Financial statement manipulation distorts the true economic condition of a company by intentionally altering accounting records or reports. This unethical practice misleads investors, creditors, and other stakeholders, potentially leading to poor financial decisions and legal consequences. Explore the rest of the article to understand the common techniques used and how you can identify signs of financial statement manipulation.

Table of Comparison

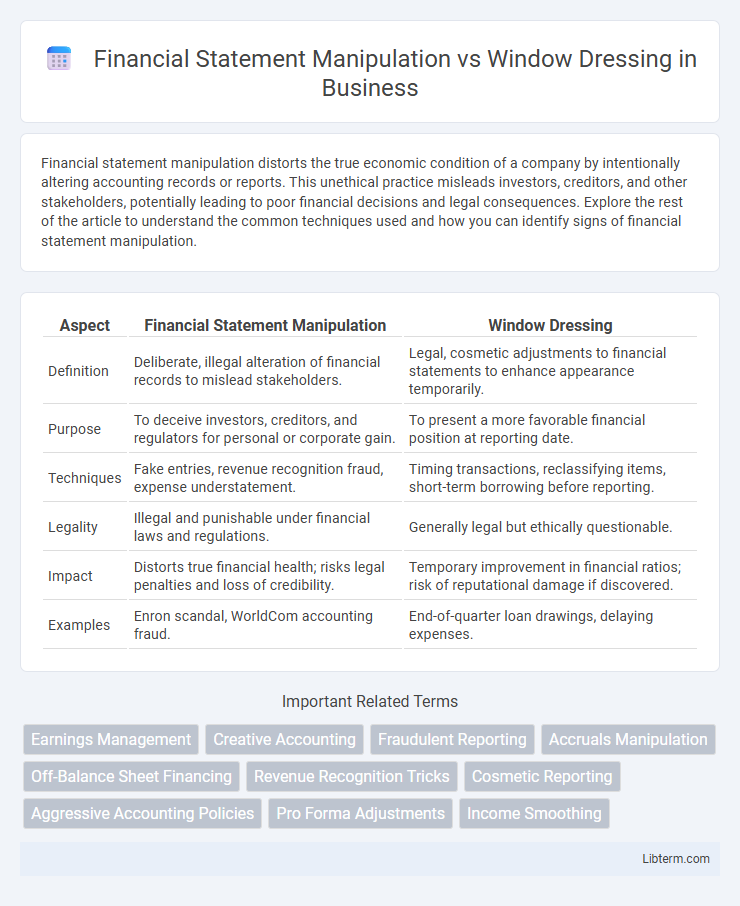

| Aspect | Financial Statement Manipulation | Window Dressing |

|---|---|---|

| Definition | Deliberate, illegal alteration of financial records to mislead stakeholders. | Legal, cosmetic adjustments to financial statements to enhance appearance temporarily. |

| Purpose | To deceive investors, creditors, and regulators for personal or corporate gain. | To present a more favorable financial position at reporting date. |

| Techniques | Fake entries, revenue recognition fraud, expense understatement. | Timing transactions, reclassifying items, short-term borrowing before reporting. |

| Legality | Illegal and punishable under financial laws and regulations. | Generally legal but ethically questionable. |

| Impact | Distorts true financial health; risks legal penalties and loss of credibility. | Temporary improvement in financial ratios; risk of reputational damage if discovered. |

| Examples | Enron scandal, WorldCom accounting fraud. | End-of-quarter loan drawings, delaying expenses. |

Introduction to Financial Statement Manipulation and Window Dressing

Financial statement manipulation involves intentional misrepresentation or alteration of accounting records to deceive stakeholders and portray a misleading financial position, often violating accounting standards or regulations. Window dressing refers to cosmetic adjustments in financial reports aimed at improving the appearance of financial health without necessarily breaching accounting rules, typically used to influence investors or lenders temporarily. Both practices impact the reliability of financial statements, but manipulation carries greater legal and ethical risks compared to window dressing.

Defining Financial Statement Manipulation

Financial statement manipulation involves deliberately altering accounting records or financial reports to mislead stakeholders about a company's true financial performance or position. This practice includes falsifying revenue, understating expenses, or misrepresenting assets and liabilities to create an inaccurate financial picture. Unlike window dressing, which entails lawful yet cosmetic adjustments to enhance financial appearance temporarily, manipulation crosses ethical and legal boundaries by distorting financial reality.

What is Window Dressing in Financial Reporting?

Window dressing in financial reporting refers to techniques used by management to temporarily enhance the appearance of a company's financial statements before presenting them to investors or stakeholders. These methods often involve restructuring transactions, adjusting timing of revenues and expenses, or reclassifying items to improve key financial metrics such as earnings, assets, or liquidity. Unlike outright financial statement manipulation, window dressing aims to create a more favorable but short-term impression without necessarily violating accounting standards.

Key Differences Between Manipulation and Window Dressing

Financial statement manipulation involves deliberate falsification of financial data to mislead stakeholders, often violating accounting principles and laws, while window dressing is the strategic presentation of financial statements within legal bounds to enhance appearance temporarily. Manipulation typically results in long-term distortions and potential legal consequences, whereas window dressing focuses on short-term cosmetic improvements without altering actual performance. Key differences include intent, legality, impact on financial health, and transparency to auditors and investors.

Common Techniques of Financial Statement Manipulation

Common techniques of financial statement manipulation include revenue recognition fraud, where companies record sales prematurely or fictitiously to inflate earnings. Expense capitalization is another tactic, misclassifying operating expenses as capital expenditures to improve short-term profitability. Off-balance-sheet financing hides liabilities and overstates financial health by keeping certain debts or obligations separate from the main financial statements.

Popular Methods of Window Dressing

Popular methods of window dressing in financial statements include accelerating revenue recognition, delaying expense recording, and manipulating inventory valuation to enhance the appearance of profitability and liquidity. Companies often engage in practices such as postponing accounts payable payments or recording fictitious sales to inflate earnings temporarily. These techniques differ from outright financial statement manipulation as they aim to present a more favorable snapshot at specific reporting dates without fundamentally altering underlying financial results.

Motivations Behind Financial Misrepresentation

Financial statement manipulation often stems from the motivation to deceive stakeholders by presenting inflated profitability or concealing liabilities to meet market expectations or secure financing. Window dressing aims to temporarily enhance financial ratios at reporting dates, influencing investor perception without altering underlying performance. Both practices compromise the integrity of financial reporting, driven by pressures such as stock price maintenance, bonus targets, or debt covenant compliance.

Legal and Ethical Implications

Financial statement manipulation involves intentionally altering financial records to misrepresent a company's true financial position, often violating accounting standards and laws, resulting in serious legal consequences such as fines or imprisonment. Window dressing, while also aiming to improve appearance, typically involves legal accounting practices to present more favorable financial results temporarily, raising ethical concerns about transparency and investor deception. Both practices undermine stakeholder trust and can lead to long-term reputational damage despite differences in legality and ethical severity.

Detection and Prevention Strategies

Financial statement manipulation involves deliberate falsification of financial data to mislead stakeholders, often detected through forensic accounting techniques and anomalous trend analysis in key metrics such as revenue and expenses. Window dressing, a less severe practice, improves superficial financial appearance at period-end but can be identified by scrutinizing non-recurring transactions and unusual asset-liability fluctuations. Prevention strategies include implementing robust internal controls, regular external audits by independent firms, and promoting ethical corporate governance to ensure transparent and accurate financial reporting.

Conclusion: Ensuring Financial Transparency

Financial statement manipulation and window dressing both undermine financial transparency by presenting distorted views of a company's true financial health. Ensuring accurate and honest financial reporting relies on rigorous auditing standards, ethical management practices, and regulatory oversight that discourage deceptive tactics. Transparent financial disclosures enhance investor confidence and promote fair market functioning.

Financial Statement Manipulation Infographic

libterm.com

libterm.com