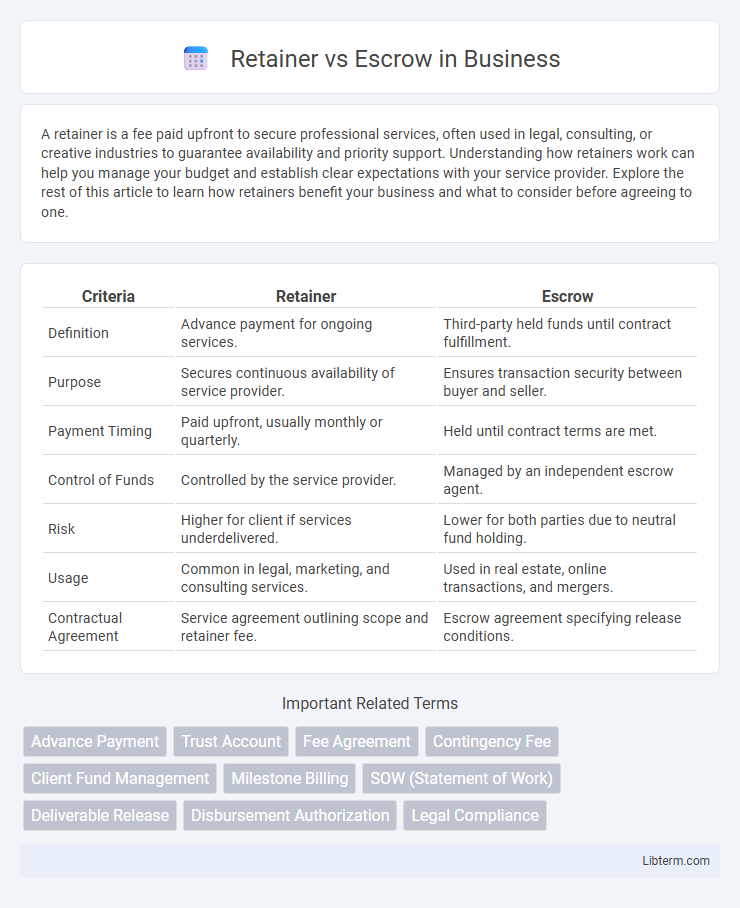

| Criteria | Retainer | Escrow |

|---|---|---|

| Definition | Advance payment for ongoing services. | Third-party held funds until contract fulfillment. |

| Purpose | Secures continuous availability of service provider. | Ensures transaction security between buyer and seller. |

| Payment Timing | Paid upfront, usually monthly or quarterly. | Held until contract terms are met. |

| Control of Funds | Controlled by the service provider. | Managed by an independent escrow agent. |

| Risk | Higher for client if services underdelivered. | Lower for both parties due to neutral fund holding. |

| Usage | Common in legal, marketing, and consulting services. | Used in real estate, online transactions, and mergers. |

| Contractual Agreement | Service agreement outlining scope and retainer fee. | Escrow agreement specifying release conditions. |

Understanding Retainers: Definition and Purpose

A retainer is a prepaid fee agreement between a client and a service provider, often used in legal, consulting, or creative industries to secure ongoing services. The primary purpose of a retainer is to ensure availability and commitment of the professional, typically covering a set number of hours or services over a specified period. Retainers provide financial predictability for clients and guarantee prioritized attention from the provider, differentiating them from escrow arrangements that hold funds until specific conditions are met.

What is an Escrow? Key Concepts Explained

An escrow is a financial arrangement where a third party holds and regulates payment of funds required for two parties involved in a transaction, ensuring security and trust. Key concepts include the neutral escrow agent who releases funds only when all contractual conditions are met, protecting both buyer and seller from potential fraud or default. Commonly used in real estate, online sales, and mergers, an escrow helps facilitate smooth exchanges by holding assets until obligations are fulfilled.

Retainer vs Escrow: Core Differences

Retainer fees are prepaid payments made to secure ongoing legal or professional services, giving clients prioritized access and service availability, whereas escrow involves holding funds by a neutral third party until contractual conditions are met, ensuring transaction security. Retainers offer flexibility in billing and continuity of service, while escrow provides fiduciary protection and reduces risk in transactions such as real estate or mergers. Understanding these core differences helps in choosing the right financial arrangement based on service type, risk tolerance, and payment timing.

When to Use a Retainer Agreement

A retainer agreement is ideal when ongoing legal or professional services require upfront payment to secure availability or priority. It provides clients with guaranteed access to expertise over a specific period, often used by lawyers, consultants, or agencies managing long-term projects. Unlike escrow, retainers are typically non-refundable fees credited against future work rather than funds held for transaction security.

When Escrow Accounts Are Most Beneficial

Escrow accounts are most beneficial in real estate transactions, mergers and acquisitions, and large financial deals where funds must be held securely until all contract conditions are met. They provide a neutral third-party safeguard, ensuring both buyers and sellers fulfill their obligations before funds are released. This reduces risk and enhances trust in high-stakes agreements.

Legal Implications: Retainers vs Escrow

Retainers involve upfront legal fees paid to secure ongoing services, granting attorneys immediate access to funds but potentially leading to disputes over unused amounts. Escrow accounts hold funds third-partyly until contractual obligations are met, offering protection and impartiality in transactions. Legal implications differ as retainers create attorney-client fee obligations, while escrow agreements establish fiduciary duties for neutral custodians safeguarding funds.

Common Industries Using Retainer and Escrow Models

Legal services and creative industries frequently utilize retainer models to ensure ongoing client engagement and steady cash flow, while real estate transactions and mergers often rely on escrow accounts to securely hold funds until contract conditions are met. Software development companies and marketing agencies also prefer retainers for predictable budgeting, contrasting with construction and online marketplaces that use escrow services to mitigate payment risks. Financial services and intellectual property sectors adopt both methods selectively to balance client trust and transactional security.

Pros and Cons of Retainers

Retainers offer consistent legal support and predictable costs by securing ongoing access to a lawyer, making them ideal for businesses with regular legal needs. However, retainers may result in unused funds forfeited if services are not fully utilized and can limit flexibility if the scope of work changes significantly. Retainers also foster a strong attorney-client relationship but can be less cost-effective for sporadic or one-time legal issues compared to escrow agreements.

Pros and Cons of Escrow Accounts

Escrow accounts provide a secure method for holding funds during transactions, reducing the risk of fraud by ensuring payment is only released when contract terms are met. They offer transparency and protection for both buyers and sellers but can incur additional fees and slow down the transaction process due to third-party involvement. Escrow accounts are especially beneficial in high-value or complex agreements where trust and compliance are critical.

Choosing the Right Payment Structure for Your Needs

Choosing the right payment structure depends on the nature of the project and the level of trust between parties. A retainer provides ongoing access to services with upfront payment for future work, ideal for long-term or evolving needs. Escrow secures funds for specific deliverables, ensuring payment is released only upon fulfillment, protecting both buyers and sellers in transactional contexts.

Retainer Infographic

libterm.com

libterm.com