A joint venture combines two or more businesses pooling resources to achieve a specific goal, sharing risks, costs, and profits. This strategic partnership enhances market reach, innovation, and competitive advantage while maintaining each party's distinct identity. Explore the rest of this article to discover how your business can benefit from forming a successful joint venture.

Table of Comparison

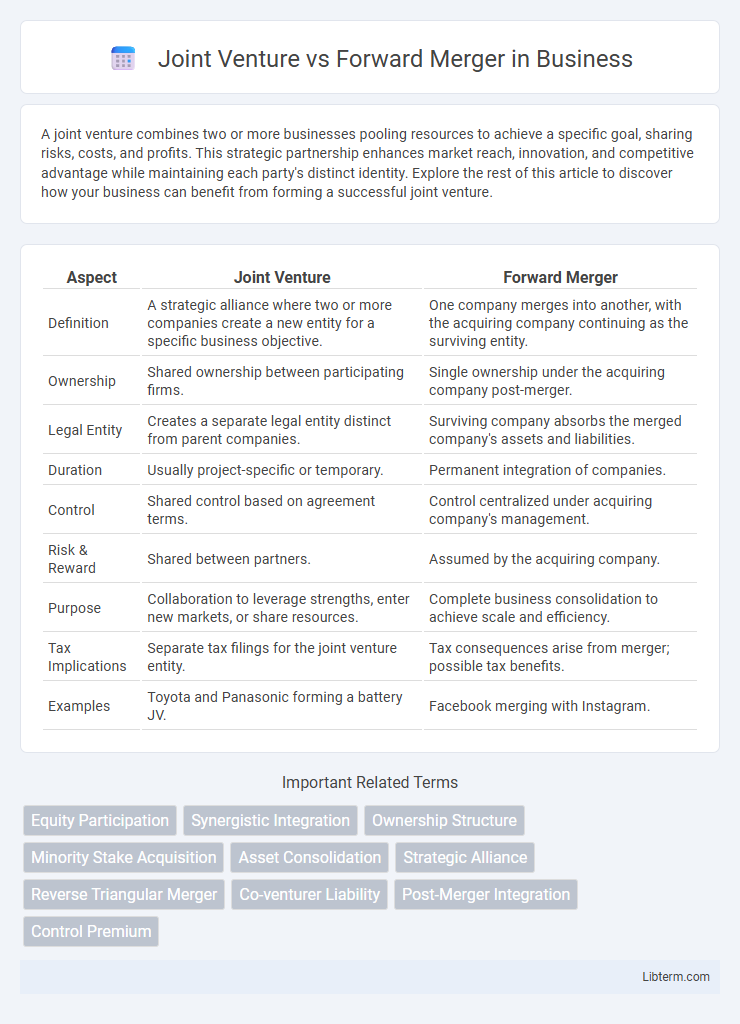

| Aspect | Joint Venture | Forward Merger |

|---|---|---|

| Definition | A strategic alliance where two or more companies create a new entity for a specific business objective. | One company merges into another, with the acquiring company continuing as the surviving entity. |

| Ownership | Shared ownership between participating firms. | Single ownership under the acquiring company post-merger. |

| Legal Entity | Creates a separate legal entity distinct from parent companies. | Surviving company absorbs the merged company's assets and liabilities. |

| Duration | Usually project-specific or temporary. | Permanent integration of companies. |

| Control | Shared control based on agreement terms. | Control centralized under acquiring company's management. |

| Risk & Reward | Shared between partners. | Assumed by the acquiring company. |

| Purpose | Collaboration to leverage strengths, enter new markets, or share resources. | Complete business consolidation to achieve scale and efficiency. |

| Tax Implications | Separate tax filings for the joint venture entity. | Tax consequences arise from merger; possible tax benefits. |

| Examples | Toyota and Panasonic forming a battery JV. | Facebook merging with Instagram. |

Introduction to Joint Ventures and Forward Mergers

Joint ventures involve two or more companies collaborating to undertake a specific project while remaining separate entities, sharing resources, risks, and profits. Forward mergers occur when a target company merges into an acquiring company, resulting in the acquiring company continuing as the surviving entity. Both structures facilitate growth strategies but differ fundamentally in operational integration and legal status post-transaction.

Definition and Key Characteristics of Joint Ventures

A joint venture is a business arrangement where two or more parties collaborate by pooling resources to achieve a specific project or objective while maintaining their separate legal identities. Key characteristics include shared ownership, joint management, and profit-sharing based on agreement terms, with risks and rewards distributed among partners. Unlike forward mergers, joint ventures do not involve full organizational integration or transfer of assets, making them flexible for limited purposes and durations.

Understanding Forward Mergers: An Overview

A forward merger occurs when a smaller company merges into a larger company, with the larger entity continuing as the surviving company, thereby streamlining operations and consolidating assets. This type of merger facilitates rapid integration and is commonly used to expand market share or acquire new technologies without forming a separate business entity. Understanding forward mergers highlights their efficiency in achieving growth objectives compared to joint ventures, which involve cooperation without full corporate integration.

Structural Differences: Joint Venture vs Forward Merger

A Joint Venture involves two or more entities creating a separate legal entity to collaborate on a specific project or business activity, maintaining their individual identities and sharing control. In contrast, a Forward Merger entails one company fully absorbing another, with the acquired company dissolving and its assets integrated directly into the surviving entity. Structurally, Joint Ventures emphasize shared ownership and management autonomy, whereas Forward Mergers result in complete consolidation under a single corporate structure.

Legal and Regulatory Considerations

Joint ventures require detailed agreements outlining profit sharing, management roles, and intellectual property rights, often subject to antitrust regulations and foreign investment laws depending on jurisdiction. Forward mergers involve the complete absorption of one company into another, necessitating compliance with securities laws, shareholder approvals, and regulatory filings to finalize the transfer of assets and liabilities. Both structures demand thorough due diligence to navigate jurisdiction-specific corporate governance rules and ensure adherence to competition laws and contractual obligations.

Financial Implications and Risk Assessment

Joint ventures typically involve sharing financial risks and capital contributions between partners, allowing for risk diversification but potential exposure to joint liabilities. Forward mergers consolidate financial statements immediately, leading to unified asset management and debt obligations under a single entity, which may increase financial integration risks. Investors must evaluate liquidity, tax implications, and contingent liabilities unique to each structure to optimize financial outcomes and risk profiles.

Management and Operational Control in Both Models

Management and operational control in a joint venture typically involve shared decision-making authority between partnering companies, allowing each to retain autonomy over their respective contributions while collaboratively managing the venture's activities. In contrast, a forward merger consolidates management under a single entity, effectively dissolving the acquired company's separate operational structure and integrating its management team into the acquiring corporation. This centralization of control in forward mergers enables streamlined operations but reduces independent managerial influence compared to the more balanced approach in joint ventures.

Strategic Advantages and Disadvantages

Joint ventures offer strategic advantages such as shared risk, access to new markets, and combined expertise, but face challenges including potential conflicts in management and less control over operations. Forward mergers provide full integration and streamlined decision-making, enhancing operational efficiency and market presence, yet involve higher upfront investment and greater risk if the merged entity fails to achieve synergies. Both approaches require careful alignment of goals and cultural compatibility to maximize strategic benefits and minimize drawbacks.

Common Use Cases and Industry Examples

Joint ventures are commonly used in industries like technology and automotive, where companies collaborate to share resources and expertise for developing new products or entering foreign markets, such as the Toyota-Subaru joint venture for hybrid vehicles. Forward mergers frequently occur in sectors like pharmaceuticals and telecommunications, facilitating full integration by acquiring target companies to expand market share or product lines, exemplified by the CVS Health acquisition of Aetna. These strategies address distinct business goals: joint ventures for cooperative innovation and risk-sharing, forward mergers for consolidation and operational control.

Choosing the Right Approach: Factors to Consider

Choosing the right approach between a joint venture and a forward merger depends on factors such as the level of control desired, financial risk tolerance, and long-term strategic goals. Joint ventures allow for shared resources and risks while maintaining independent operations, making them ideal for exploring new markets or technologies. Forward mergers involve full integration under one entity, offering streamlined management and unified branding but requiring greater commitment and operational alignment.

Joint Venture Infographic

libterm.com

libterm.com